In the latest edition of its ‘Investment Advisory Fee Benchmarking Report’, fund research company Fitz Partners has looked at the different costs which make up fund management fees and also an estimate of fund margin levels.

The latest Fitz Partners’ research is based on asset managers’ confidential fee schedules and covers over 1,300 funds with US$1.7 trillion of assets under management (AUM).

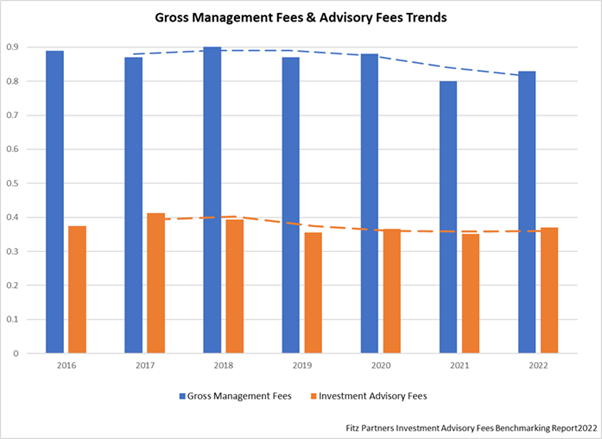

In Europe it found that asset managers gross revenue earned from management fees have fallen by 10% over the last three years. Over the same period to 2022, the cost of portfolio management or investment advisory has remained virtually stable after a couple of years of reduction prior to 2019 while average gross management fees including some distribution fees in Europe have gone down by 4.6% since 2019.

Hugues Gillibert, Fitz Partners CEO commented: “For many years now, European asset managers have been focusing and competing extensively on investor fees which has translated into a general drop in fund management fees overall. Expenses such as investment advisory fees or distribution fees make the largest proportion of management fees and as they have remained relatively flat while management fees came down, net final revenues left to asset managers had to drop. In the current climate, it remains imperative for asset management firms to review the level of all underlying fund costs and especially funds investment advisory fees as it represents a significant part of fund management fees and impacts asset managers’ revenues substantially.”

According to Fitz Partners research, mixed assets funds across all investment areas deliver on average the highest net profit margin corresponding to 0.36% of fund assets, followed by alternative funds generating 0.31% net profit. These figures represent the net revenue earned by asset management firms net of any rebates or retrocessions and after all portfolio management expenses have been paid.

Gillibert said, “In our research, funds net profits would usually remain lower than the corresponding level of investment advisory charges although mixed assets funds across sectors are one of the exceptions, with a level of net profit exceeding half the funds management fees. Thanks to the number of clean classes across Europe reaching a significant level, we are now able to measure precisely funds net profit after any portfolio management costs and without any trace of fund distribution costs or rebates which often distort fees and costs debates in Europe.“

©Markets Media Europe 2025