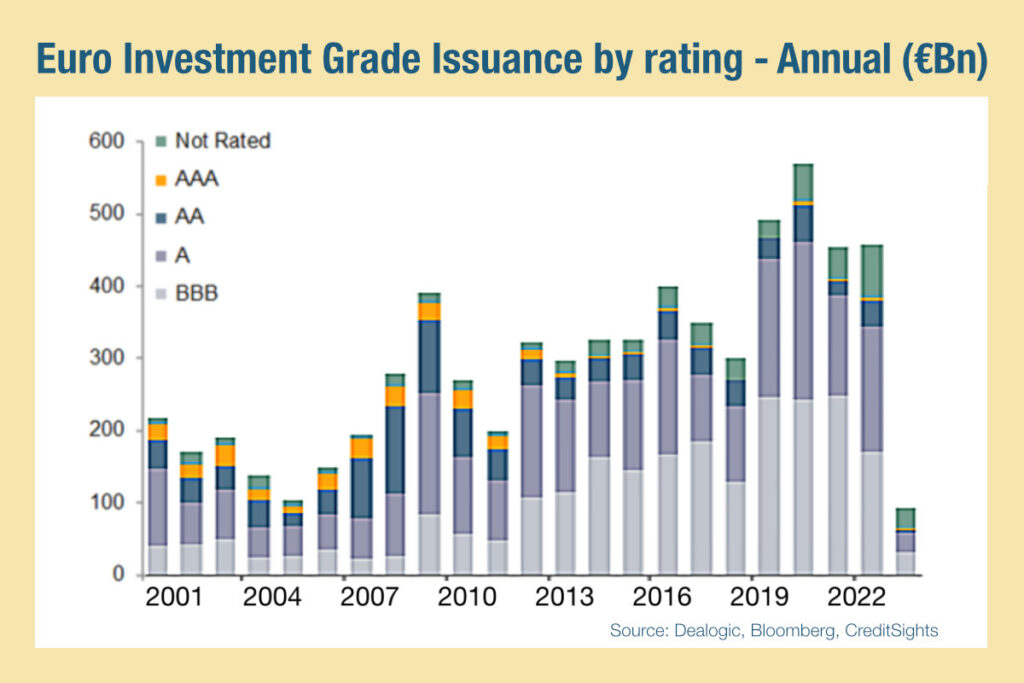

January was a record month for investment grade bond issuance in Europe, with shorter-dated driving this activity. According to analyst firm CreditSights, shorter maturity bonds took a big chunk of this with €19.6 billion of sub-five year bonds (reportedly the highest level since March 2022) and five-10 year bonds coming in at €50.9 billion, the highest level since April 2020.

In S&P Global Ratings’ recent report ‘Global Refinancing – Pandemic-Era Debt Overhang Will Add To Financing Pressure In The Coming Years’ it noted that higher quality credit issuance had fallen in in 2022, but to a lesser extent than issuance overall.

“Investment-grade bond issuance fell by 11% globally to almost US$2 trillion,” the report said. “Even so, it remained well over upcoming annual maturities of investment-grade bonds, which peak at US$1.71 trillion in 2025. The majority of investment-grade bonds maturing through 2025 (at 52%) are from financial services, the largest share of which are European.”

The activity seen at the start of the year has positive and negative implications for buy-side desks. New issuance is continuing to support existing portfolios, and providing a source of liquidity and pricing for corporate bond markets which help bond portfolios seeing increasing inflows.

Issuance at lower maturities also supports electronic trading, as the relative volume of e-trading for shorter maturities is greater than for longer-dated bonds according to traders.

That may help with the less positive aspect of record new issuance; busy primary markets make secondary markets more challenging to trade as it can consume the workload of at least one trader on the desk – depending on the amount of primary market engagement – increasing the strain on others.

On the flipside, with issuance superseding existing debt levels, the rising appetite for bonds should continue to be matched by supply, reducing competition and pricing increases.

©Markets Media Europe 2023

©Markets Media Europe 2025