Banks in the US have been asked by Government agencies to issue new debt to support their stability under a new proposal by the Federal Deposit Insurance Corporation (FDIC).

The proposal is that a covered entity with over US$100 billion in assets, would be required to maintain outstanding eligible LTD in an amount that is the greater of 6% of the covered entity’s total risk-weighted assets, 3.5% of its average total consolidated assets, and 2.5% of its total leverage.

The type of new bonds issued will have to be in line with eligible debt issued by globally systemic important banks (GSIBs) under the total loss absorbing capability (TLAC) rules, meaning they will be unsecured, plain vanilla debt issued by the bank holding company and barriers to short term issuances with a bar on debt of less than a year in tenor, with anything under two years tenor being subject to a 50% haircut.

US agencies have gotten involved as they noted costs of bankruptcies are carried by the FDIC. The FDIC noted in its proposal for debt issuance that the “insured depository institutions (IDIs) of certain non-GSIB banking organisations with consolidated assets of US$100 billion or more experienced significant withdrawals of uninsured deposits in response to underlying weaknesses in their financial position, precipitating their failures.”

The FDIC noted that these failures, most publicly the failure of Silicon Valley Bank (SVB), have highlighted a risk that the failure of one of these banking organisations can spread to other financial institutions and potentially give rise to systemic risk.

“Moreover, these recent IDI failures have resulted in significant costs to the FDIC’s Deposit Insurance Fund (DIF),” it noted. “To address these risks, the Board is proposing to require Category II, III, and IV bank holding companies (BHCs) and savings and loan holding companies (SLHCs / covered HCs) and Category II, III, and IV US intermediate holding companies (IHCs) of foreign banking organisations (FBOs) that are not GSIBs e.g. covered IHCs and covered HCs (covered entities) to issue and maintain minimum amounts of long-term debt (LTD) that satisfies certain requirements.”

It will not apply to an SLHC with 25%+ of total consolidated assets in insurance underwriting subsidiaries, other than assets associated with insurance underwriting for credit, an SLHC with a top-tier holding company that is an insurance underwriting company, or a grandfathered unitary SLHC that derives a majority of its assets or revenues from activities that are not financial in nature.

“The proposed LTD requirements would improve the resolvability of covered entities and covered IDIs because LTD can be used to absorb loss and create equity in resolution,” wrote the FDIC. “In particular, because LTD is subordinate to deposits and can be used by the FDIC to absorb losses by leaving it behind in the receivership estate of a failed IDI, it can help mitigate the risk that any depositors would take losses in the resolution of the IDI. Because LTD absorbs losses before deposits, an LTD requirement at the covered IDI would give the FDIC greater flexibility, including the potential to transfer all deposit liabilities (including uninsured deposit liabilities) of a failed IDI to an acquirer or to a bridge depository institution in a manner consistent with the FDI Act’s least-cost requirement.”

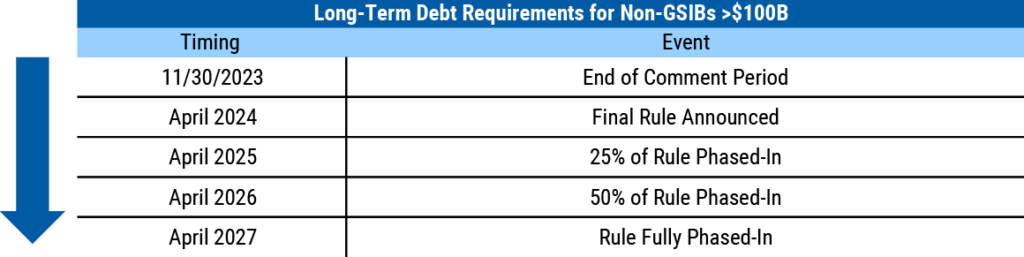

If the proposal is adopted after the end of the comment period in November 2023, the rule would come into effect in Q2 2024 and roll out to April 2027.

©Markets Media Europe 2023

©Markets Media Europe 2025