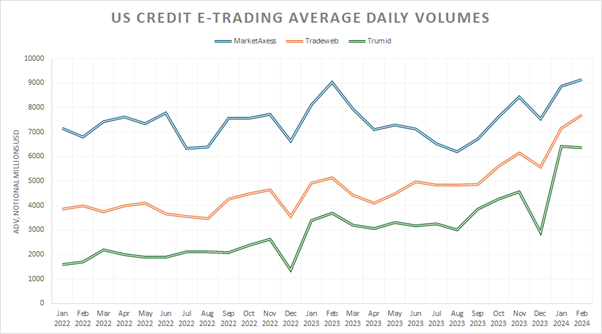

The highly competitive corporate bond market saw average daily volumes converge in the US across electronic trading venues in February. The DESK has exclusively gained access to data showing the blow-by-blow action across investment grade and high yield trading between platforms.

The leader in US credit, MarketAxess, had a 14.6% increase in US high-grade ADV, while US high-yield ADV stood at US$1.4 billion, down 37.1% YoY but reflecting the great spike of activity it saw in the same month last year.

For Tradeweb, fully electronic US credit ADV was up 49.9% YoY to US$7.7 billion, attributed to increased client adoption of Tradeweb protocols, the firm noted, particularly request-for-quote (RFQ), portfolio trading and Tradeweb AllTrade.

Trumid reported ADV of US$6.4 billion in February, up 73% YoY, while the firm said its high yield momentum continued into February with a record number of users engaging across all Trumid trading protocols driving ADV and market share to record highs.

Looking at the figures since January 2022, it is clear that MarketAxess has seen greater outperformance at points of market stress, such as Q1 2023, however its rivals are closing ground.

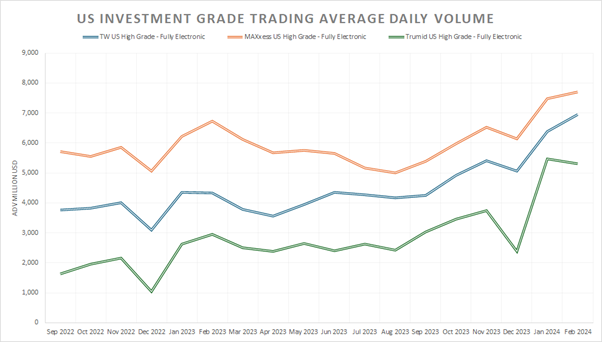

Using ADV data gained exclusively by The DESK, we are now able to compare the different rating categories of credit. In investment grade trading, Tradeweb’s volumes were about 60% higher in February on the previous year, while Trumid’s were up 80%.

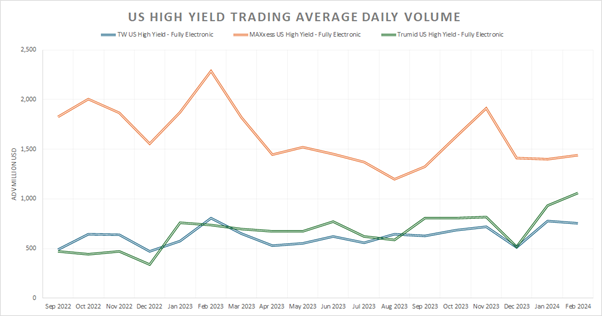

In high yield, a more striking difference is that in February, Trumid broke away from Tradeweb with whom it has tussled for second place since at least September 2022, to clearly become number two for electronic high yield trading. While MarketAxess has seen a gradual reduction in HY volume – yet still with greater outperformance than rivals at points, Tradeweb has seen a mild incline and Trumid more pronounced growth.

Globally, MarketAxess saw credit average daily volumes (ADV) of US$15.2 billion in February 2024 (an increase of 5.2%), driven by year on year (YoY) increases across investment grade, emerging markets, Eurobonds, and municipal bonds. Emerging markets ADV hit US$3.6 billion, up 12.5% YoY, driven by a 6.4% increase in hard currency trading ADV, and a 26.5% growth in local currency markets trading ADV.

Chris Concannon, CEO of MarketAxess, said, “Strong credit volumes quarter-to-date across several of our growth cylinders have more than offset significantly lower levels of US high-yield trading activity on our platform impacted by continued low levels of credit spread volatility. The roll-out of MarketAxess X-Pro is continuing and client engagement is increasing with approximately 14% of our largest client firms active on the platform, up from 12% in January 2024.”

Emerging markets ADV hit US$3.6 billion, up 12.5% YoY, driven by a 6.4% increase in hard currency trading ADV, and a 26.5% growth in local currency markets trading ADV. Eurobonds ADV stood at US$2.0 billion, up 9.1% YoY. Municipal bond ADV hit US$434 million, up 8% YoY.

Total rates ADV stood at US$19.1 billion, down 18.6% from the previous year, but up 13% from January 2024, the firm said.

For its total global trading volumes, Tradeweb reported US$37.9 trillion and ADV of US$1.87 trillion in February, an increase of 31.1% YoY. The firm reported “record” ADV in US government bonds, ADV in Eurobonds, and ADV in fully electronic US investment grade credit.

US government bond ADV was up 44.% YoY to US$207.8 billion, supported by growth across all client sectors, leading to record volume on the institutional platform for the second consecutive month, Tradeweb said. Increased adoption across a wide range of trading protocols alongside sustained rates market volatility contributed to the increase in volume.

European government bond ADV was up 17.9% YoY to US$51 billion, buoyed by UK Gilts, which saw continued flow and growth in Tradeweb’s dealer-to-client platform.

European credit ADV was up 4.7% YoY to US$2.3 billion which the firm said was supported by continued growth in client use of Tradeweb Automated Intelligent Execution (AiEX) and portfolio trading.

Municipal bonds ADV was down 4.4% YoY to US$322 million. Tradeweb said volumes slightly outperformed the broader market, which was down more than 5% YoY. Credit derivatives ADV was down 23.1% YoY to US$8.1 billion. Tight credit spreads and low market volatility led to subdued swap execution facility (SEF) and multilateral trading facility (MTF) credit default swaps activity, the firm noted.

For equities, US ETF ADV was up 20.6% YoY to US$8.7 billion and European ETF ADV was up 7% YoY to US$3 billion. US and European ETF growth was driven by continued institutional client adoption of ETF trading via Tradeweb’s electronic RFQ as well as an uptick in the use of our ETF portfolio trading functionality.

Trumid claimed a record number of unique users executed a trade across one or more of its protocols in February. The daily average number of users trading in Trumid’s Request For Quote (RFQ) protocol has grown more than three times since the launch of Trumid Disclosed RFQ in May 2023. Its ‘Swarms’ protocol saw a record month for average daily volume, the firm noted, up 79% year-over-year, with 30% more traders transacting daily in the protocol than a year ago.

Trumid Portfolio Trading (PT) was said to be particularly valuable at month end, capturing a greater concentration of trades, active traders, and organic volume, the firm said.

Justine Robertson, head of US sales and client strategy, said, “Delivering all the protocols in one place has led to clients engaging the newer ones, so there are more eyes on the platform on a daily basis. We’re seeing record engagement across trading and our most active institutions on the platform are trading across multiple protocols.”

©Markets Media Europe 2025