The latest BofA Global Fund Manager Survey has found that 76% of respondents expect two or more Fed cuts in 2024 versus 8% who expect to see no cuts.

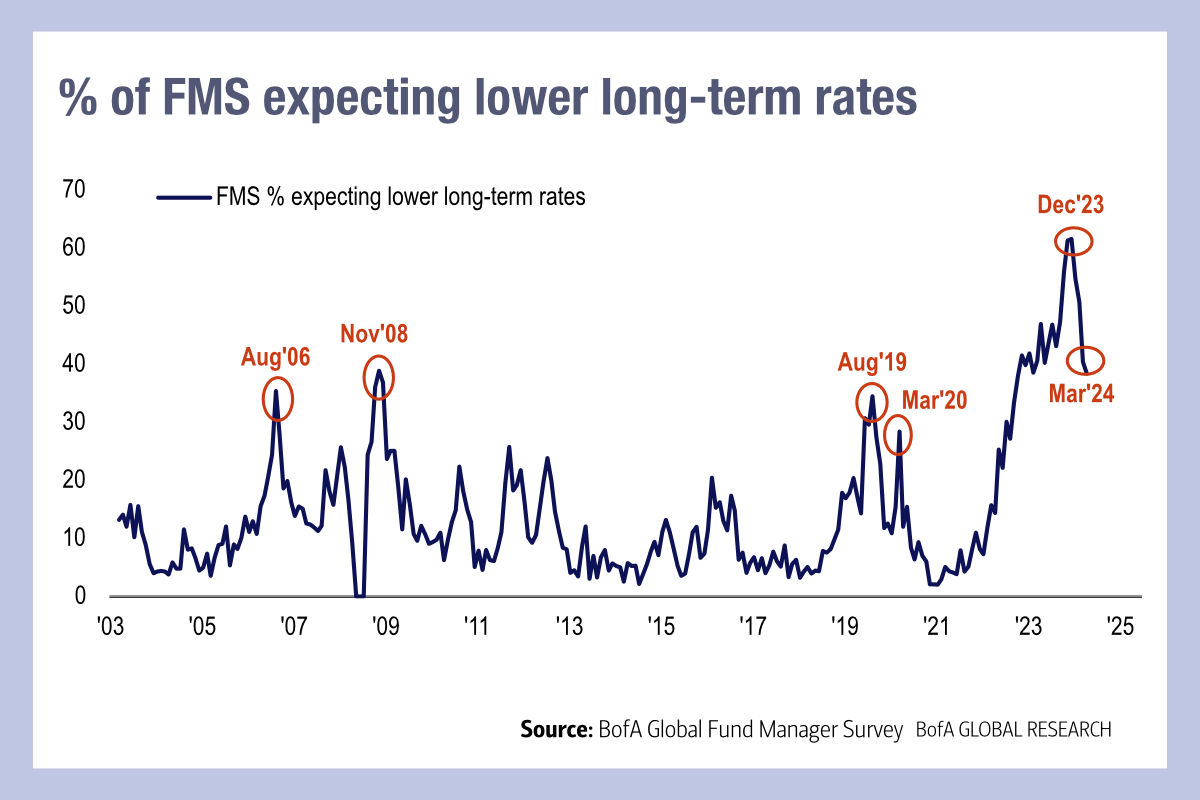

That said, but investors are reportedly less optimistic on inflation and bonds than they were last year, with 38% expecting lower bond yields versus 62% in December 2023. The survey also found that more managers expect a stronger economy over the 12 months.

Having seen the 2 Year US Treasury yield tick above 5% yesterday – very briefly – it seems bonds may be at their peak coupon point in the first half of this year. If yields are ticking down over the latter part of 2024, and the economy is strengthening, firms may be comfortable issuing debt at higher levels, and possibly holding off issuing in the mid part of the year. Based on that assumption, there are two likely effects. One is a drop in short-term market liquidity as primary issuance typically leads to greater market liquidity, and the second is a relief from management of primary activity on buy-side trading desks.

While both S&P Global’s Investor Access and Directbooks have made great strides towards electronifying bond issuance, and Bloomberg has helped deliver straight-through-processing of new debt, bond traders are still finding the volume of new issuance deals a workload burden with limited value add from the trading desk.

If we then see issuance tick-up early next year, following a pause as rates drop, many buy-side traders will be hoping that these innovative tech firms can deliver a truly low-touch electronic workflow by the end of this year.

©Markets Media Europe 2024

©Markets Media Europe 2025