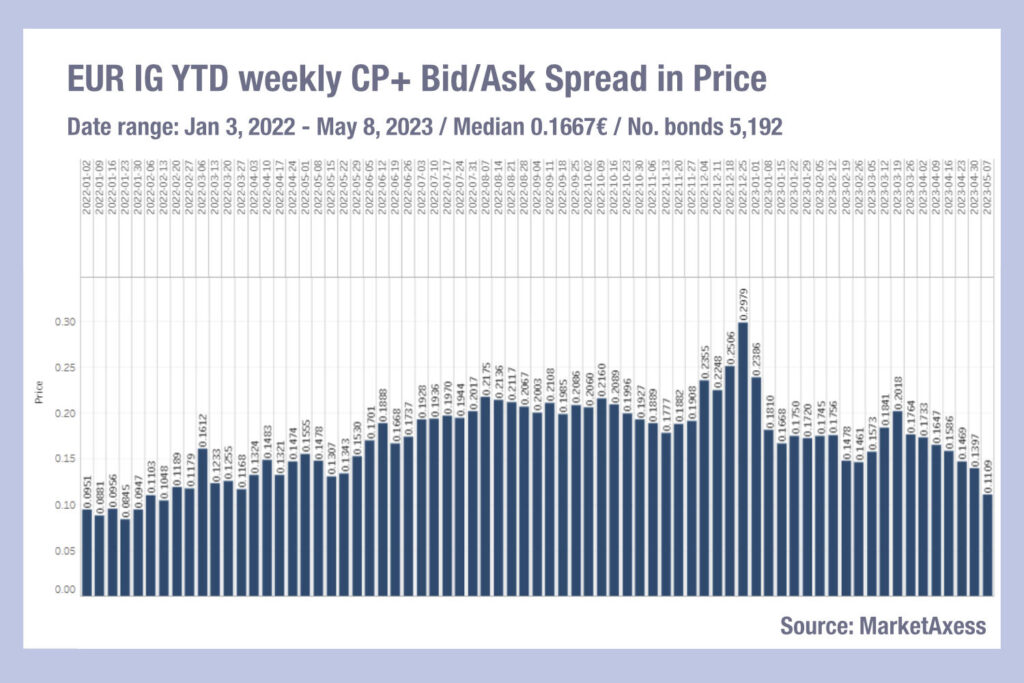

Bid ask spreads in European investment grade (IG) credit trading have fallen substantially over the past month, based on data from MarketAxess’s CP+ composite price tool. The fall is notable because European high yield credit has not seen a similar level and in fact spreads have been reasonably elevated since mid-February.

Consequently, European IG liquidity is looking cheap, although lower trading volumes may make the liquidity discovery process harder.

Tighter spreads could indicate that banks are better able to support risk trades for clients, and although some had a tough first quarter, European banks including BNP Paribas and Barclays did well in the bond trading space.

The longer term trend towards less profitability in secondary markets for fixed income does suggest that banks may find it hard to maintain lower bid-ask spreads and with the MOVE index still looking toppy, there are reasons to think that it will continue to be challenging to price bonds quickly.

One possible non-bank influence on the bid-ask spreads may be electronic market makers, which have been supplying liquidity effectively via all-to-all trading platforms and direct liquidity provision, by pricing indexed bonds via exchange-traded funds.

We have also seen average trade sizes reducing significantly in European credit, halving since the start of 2022, to stay around US$600k. Typically it is easier to trade smaller tickets, and that may be the reason behind the falling bid-ask spread, and certainly that might tie to the hypothesis that e-trading firms are helping to lower the cost of liquidity as they trade in small size.

©Markets Media Europe 2023

©Markets Media Europe 2025