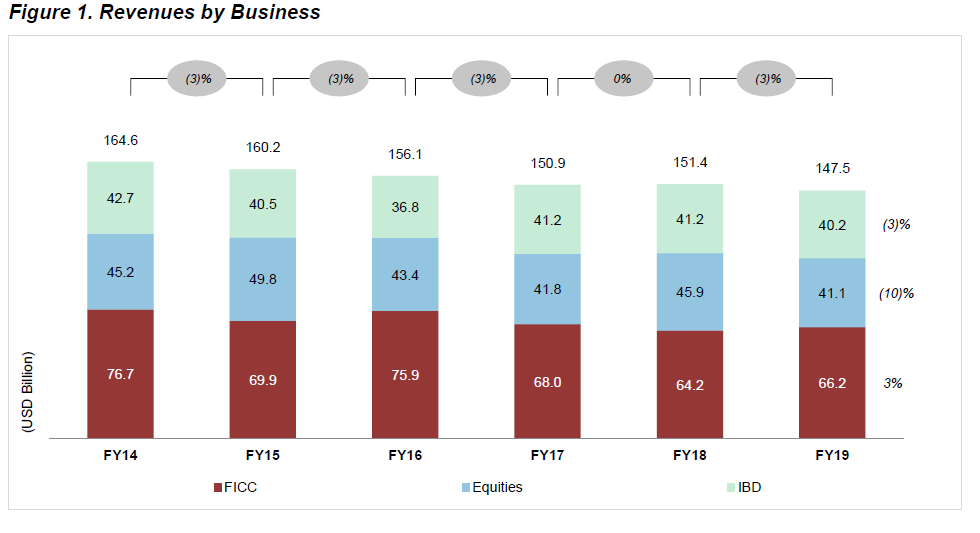

Fixed income, currencies and commodities (FICC) revenues were up 3% year-on-year for investment banks in 2019, halting a two-year slide, according to the latest research from analyst firm Coalition, while overall revenues fell 3% (see Figure 1).

Revenues had fallen by 15.4% between 2016 and 2018, and although the 2019 figures are still down 12.7% against 2017 the increased revenue suggests that operational changes to the banks’ models have been effective.

In part the bounce was a result of better fixed income trading, notably in flow products. Growth was driven by strong results in investment grade credit, agency residential mortgage-backed securities (RMBS) and emerging markets (EM) flow credit, along a significant increase in G10 flow rates, and government bond trading. Banks also saw higher revenues from oil trading and metals. Debt capital markets activity remained stable as through robust performance in bond underwriting which offset the decline in loan syndication activity.

At the same time G10 foreign exchange and EM macro trading decreased due to lower volumes and one-off trading underperformance.

Equity revenues fell across all regions with significant underperformance in flow derivatives and a fewer number of strategic equity transactions, a significant underperformance in 1H 2019 hurt prime brokerage, despite a recovery in the second half of the year and cash equities was due to lower trading volumes and continued margin compression, despite a small uptick in 2H 2019.

Front office producer headcount fell a massive 6%, with a 10% decline in equities and a 7% drop in FICC.

©The DESK 2020

©Markets Media Europe 2025