Big picture phrases like ‘higher for longer’ and ‘transitory’ inflation are too imprecise to guide a professional investor, the Fixed Income Leaders’ Summit (FILS) in Barcelona heard today.

Instead investment strategy needs to be based on a detailed picture factoring in access to capital and the liquidity picture. “We’ve gone from an environment of quantitative easing (QE) to quantitative tightening (QT), central banks aren’t going to be backstopping the market anymore, that’s pretty clear,” said Altaf Kassam, head of investment strategy and research, EMEA at State Street Global Advisors. “The market has to get out of that ‘buy-the-dip’ mentality. Every so often, the penny drops for equity markets, but then they get lulled back into this sense of false sense of security. Another reason we think fixed income is a better place to be over one to three years than equities.

The other overarching theme we’re seeing is an increase in the cost and scarcity of capital. It’s harder to find the capital that you need compared to the kind of QE environment.” A big risk that is impacting near-future scenarios is political risk, he said, and Iain Stealey international chief investment officer for Global Fixed Income, Currency and Commodities, at JP Morgan Asset Management agreed. However, he also noted that central bank activity was a major dynamic, with over 500 basis point rises in interest rates to counter inflation leading to uncertainty of the next move. “We can see the economy’s slowing, why wouldn’t you take a pause, and see what might happen?” he asked. “But it feels like there is a fixation on the growth aspect. The concern I’ve got is that other central banks … they’re a bit reluctant to make a bet lately based on recent statements because they were so wrong two years ago with ‘transitory inflation’ and effectively weren’t willing to tighten then. Now they’re almost exactly the other way. That’s probably my biggest concern.”

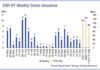

The four likely scenarios are high growth / high inflation, stagflation, disinflation and recession, explained Edward Smith, co-CIO at Rathbones. Addressing the capacity to trade in and out of positions to express investment ideas had become particularly challenging. “Putting money to work, particularly in spread products this year, has been very, very difficult,” he said. “You’ve got to speak to dealers all the time, work over many days to get trades in place. Some of my younger colleagues on multi-asset teams, which is the bulk of our business, started working in the last 10 years and really hadn’t bought a bond their entire professional career. They’re surprised that it’s not easy. Dealers in fixed income are really important. I think that’s only going to get more challenging. This year the market has seen a trillion dollars move into money market funds, US$200 billion into bonds, US$100 billion in equities. Next year, I think a lot of that money is going to rotate into bonds, both on the cash side and the equity side. And in our opinion, getting liquidity trying to buy bonds, and both primary and secondary markets is only going to become harder.”

The potential for differentiating investment strategies over the next year would be affected in part by the timing of emerging market and high yield investment decisions. For buy-side traders, the panel agreed the three watch words over the next year would be liquidity, deficits and tail risk.

©Markets Media Europe 2023

©Markets Media Europe 2025