The new index launches address the growing trend of integrating sustainable investment themes into fixed income indexes.

The new index series consists of the FTSE Fixed Income Global Choice Index Series, FTSE Fixed Income Excluding Fossil Fuels Enhanced Index Series and FTSE Impact Bond Index Series, and the launch is accompanied by research paper: Sustainable Investment – Not Just an Equity Game.

FTSE Russell, a leading global index provider, announces the launch of a new set of sustainable investment fixed income indexes. These SIFI indexes are designed for investors seeking to integrate their sustainable investment strategy into their fixed income investments.

The newly launched FTSE Fixed Income Global Choice Index Series and the FTSE Fixed Income Excluding Fossil Fuels Enhanced Index Series use a methodology inspired by their equity counterparts, the FTSE Global Choice Series and the FTSE Ex Fossil Fuels Series, bringing consistency across equity and fixed income.

The FTSE Fixed Income Global Choice Index Series has been designed to represent the performance of securities in FTSE Fixed Income indexes that exclude issuers based on their conduct or product involvement in specific sectors. The Index Series helps investors align their portfolios with their individual values by selecting issuers based on the impact of their conduct and products on society and the environment.

The FTSE Fixed Income ex Fossil Fuels Enhanced Index Series is designed to represent the performance of securities in FTSE Fixed Income indexes after the exclusion of issuers that have certain exposure to fossil fuels.

The FTSE Impact Bond Index Series enables global debt investors to participate in the rapidly growing green, social, and sustainable (GSS) bond market. Impact Bonds have greater transparency in their use of proceeds and project impacts, providing a vehicle for investors who are looking for investments which yield direct climate, environmental or social benefits.

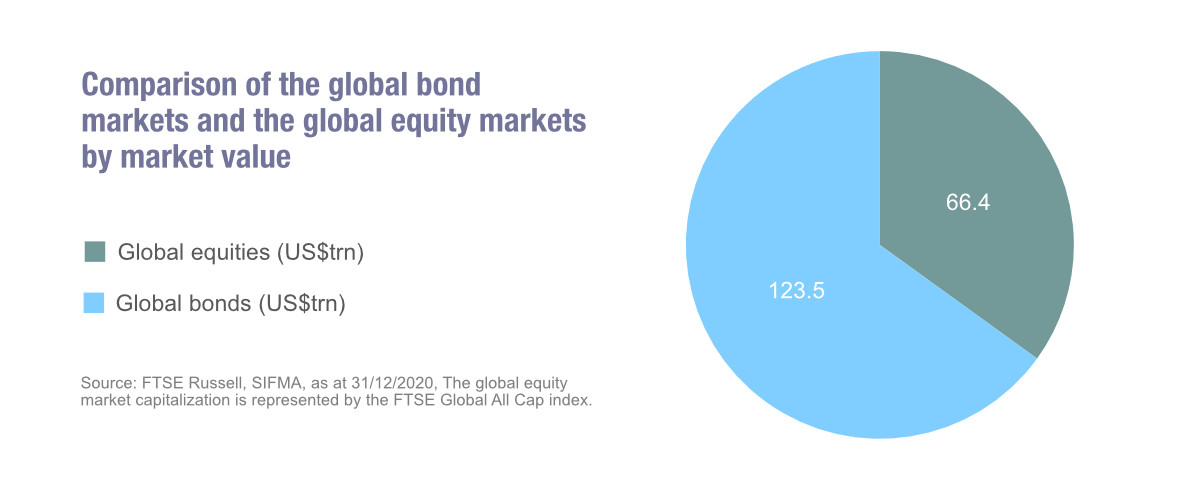

The paper, Sustainable Investment: Not Just an Equity Game, explores the role of sustainable investment in the global securities market’s largest asset class, fixed income. The paper notes growing investor demand for this type of solution, investigates the challenges in implementing a sustainable approach in fixed income, looks at the potential impact of sustainability on a portfolio’s risk/return profile and describes FTSE Russell’s approach to implementing sustainability in fixed income indexes.

Scott Harman, Global Head of Fixed Income at FTSE Russell comments: “Our new FTSE Russell SIFI indexes address a growing need for sustainable investment solutions in the fixed income market. As investors look to align their portfolios with their ESG values, we have developed a thorough methodology to enable investors to exclude issuers based on their conduct or product involvement in specific sectors. Our experience in the equity market has allowed us to develop a methodology inspired by our FTSE Global Choice and FTSE Ex Fossil Fuel series, bringing consistency for investors across our equity and fixed income offering.

“We believe sustainable investing in the fixed income market will accelerate in the coming years, becoming mainstream and making it more challenging to hold portfolios without at least a basic sustainability element.”

Source: FTSE Russell

©Markets Media Europe 2025