Understanding the unique features of European capital markets is hugely important for traders and infrastructure providers, but so are the differences this makes to the path of electronic execution.

Having a single regulator in the European Union (EU) via the European Securities and Markets Authority (ESMA) with oversight of all asset classes presents a different model to that of the US, where cash and derivative markets have different oversight from the Securities Exchange Commission (SEC) and the Commodity and Futures Trading Commission (CFTC).

“In theory, the European version is easier, because these broad rules can be created that apply across markets,” notes Kevin McPartland, head of market structure and technology research at Coalition Greenwich. “However, as we all know, the equities market and corporate, government and municipal bond markets are all very different. They have different dynamics and liquidity profiles and investor profiles, and so overseeing them in the same way does feel a bit of a stretch. That’s resulted in a US market that perhaps has more appropriate levels of oversight per market, although I feel a more complicated regulatory structure, with Europe, having a little more straightforward structure, but with a lot of unintended consequences because you’re trying to apply the same rules to markets that are actually very different.”

ESMA’s trading venue perimeter rules in Europe are cited as one reason why direct streaming of prices and potential no-touch trading could be slower to roil out in Europe relative to the US markets.

Other structural factors are also at play, and have significant results. Europe beyond the EU is not a single market, and has varying levels of compliance with ESMA rules, but also a range of currencies, national markets, central banks and legal jurisdictions.

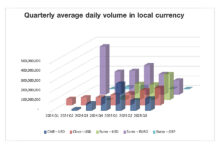

While the Euro region is heavily brokered in credit, with wafer thin bid-ask spreads for investment grade trading, other local markets, including US sterling, have limited liquidity providers, with much wider bid-ask spreads and the small pool of dealers can quickly become bottlenecked during volatile markets or heavy trading. Conventions also impact liquidity provision.

Andy Munro, global head of trading, fixed income, at Janus Henderson, says, “The UK and EU have bigger minimum denominations in corporate bonds compared to the US, this makes the market harder for retail investors to participate and also makes the fair allocation of partial trades harder to manage especially if some of the funds are relatively small compared to others on an order,”

A large amount of liquidity provision in the US has hinged upon indices which are tracked by exchange traded funds (ETFs), used by electronic liquidity providers via the creation / redemption process to build portfolios of bonds into highly liquid, equity-like funds.

Europe lacks an ETF market of the same scale as the US, and sees smaller secondary volumes traded. This will make it harder for liquidity providers to generate greater revenues on European credit without significantly increasing volumes, and therefore the market is likely to see a greater amount of trading in Europe conducted as large blocks, bilaterally between banks and buy side firms, than electronically.

For Europe to compete the US market, it will need to see greater transparency, standardisation and indexation of its credit markets.

©Markets Media Europe 2025