Moving liquidity from the spot or cash markets into futures is raising some concern amongst market participants. In FX, trading volume on the Thomson Reuters and EBS markets, which are considered ‘primary markets’ by the Bank of International Settlements (BIS) for fixing spot pricing between currency pairs, has been declining. Futures volume has been increasing.

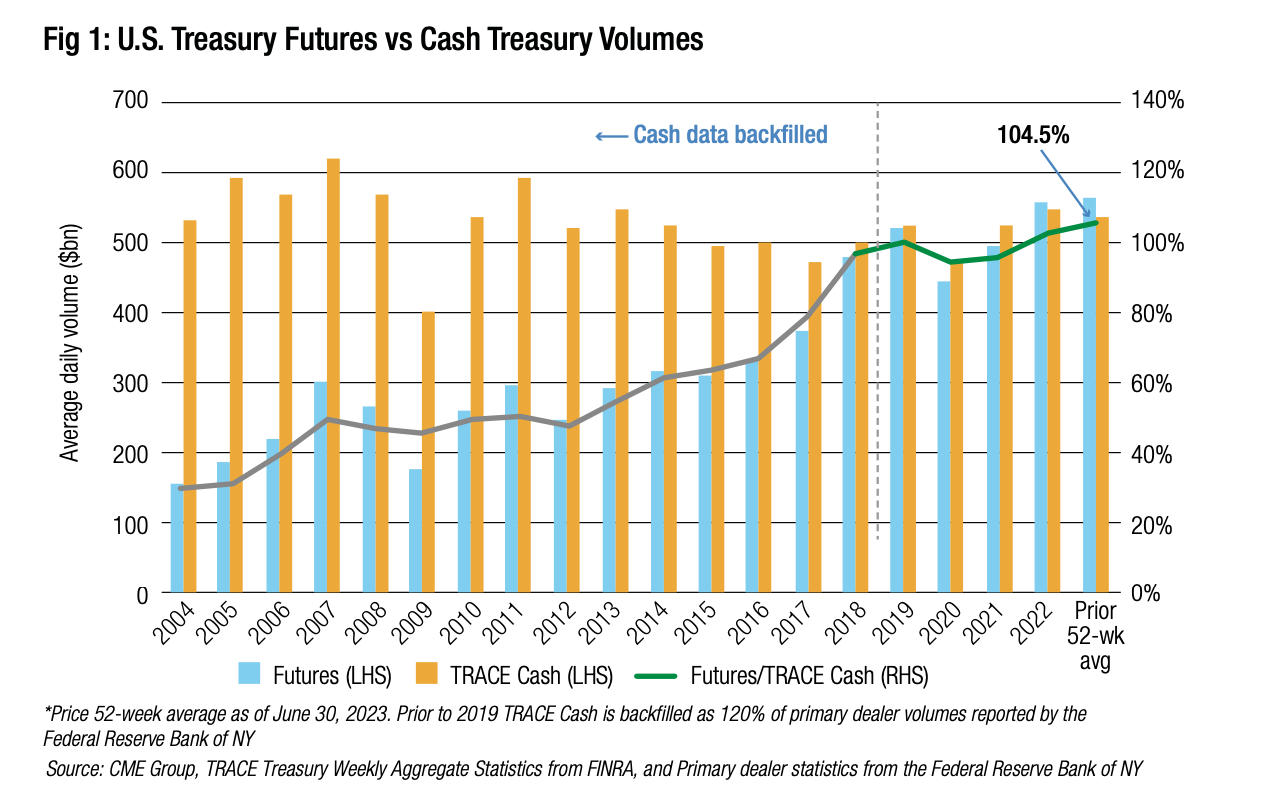

In the US, interdealer trading volume for US treasuries has been declining, according to Coalition Greenwich research, as has central limit order book trading. Data from the CME indicates that relative to overall Treasury trading volumes, futures trading has been increasing with a spokesperson for CME noting “a significant amount of price discovery and risk transfer [is] taking place in futures.”

This is all potentially good news for efficient markets and of course the market operator.

The concern raised by traders is that the CME and other exchanges operate within market hours with price limits (limit up/ down) applied to futures trading. These set the maximum price range permitted for a futures contract in each trading session, if that is breached, markets may temporarily halt until price limits can be expanded, remain in a limit condition or stop trading for the day, based on regulatory rules.

If large directional trading hits the FX and / or US Treasuries markets, the ability for banks to intermediate would potentially rely on futures markets subject to limit up/down rules, or less to markets being open and liquid cash markets which would potentially jam up as in March 2020.

©Markets Media Europe 2023

©Markets Media Europe 2025