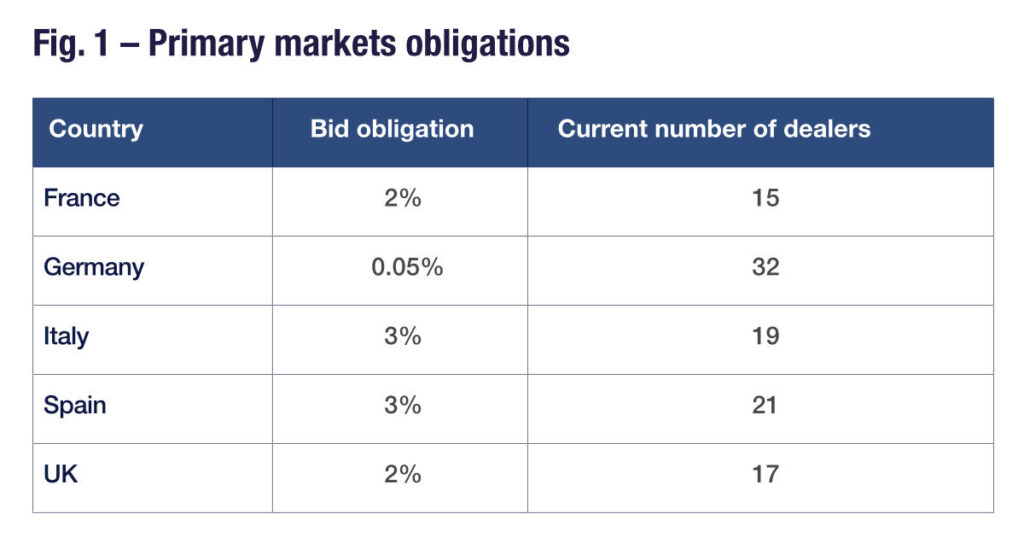

Germany’s government bond market is in rude health, according to the latest analysis of sovereign debt by Andy Hill, director at the International Capital Markets Association (ICMA), despite having the loosest primary market obligations for primary dealers, who are engaged to broker newly issued debt out to the market.

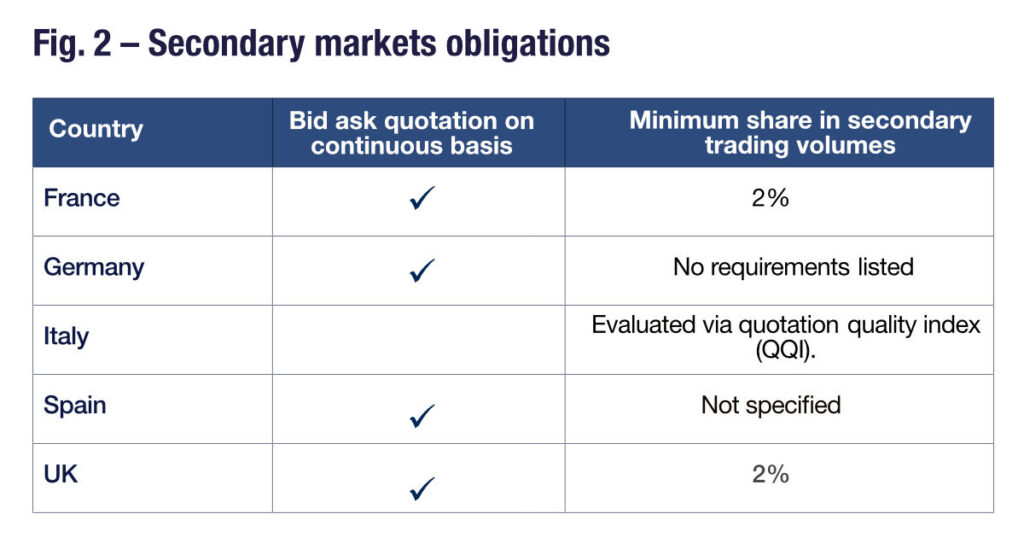

Of course, sovereign debt markets are each unique and that factors that support liquidity are often more fundamental. From a secondary market perspective, ICMA examined the traded volumes between January 2022 to May 2023, and found German debt is the most traded in terms of notional on a weekly basis and has the second largest average weekly trade count, behind Italy, which unusually has an active retail debt market. The factors behind Germany’s debt market activity are many, Firstly, it has the largest number of primary dealers in European markets, twice as many as the UK or France, creating easier access to liquidity for investors and potentially driving down the costs of intermediation through competitive pressure.

Secondly, Germany has a thriving sovereign derivatives market with Bund futures, adding to liquidity by allowing sophisticated investment and trading strategies to be expressed. Like the US Treasuries market, this enhances the capacity of firms to take long and short investment positions, reducing directionality of market liquidity.

Third is of course the perceived strength of the economy, which makes the market highly investible. Other European Sovereign countries could do well to note that a more relaxed attitude to control of primary dealer obligations – including the expansion of primary dealer numbers – does not necessarily reduce secondary activity, but in fact can enhance activity.

©Markets Media Europe 2024

©Markets Media Europe 2025