Electronic trading in US fixed income is hotly contested between Bloomberg, MarketAxess, Tradeweb and Trumid all competing for market share of trading cash bonds in the dealer to client (D2C) market.

The dynamics behind these struggles will be closely discussed at the Fixed Income Leaders’ Summit in Boston, but there are three major battles being fought around innovation:

• D2C trading interfaces;

• D2C trading protocols;

• Dealer-initiated liquidity.

“Clients are focused on being able to do their job more efficiently and more intelligently,” said Billy Hult, CEO at Tradeweb, speaking to analysts on the firm’s Q1 earnings call. “If pricing was the main focus, our largest competitor in institutional rates market would have all that business. And if it was the main focus, we’d be the full leader in the credit market. These are complex dynamics.”

Trading interfaces

Tradeweb’s recent success in D2C has been supported by its ongoing integration with Aladdin, the BlackRock-owned order management system (OMS). The integration is allowing orders to be staged within Aladdin and directly traded via Tradeweb, without the need to rekey orders onto the platform, as had previously been needed.

Hult said the partnership with Aladdin is an important component of Tradeweb’s growth strategy in credit, particularly in high yield (HY). Having established dealer access and piping inventory data into Aladdin during the first phase in late 2023, the firm is currently building out the second phase for all-to-all trading, with functionality to respond to auto inquiries via an Aladdin dashboard.

“In Phase 3, clients will be able to initiate a request for quote (RFQ) on Tradeweb from within Aladdin and then also use our automation tools,” he said. “We expect this phase to be completed over the next 12 months, [and] on volumes, revenue and market share, we expect this to be a steady progression as we move forward with more clients within Aladdin using Tradeweb functionality.”

Jason Quinn, chief product officer & global head of sales, Trumid, says, “Within our own UI, we look to deliver not only trading execution tools, but a robust offering of pre- and post- trade analytics designed to help our clients make more informed trading decisions. This can be demonstrated in portfolio optimizations, pricing estimations, or decision-making tools to guide to which protocol is optimal when executing a particular trading axe. At Trumid, we have always been a design and UX driven technology focused platform.”

MarketAxess has also been targeting growth through interface enhancement, primarily the development of its own interface, X-Pro, which has increased the functionality available to users, and is handling 55% of US credit trade count for the firm’s 22 largest clients. CEO Chris Concannon told analysts in May, “We intend to put X-Pro in front of all traders and all clients globally, you’ll see X-Pro rolling out in Europe and throughout the international client base this summer. We’re excited to continue the rollout of X-Pro for traditional RFQ, but more importantly, for portfolio trading. We started that rollout for ‘power users’, where we see the biggest benefit.

The workflow efficiency designed in X-Pro does help those users and we do think that the portfolio trading tool is also a benefit.” The firm is rolling out AI Dealer Select on X-Pro in late summer, which is designed to help clients select the preferred dealer in a given CUSIP or a given bond, using proprietary MarketAxess data.

Trading protocols

Inherent in the MarketAxess X-Pro offering is its support for different trading protocols, as Concannon noted, with portfolio trading (PT) a major focus, but also block and RFQ trading. “Our launch of credit algorithms and block trading solutions on X-Pro are targeting the more challenging parts of the market that have not migrated to electronic trading solutions.

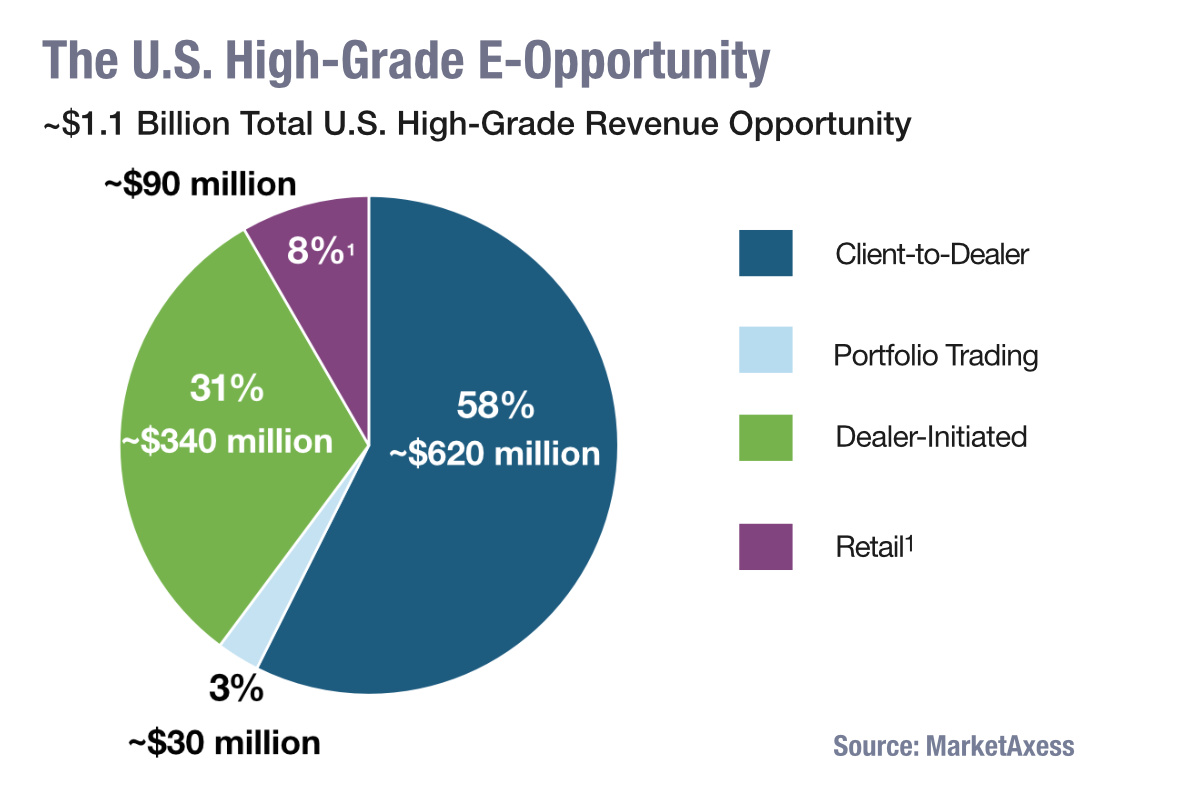

The client initiated segment of the market excluding PT is an estimated $620 million revenue opportunity, representing approximately 58% of the total estimated e-trading opportunity in US high grade. An important next phase of X-Pro coming this summer will be the high touch or block trading solution, with dealer information being onboarded to support that currently. “Our block trading solution is very dealer friendly,” he said. “It allows dealers to be in comp without all-to-all. So it allows them to price clients based on a smaller universe of competition.”

While the fight for PT dominance focuses on a tight ecosystem of 30 to 40 dealers in the US alongside larger buy-side firms, straightforward request-for-quote trading reaches all participants.

“We feel like RFQ trading is really – in a pretty straightforward way – our biggest tangible opportunity in credit right now,” said Hult. “It’s a foundational protocol that you have to get really right to be in the flow of things.” He added that its growth often stems from investment in other protocols, such as portfolio trading and all-to-all networks.

“An ecosystem of protocols is important for increasing velocity of the asset class and driving liquidity in our space. Over the past 18 months, we have successfully rounded out our ecosystem to provide a full offering of trading protocols across US corporate bonds,” says Quinn. “Trumid Swarms and Attributed Trading are working alongside Trumid PT and RFQ, increasing both new issue and non-new issue traded volume on the platform, and proving the benefit of a trading protocol ecosystem. It’s why we’ve been focused on the sum of the parts on our platform. This is also directly related to the future of automation. It’s a really exciting next phase. With an ecosystem of protocols in one place, automation can mean more than simply the hit/lift decision when initiating an RFQ. It’s why we are focused on automation and believe that we can help drive true innovation in this area.”

“The fixed-income market is moving into the next phase of electronic trading in which trade execution is not simply electronic, but fully automated” says Kevin McPartland, head of research at Coalition Greenwich Market Structure & Technology. Tradeweb saw automated credit trades grow globally by 70% year-on-year on its AiEX protocol over the last year, while users of AiEX have largely expanded from outside of its top 200 client base.

MarketAxess continues to see significant growth in this space. Rich Schiffman, global head of trading solutions at MarketAxess, said in Q1 2024, “We experienced another quarter of record automation trade volume and count with three-year CAGRs of 34% and 40%, respectively, and a record 231 active automation client firms. Automation trade volume now represents 10% of our total credit volume and a record 25% of our total credit trades. There were a record 11 million algo responses from dealers, an increase of 50% year-over-year.”

Dealer initiated liquidity

A new point of competition is the engagement around dealer-initiated trading.

“Dealer initiated liquidity is growing in terms of activity and importance. All-to-all workflows, such as auction style protocols and dealer initiated RFQs, allow dealers to source and provide liquidity and are valuable tools for managing risk.”

Concannon noted that his firm’s automation suite is provided to dealers, and makes up between 17% to 20% of dealer RFQ. “Since 2019, portfolio trading and dealer initiated flow have grown at four-year CAGRs of 38% and 10%, respectively, compared to 2% for client initiated flow,” he said. “The growth of these segments is closely linked because dealers typically recycle the risk from a portfolio trade in the interdealer market … For dealer initiated flow, we are now delivering the same trading automation tools to dealers seeking liquidity that have been rapidly growing with investor clients.

These tools improve dealers’ trading efficiency and help solve their need to rapidly exit inventory risk. Approximately 30% of the liquidity we provide to dealers comes from our investor client firms.” Hult also cited portfolio trading as a driver for dealer RFQ activity on Tradeweb, which increased almost 40% in the first quarter. “Dealer RFQ, which is a sort of change in market structure, is a more recent initiative for us.,” he said. “[We’re] still in early stages of building that protocol, but we feel given the relationships we have with the dealers, with the banks that the momentum there is quite promising.”

“Dealer initiated liquidity is growing in terms of activity and importance. All-to-all workflows, such as auction style protocols and dealer initiated RFQs, allow dealers to source and provide liquidity and are valuable tools for managing risk,” says Quinn.

Concannon noted that 30% of the firm’s RFQ trading is currently coming from dealers initiating on the RFQ side. “As we introduce our matching solutions in the market, which we know have been very attractive to firms; also our order book Live Markets is an area we think will be attractive to that user base,” he said.

©Markets Media Europe 2024

©Markets Media Europe 2025