A considerable increase in trade failures, combined with falling volume and buy-and-hold strategies is creating a shallow market in US treasuries, making the October 2014 flash crash a cause for serious concern. Peter Barker reports.

Mike Lorizio, head of treasuries at John Hancock Asset Management, said that the market had become quite reliant on electronic trading as an efficient way of getting normal-sized trades done.

“That day we saw some dealers, leaders in their asset class, were just shutting off screens and not really being willing to price electronic trades. Once that kind of behaviour rears itself and provokes a continued flight to quality, the tone becomes that much more contagious. And that is what led to a 40bp intraday range in five-year treasuries,” he says.

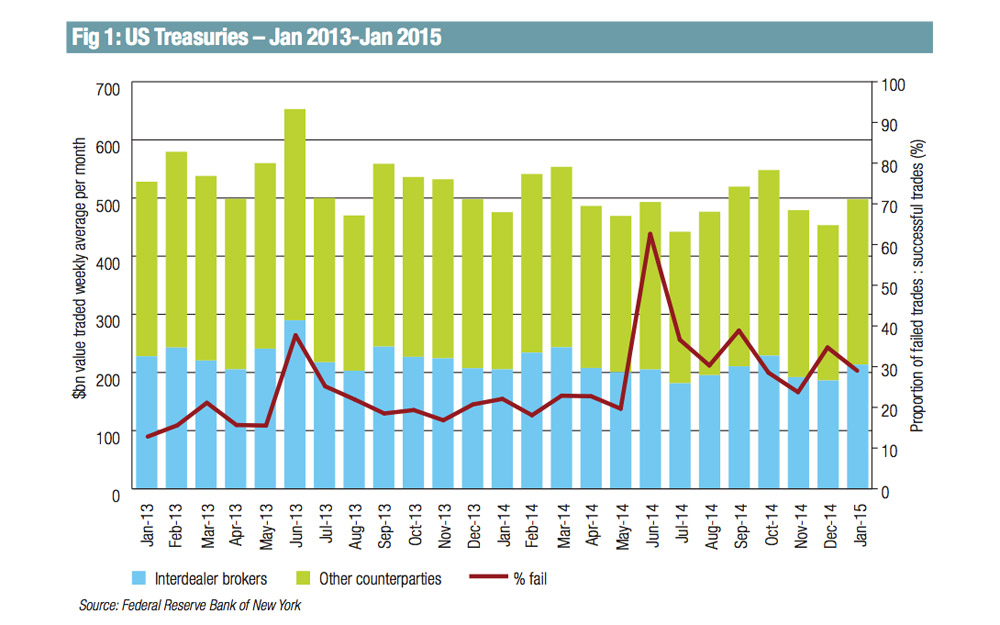

The proportion of failed trades has grown to nearly 30% and volume by value traded has fallen slightly. The number of trades that failed to deliver between January 2013 and January 2015 increased by 112.9% and those that failed to receive increased by 114.2%, according to Federal Reserve data. At the same time the volume of trading in US treasuries has declined by 6% between dealers and clients (see Figure 1) and by 5.3% in the interdealer market.

Liquidity in the treasuries market has been shallowing for some time, according to Mike Cullinane, senior vice president trading at dealer DA Davidson. A treasuries trader since 1985, he says despite being spared the impact on liquidity of Trade Reporting and Compliance Engine (TRACE), which since 2002 has captured and disseminated consolidated information on transactions in the secondary corporate bond market, the treasury market is starting to show a weakening.

“The Treasury market was spared what much of the other asset markets went through,” he says. “But of late, and I would call that the last year or so, there is a marked reduction in depth of the market. The Treasuries market has always been billed as the most liquid, the deepest and the most efficient market in the world – it still is all of those things but it is certainly different from what it was.”

Cullinane says that regulatory initiatives with the Volcker Rule in the US and Basel III, created an environment where dealers had reduced inventory significantly, and have pulled back from making aggressive deep markets.

“That has definitely had an impact on the market,” he says. “You can tell that because when you are trading bonds on the screen you can see what kind of size moves markets. To me that has always been the barometer of how deep the market is, and back in the day you could do $200 million to $300 million without significantly moving the market and I guess it is maybe half of that now.”

Cause and effect

Gennadiy Goldberg, US strategist at TD Securities in New York says that changes in the regulatory environment were affecting the behaviour of banks.

“You have a number of regulations, like liquidity coverage ratios, you have had other ratios that

the banks have had to comply with, so they have been forced to buy up very high quality assets and hold them,” he says. “I think what you have been seeing is really a continuation of that. Small banks haven’t really added much to their holdings but ever since our liquidity rules, or at least a proposal was published, banks have added $200 billion to their balance sheets in US Treasuries.”

Goldberg said this was from September 2013 onwards, from which point holdings have gone up and up.

“Partially it is Basel III and partially it is the rules stemming from Volcker. As those come into play, there are a lot of ratios they have had to comply with and treasuries are probably the easiest and most liquid way to meet these. So they are just adding more and more security to the balance sheet,” he says.

However Kevin McPartland, principal in market structure and technology at Greenwich Associates, believes that the treasuries market is driven more by what the Federal Reserve says, and has not yet been affected by the impact of regulation.

“It is still very much market forces, supply and demand driven primarily by central bank policy. Volcker exempts US government debt from the rules. There is no impact there, the banks are still allowed to put on proprietary positions on US government debt. The impact of Dodd-Frank eventually could be in increasing the demand for high-quality collateral. But for a variety of reasons we really haven’t seen that yet,” he said.

The current environment is having an impact on the buy-side which is finding it harder to fill orders, says Goldberg, who concurs with Cullinane that liquidity is shallower and the consequence has been changing behaviour to try to achieve execution.

“There are a lot of large money managers or maybe large bond funds trying to execute strategies that they normally have and realising that they cannot anymore,” he says. “Or that they have to adjust the strategies by perhaps breaking things into smaller bite size pieces because the sizes that they used to buy and sell in the market now end up moving the market very hard in the wrong direction. It is certainly creating a very difficult headache for them and a very difficult trading environment.”

Structural impact

Josh Galper, the managing principal at Finadium, a financial research and consulting firm saw banks reacting to tougher regulations, and that decision had impacted on markets. He also notes that a reduction in the number of market makers means there will be less liquidity on hand.

He says, “The market-making system, while it has seen certainly its fair share of frustrating practices over the years, has served as a provider of liquidity through thick and thin, perhaps not at a price which all market participants would like, but the ability to sell at some price. A reduction in the number of market makers means that that stand-by liquidity is disappearing.”

McPartland sees proprietary trading firms and high-frequency traders as taking up a market-making type role and thereby adding liquidity to the market.

He says, “Those proprietary trading firms have been in the treasuries market for quite a while. Primarily on the eSpeed and BrokerTec markets. I suspect we will see more of that. The role they play in those markets is different than the dealers, often the dealers are looking to those markets to offload risk that they have put on because of client demand, whereas the prop firms are simply trading for their own book, looking to capture spread.”

Despite concerns around the effect of high frequency traders on the eSpeed and BrokerTec markets (see The DESK Q4 2014 “Flash Boys hits US treasuries”) McPartland says the majority of prop trading firms do add liquidity in a useful capacity.

“There always could be some whose trading strategies are really not supportive of liquidity creation but I think by and large, especially the bigger firms in those markets, they are net positive for liquidity in Treasuries.”

He also voices concern that the October 2014 flash crash could be overstated as an event, blamed on electronic trading when the advantages it offers are not emphasised.

“Like any market shock the market got spooked and everybody started to go in the same direction at the same time,” he says. “The market by and large quickly recovered. If we look back 30 years when the markets were slower and less electronic we still had market crashes, it just took a little longer to play out. Now everybody reacts so fast that it happens in a matter of minutes or seconds. There is nothing new with shocks like this, it just happens faster.” ■

©TheDESK 2017

©Markets Media Europe 2025