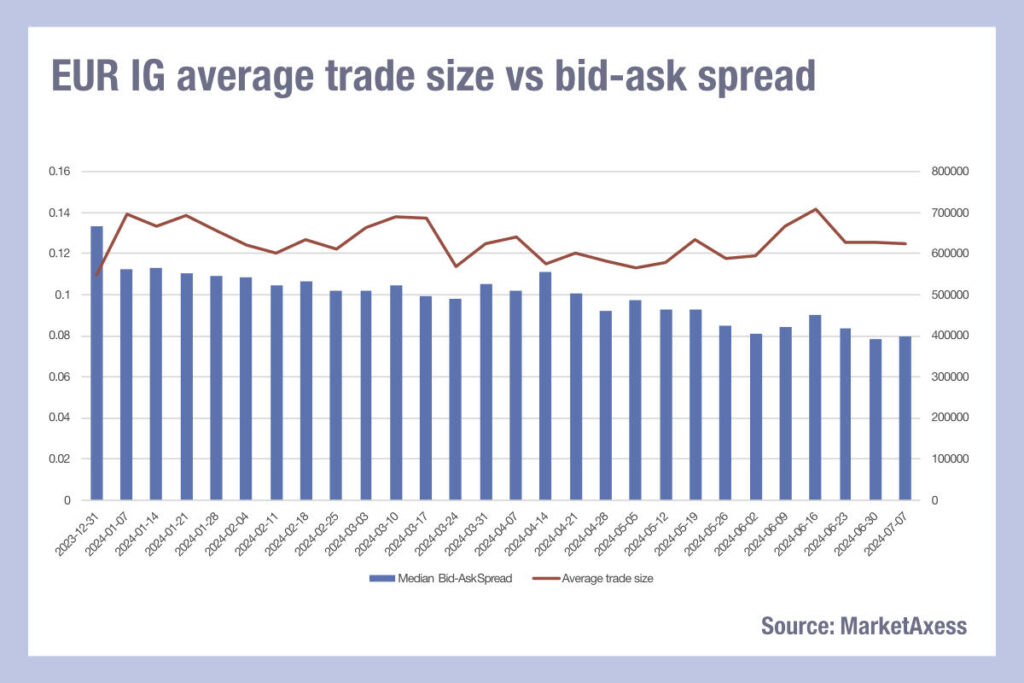

European investment grade (IG) credit traders will have seen average bid-ask spreads declining since April, with the median average (typically about €0.03 cents lower than the mean average) sinking below €0.10 cents in April and falling below €0.08 cents in June according to MarketAxess CP+ data, while average trade sizes remained relatively range-bound between 600,000-700,000, based on MarketAxess TraX information.

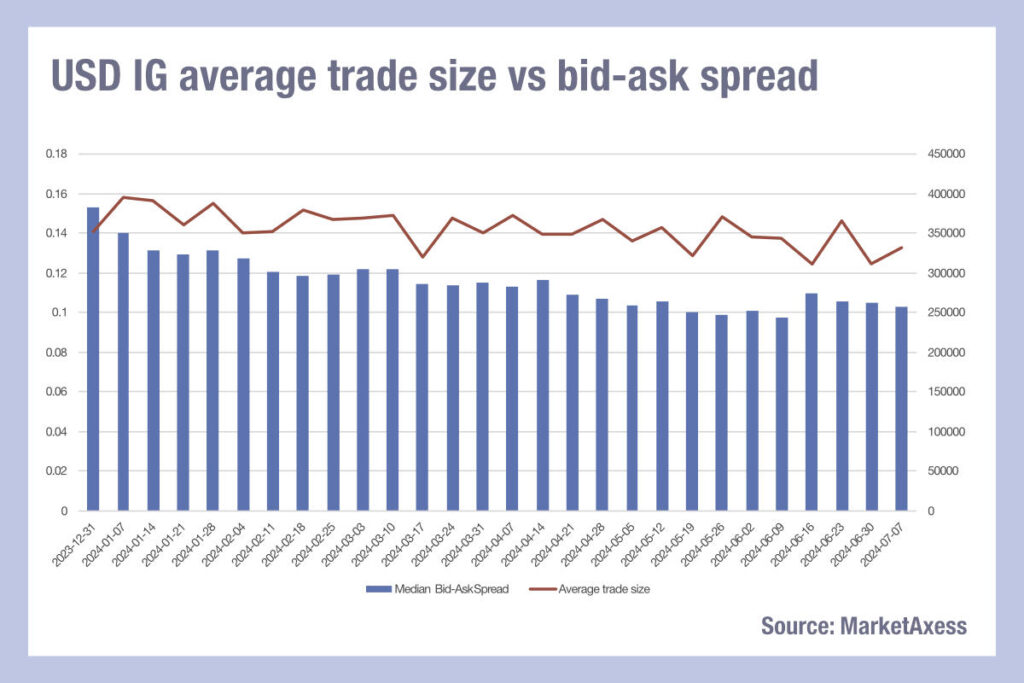

By contrast, US investment grade credit saw median and mean average bid-ask spreads jump in mid-June, having dipped below US$0.10 cents one week in May and once in June. Meanwhile average trade sizes have continued to gradually decline, from the 350-400,000 range earlier in the year to the 300-350,000 range in summer, based on MarketAxess TraX information.

Pricing and average order size do not automatically correlate – block trades might lead to lower net prices, where odd lots can be priced up as more difficult to trade away by market makers. However, smaller, electronic low-touch trades can be cheaper to execute than mid-sized trades manual trades, and the rise of portfolio trading can result in a balancing out of risk pricing between illiquid and liquid bonds.

The new issue market on both sides of the pond has been booming, with subscription of investment grade deals being pretty impressive from a participation point of view. New issue premium tightening has really ramped up across both IG and high yield. That may feed into strong technical trading in credit markets. Yet traders report there has been no noticeable difference between Europe and the US in this regard.

Why would the cost of liquidity be less in Europe, with trade sizes static?

Traders cannot see an easy answer to this, so the obvious points would be that dealers may be pricing more effectively in Europe as a result of the better balance sheet provision, or more aggressively to compete more effectively, even in markets where they see potential losses over the short term.

It will be interesting to track this trend over the rest of 2024 and see if there is some anomalous activity impacting the numbers, or if there is a real difference playing out in the markets.

©Markets Media Europe 2024

©Markets Media Europe 2025