In 2013 when markets still looked precarious amid the fallout from the financial crisis, utilities were a good investment.

With a near cast-iron cashflow and very boring business model, they were a tonic to investors who had seen big firms – notably financials – get put through the ringer, or even fail. Yet when a tier one bank failed in 2023, with financial looking wobbly, investors turning to UK utilities would have been shocked to discover they were looking precarious. This journey from safe haven to pariah was tracked in analysis by S&P Ratings.

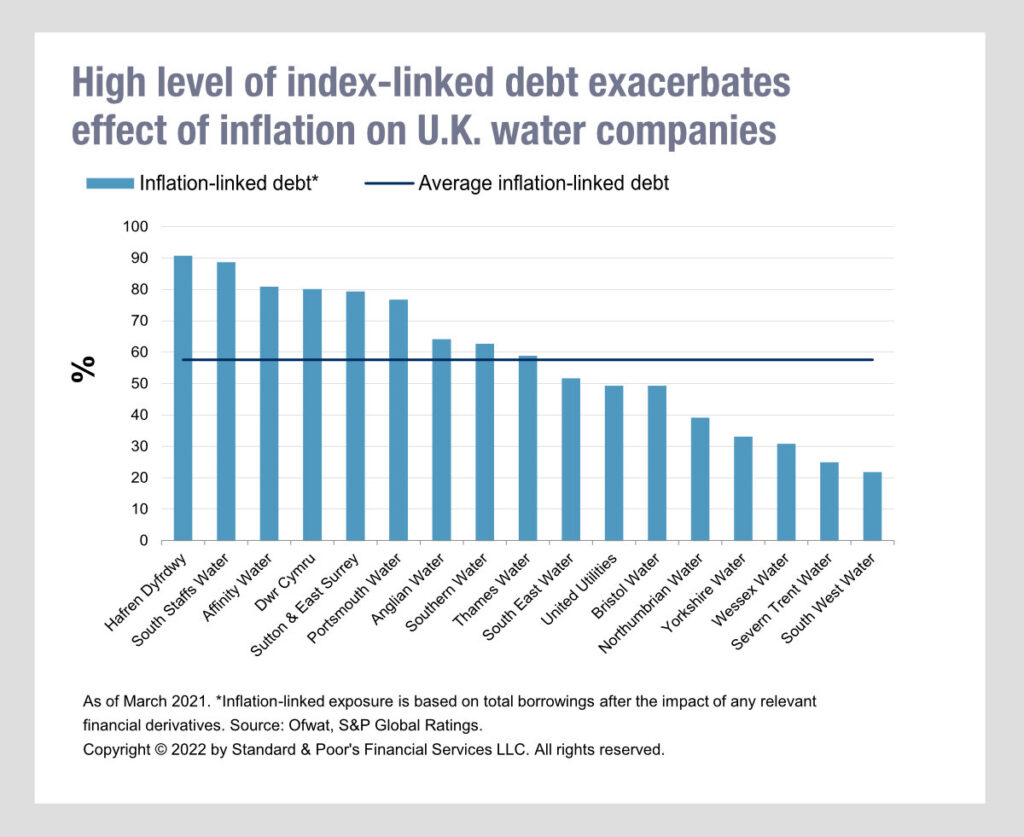

In December 2022, it showed that shows that utilities had loaded up with inflation linked debt, and that key metrics – funds from operations (FFO)to-net debt and debt to EBITDA, had weakened noticeably on average across the sector “and in most cases we do not expect them to recover to levels commensurate with the ratings on the entities until close to March 2025, when the current regulatory period ends.”

It also observed that cash flows were going to be tight for at least three years because of the level of investment required within infrastructure. “The rating actions we have taken in recent weeks now imply a negative outlook bias for the sector,” the firm noted. “We are likely to stabilise the outlook in cases where we see that a provider’s metrics have a firm path to recovery by 2025.

It also observed that cash flows were going to be tight for at least three years because of the level of investment required within infrastructure. “The rating actions we have taken in recent weeks now imply a negative outlook bias for the sector,” the firm noted. “We are likely to stabilise the outlook in cases where we see that a provider’s metrics have a firm path to recovery by 2025.

Conversely, we are likely to lower the ratings on those entities where we see metrics come under further pressure; this could occur because of an inability to recover costs via bill increases, for example, or if the effects of inflation persist for longer in the companies’ cost base.” At that point Thames Water announced it had spent its money over the past year as follows: £1.3 billion net investment in its network including £115.3 million of capitalised interest payments i.e. unpaid interest added to the loan amount. It also had £194 million in net financing costs and dividends; £901 million in day-to-day operational expenses. In its statement, Thames Water said it maintained relatively long-dated debt maturities with an average tenor of approximately 13 years) to minimise refinancing risks, although S&P analysis shows that 60% of this debt was inflation linked.

The average interest rate Thames incurred during 2021/22 was 6.63%, and it paid net interest of £273.6 million on our debt, including the £115.3 million being capitalised. Consequently, we can see the firm was paying £2.085 billion a year to support the business, whilst costs of financing were £309 million including the interest payments being deferred. That means its costs of financing were nearly 15% of total expenditure, or 34% of running costs. Its income, from both bills and borrowing in that period was £2.4 billion, exactly equal to its outgoings. However, its current EBITDA according to S&P is approximately £1.1 billion, so if financing costs remained flat, they were 28% EBITDA.

Fast forward to summer 2023, and following the resignation of Thames Water’s CEO, the firm was in a particularly precarious position. “Thames Water is the most indebted water company we rate, with S&P Global Ratings-adjusted debt of £13.7 billion as of March 31, 2022, translating into 80.6% of its regulated capital value (RCV),” noted S&P on 30 June 2023. “The company’s shareholders have previously indicated support for equity injections totalling £1.5 billion by the end of the current regulatory period, ending March 2025, toward financing the turnaround.

So far, £500 million of this has been received, with the remaining amount conditional on ongoing operational improvements and the company’s submission of its business plan for the next regulatory period. The exact timing of additional injections is unknown.” “With ‘significantly’ higher levels of investment needs for the sector in the next regulatory period, starting April 2025, to deliver improvements–notably in environmental quality–“amid intense public, political, and regulatory scrutiny.

These will coincide with a greater regulatory focus on financial resilience, potentially requiring lower overall leverage … We therefore envisage that additional shareholder support will remain critical for Thames Water beyond the current rating horizon.”

©Markets Media Europe 2023

©Markets Media Europe 2025