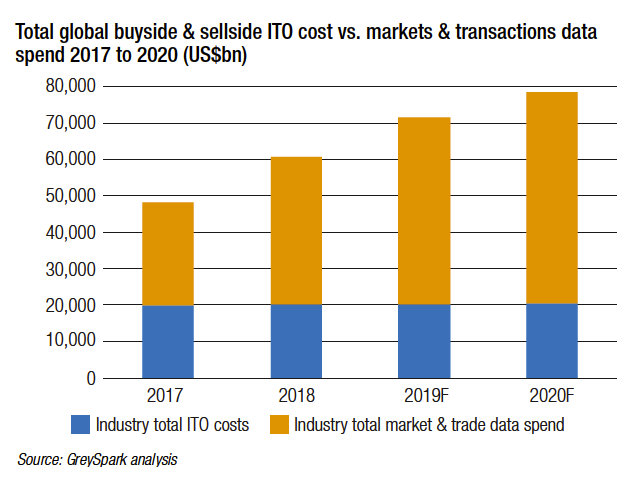

A new piece of GreySpark Partners research has found that spending by investment banks and asset managers on markets and transaction data in the cash equities, fixed income and currencies markets is estimated to reach US$50bn by the end of 2019, rising by 5 per cent, per year.

The report observes that a new breed of big data analytics, which it classifies as ‘smart data’, can boost the value of the data assets maintained by buy-side and sell-side firms in the daily running of cash equities, fixed income and currencies trading businesses.

The report observes that a new breed of big data analytics, which it classifies as ‘smart data’, can boost the value of the data assets maintained by buy-side and sell-side firms in the daily running of cash equities, fixed income and currencies trading businesses.

Russell Dinnage, head of GreySpark’s Capital Markets Intelligence practice and report author, said, “GreySpark believes that the inclusion of smart data analytics capabilities into the institution-wide data strategy equation can create new opportunities over time to not only offset the depreciation of data assets, but also to drive the uptake of cultural understanding that smart data is an investment class in and of itself – one that is capable of creating distinct markers as to how ITO expenditure on overall data quality maintenance can act as an engine for commercial growth.”

At issue for asset managers and investment banks alike in 2019 is the extent to which the electronification of trading across all major asset classes precipitates ever-larger levels of portfolio manager or trader demand for granular, real-time intelligence.

Matthew Hodgson, CEO & founder of report sponsor Mosaic Smart Data, said, “Financial markets participants must evolve from a focus on the sheer volume of data firms are collecting and, instead, should consider more rigorously how effectively they are extracting the value from the data they have.”

The research argues that those types of real-time intelligence inputs, which define and underpin the concept of Smart Data, are set to become more important over the next three to five years from a client performance analytics and competitive differentiation value creation perspective.

However, market participants must first undo decades of legacy, siloed data capture, management and storage architecture that is not fit-for-purpose.

©Markets Media Europe 2025