A report by the Association for Financial Markets in Europe (AFME) has found that primary issuance of European high yield (HY) bonds in 2023 reached a value of €66 billion on 185 deals, which was a 46.7% increase over the €45 billion achieved on 124 deals in 2022.

Nevertheless, issuance has declined substantially against 2021, potentially reflecting the risks faced by issuers as rates increased. “Developed market Europe issuance accounted for 80.3% of 2023 issuance, or €53bn on 149 deals, while the remaining €13bn on 36 deals was issued by Emerging market firms,” the report noted. “During the year, high yield bond Europe issuance rose for both developed and developing markets by 39.5% and 85.7% respectively when compared to 2022 figures.”

It is worth observing that while issuance increased somewhat, its historically muted levels are also having an impact on liquidity in secondary trading. Although volumes have followed an ‘M’ like pattern since the start fo the year, suggesting periodic levels of higher and lower activity, European high yield trading has seen bid-ask spreads rising since the start of March 2024, according to MarketAxess CP+ data, while the market for investment grade debt has seen a more continuous fall. As interest rates stay higher for longer – a policy supported by some central bankers – credit risk increases.

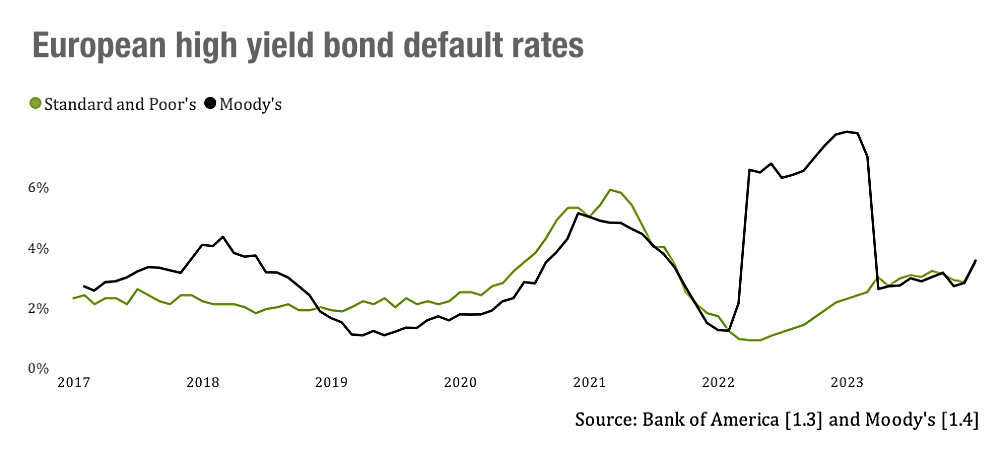

The AFME research found that S&P reported the trailing 12-month speculative-grade bond default rate at 3.47% in December 2023, an increase from 2.16% in December 2022, while Moody’s reported the speculative-grade default rate at 3.55% in December 2023, down from 7.8% in December 2022 but up from 2.61% of March 2023.

Although higher issuance may contribute to liquidity in HY debt, there may also be corresponding pressure due to increased credit risk that limits market making activity and drives up the cost of liquidity.

©Markets Media Europe 2024

©Markets Media Europe 2025