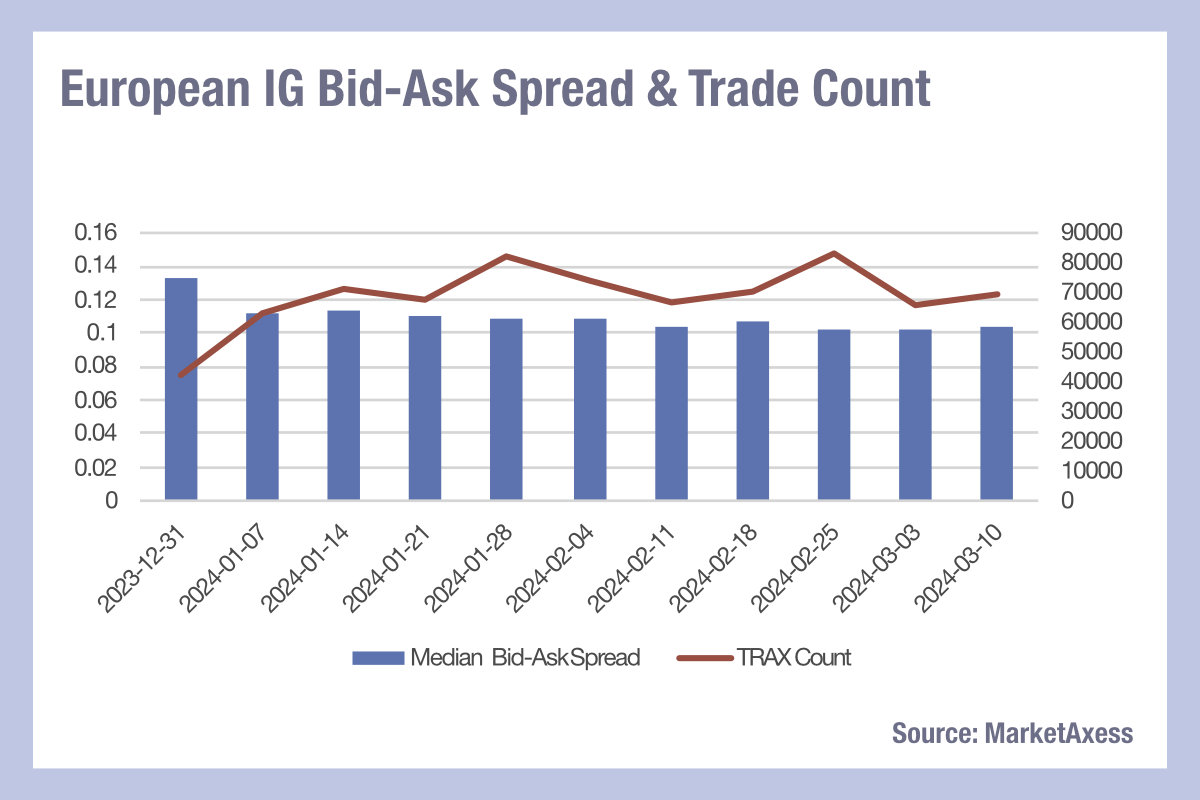

European investment grade bond traders are seeing a falling bid-ask spread, and a rising trade count since the start of 2024, according to MarketAxess’s CP+ and TraX, which follows activity across multiple markets.

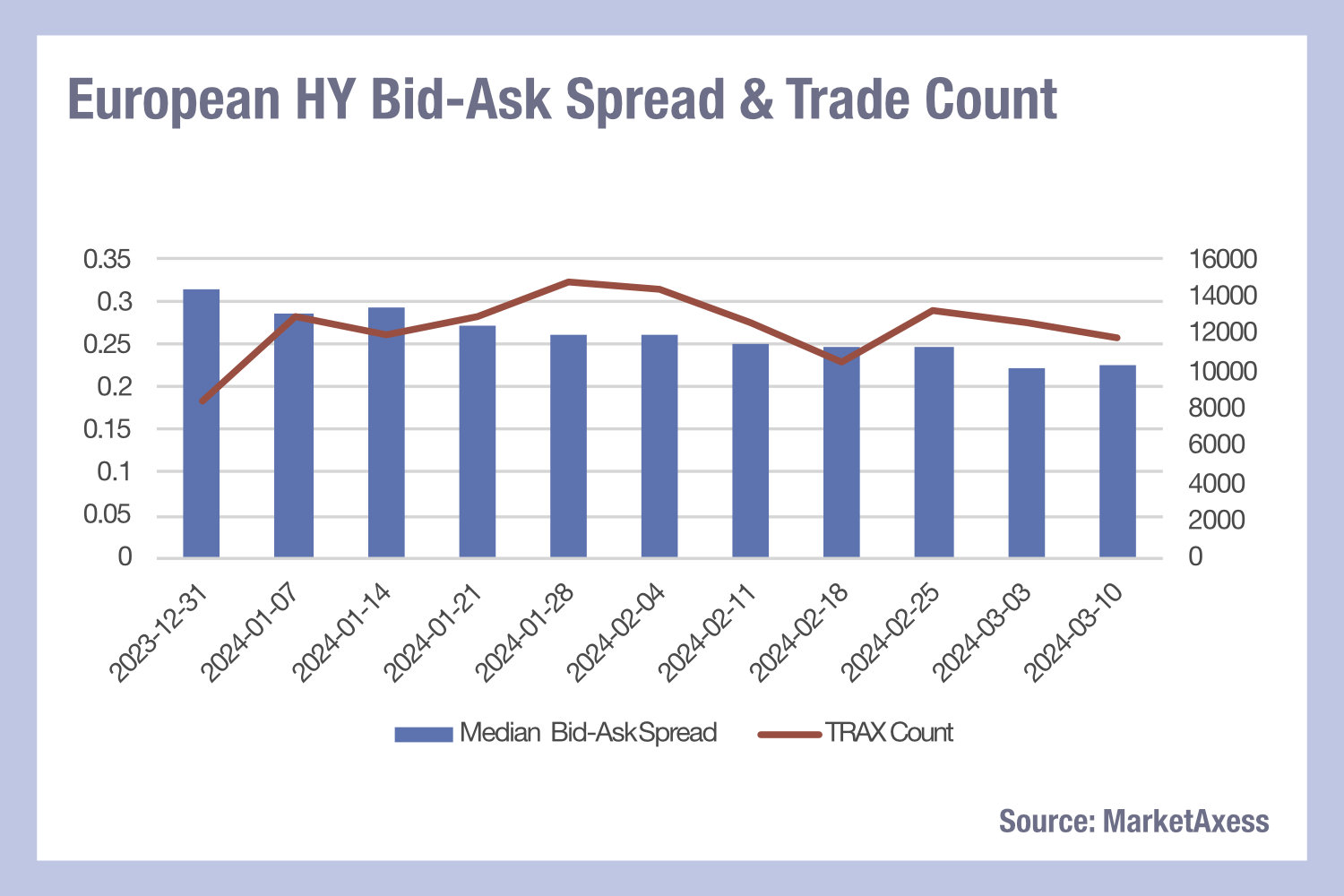

This points to an increase in the number of smaller, lower cost trades, and may imply greater electronification of trading. At the same time, high yield trading in Europe is seeing trade counts fall as bid-ask spreads decline – the latter in a similar pattern to IG bonds – suggesting that riskier investments are also experiencing lower costs of liquidity access, however less clearly through an electronification process.

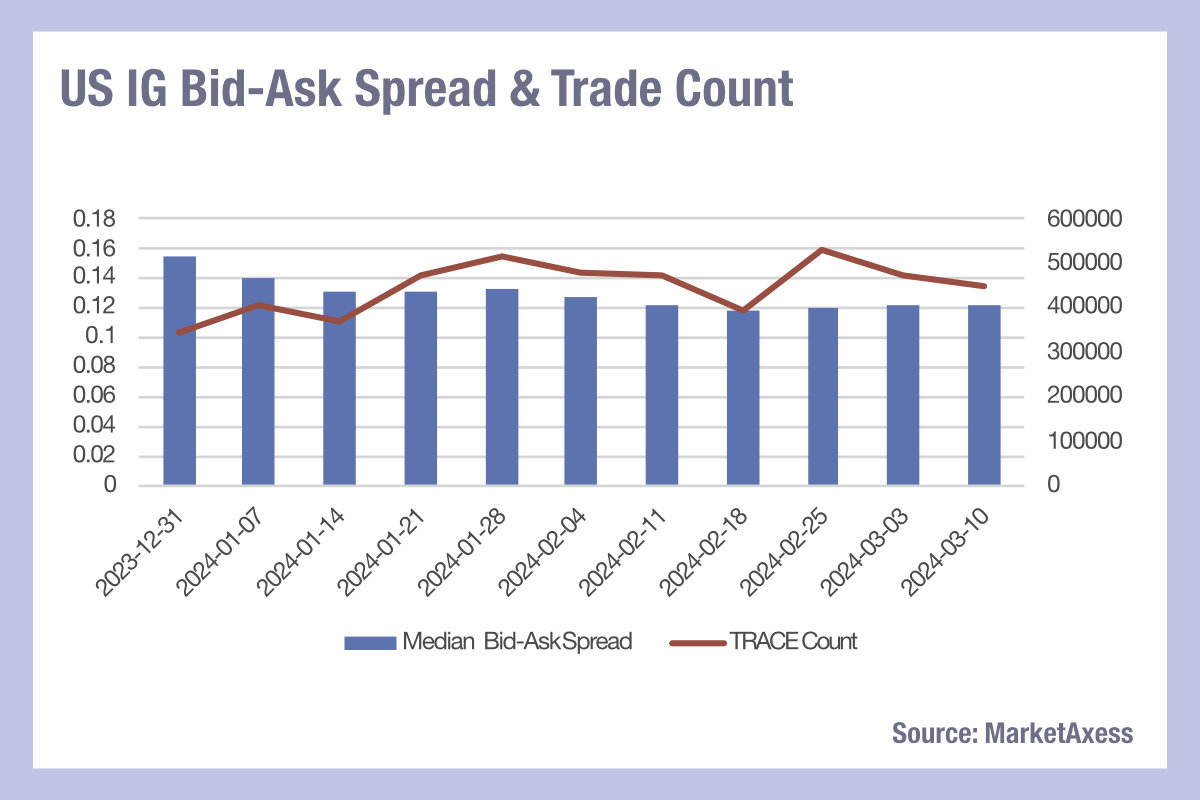

As one trader noted, “High yield spreads have never been tighter.” While US markets are exhibiting a relatively similar pattern there are important differences. IG trading has seen a similar breakaway between trade counts and bid-ask spreads, but less pronounced and with a decline in trade count since late February.

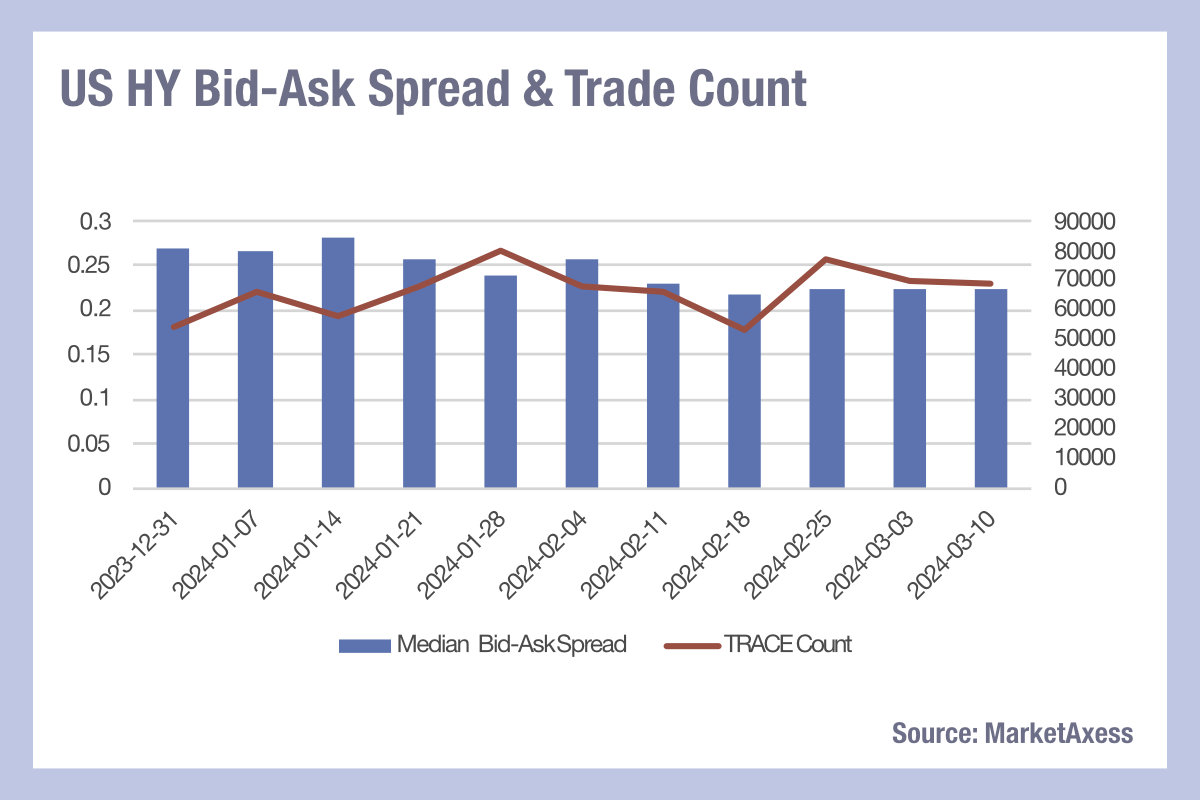

Nevertheless, the trend of the year suggests that a similar level of electronification is occurring, with smaller trade leading to lower costs of execution through low touch dealing desks and e-trading platforms. US high yield has had a far more correlated bid-ask spread and trade count, looking at TRACE data, which implies that it is not seeing the same reduction in trade sizes, and although bid ask spreads have fallen somewhat, the reduction is less pronounced.

The implication is that trades are being conducted in a higher touch manner. These data points appear to correlate with reports on market activity from banks and analyst firms, which suggest the electronification of European bond markets is proportionally higher than that of US markets, however, US IG trading is now increasing after a flat period, while electronification of US high yield has actually declined over recent months.

The direction of travel is a positive one for buy-side traders seeking to reduce trading costs and market impact. It also raises the ongoing question of how market dealer structure is impacting progress towards electronification. Buy-side traders have long said it is ‘easier’ to trade in the US, while for the sell side, the market clearly offers larger, more profitable bid-ask spreads. Electronic trading models are rolled out in the US first.

In Europe, the wider range of dealers and lower reliance on a handful of brokers to support primary market allocations allows for tighter bid-ask spreads and a more competitive environment. Despite being the secondary launchpad for electronic trading tools, this allows e-trading to flourish once in place.

©Markets Media Europe 2024

©Markets Media Europe 2025