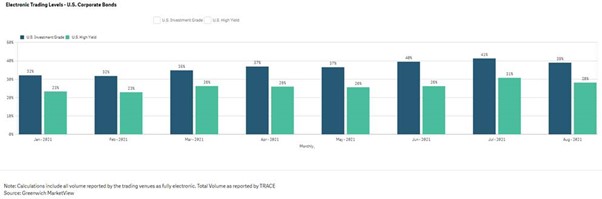

This week we look at the growth of electronic trading in the US fixed income markets, and the potential it holds to reduce time for trading. Ove the past year, electronic trading in US investment grade has increased to over 40% of volume in two months, June and July. While summer has seen a drop of in activity as is typical for the season, the overall trend for e-trading this year has been one of growth.

Electronic trading is a broad category of different execution types, making it hard to assess the exact impact this might be having upon trading efficiency. However, trading venues publish figures with a more detailed breakdown and these show some interesting outcomes.

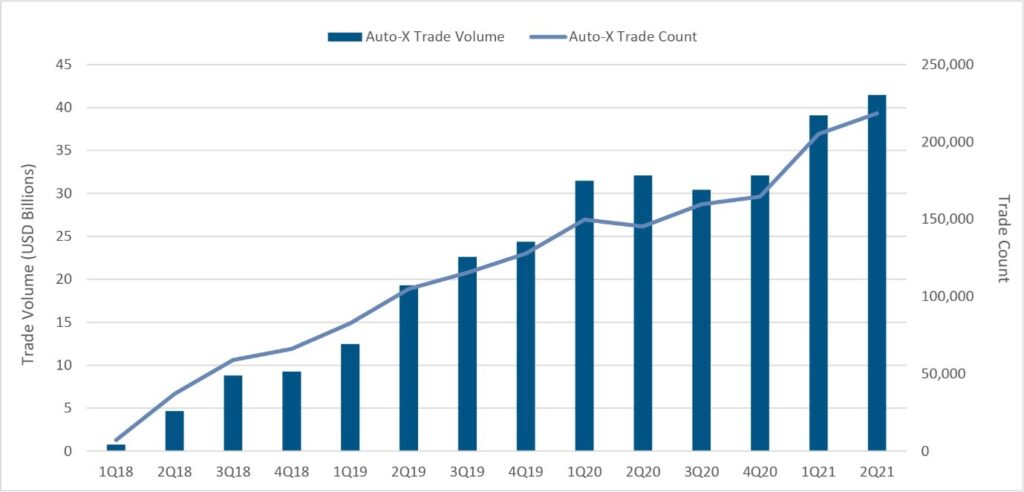

Auto-execution, in which an order is posted with specific parameters and traded when these are met, has increased in use even more rapidly than electronic trading over the past year. That is interesting because MarketAxess research has found auto-execution can cut time to trade in half. Using what it describes as a ‘conservative’ estimate that a trader might take 60 seconds to validate the data available to process an automated transaction, on average they take 130.8 seconds to assess the responses on a traditional request for quote (RFQ) and choosing to select one to execute against.

Although automated trading data is not always disclosed, we have found that a reported 219,000 trades were executed in Q2 2021 on MarketAxess which represents an increase to 17% of trades up from 11% in Q2 2020. If that is being replicated across the market it suggests that the type of electronic trading taking place is changing substantially. By the firm’s own analysis, traders would have saved more than 3600 hours or 400 trading days in that quarter – even more when including rival platforms’ auto-execution tools.

The growth of automated trading in the fixed income space is still largely confined to IG bonds but if the success it has seen here is replicated across the market – with nearly 25% volume increase year on year by notional traded – there is clearly a lot of scope for its application in the more liquid fixed income instruments. E-trading volumes have likewise risen by nearly a quarter between January and July 2021, and the virtuous circle of increased electronification, driving data availability, driving automation, suggests trading desks that are able to engage with automated execution could be helping deliver significant advantage to investors.

©Markets Media Europe 2025