The European Securities and Markets Authority (ESMA) has confirmed consolidated tape providers (CTPs) will be selected by the end of next year, pushing the launch of the CTPs to 2025.

The Markets in Financial Instruments Regulation (MiFIR) review, which begins Q1 2024, will task ESMA with appointing and establishing a CTP each for bonds, equities (shares and ETFs) and OTC derivatives.

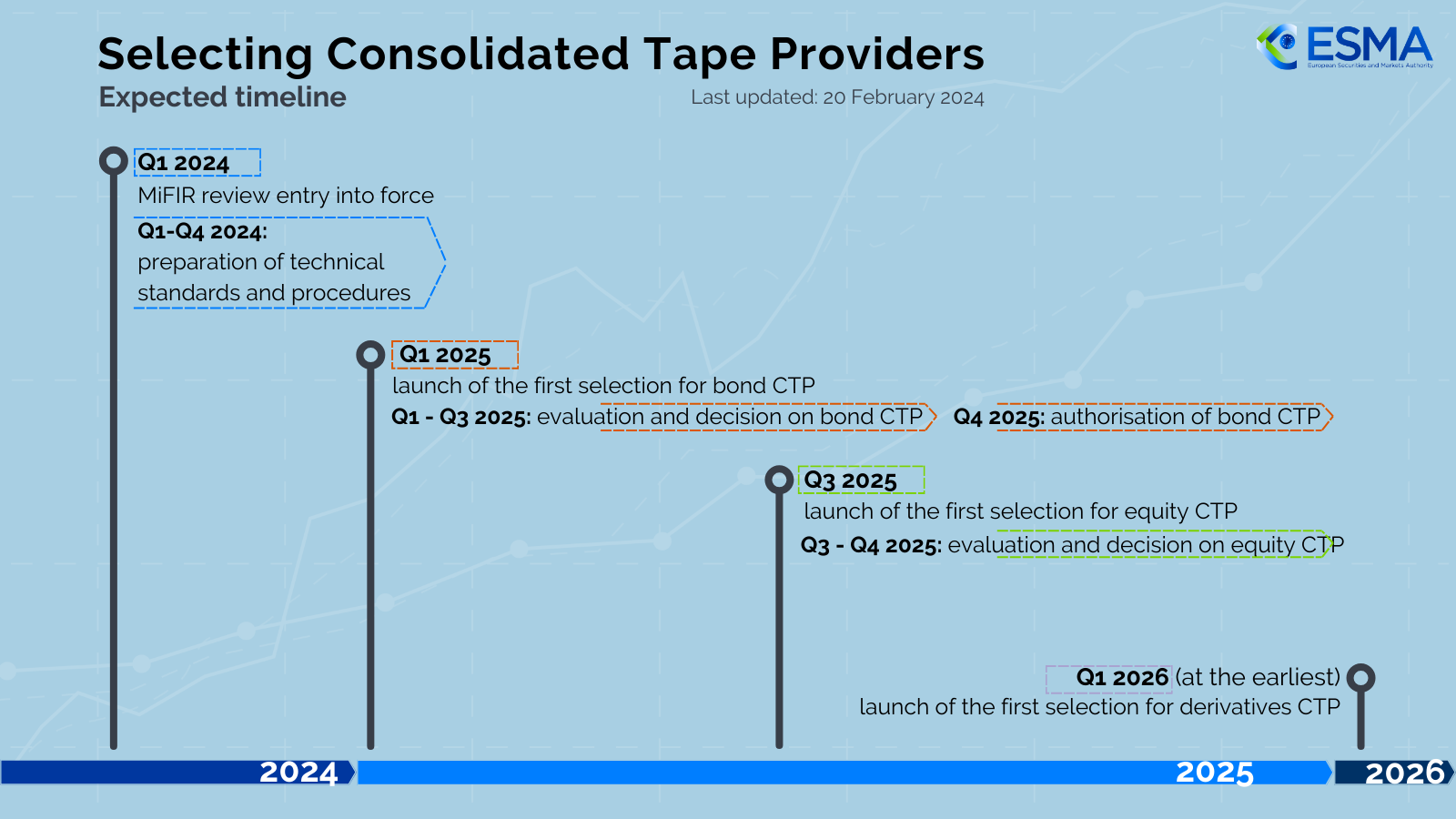

The launch of the first selection process for a bond CTP will begin in Q4 2024, with a decision made over the course of Q1 to Q3 2025 and a go-live in Q4 2025. The selection process for an equity CTP will begin in Q2 2025, with a decision made on this CTP provider by Q4 2025. Lastly, in Q4 2025, at the earliest, the selection process for a derivatives CTP will begin.

CTPs will be responsible for collecting from trading venues and approved publication arrangements (APAs) market data about financial instruments and for consolidating such data per financial instrument into a continuous electronic live stream made available to the public.

ESMA will have nine months to organise the first selection procedure to award a single entity the right to operate as a CTP for five years. Each selection procedure will last six months.

Ahead of the launch of the first selection procedure for the bonds CTP expected by the end of 2024, ESMA will draft the relevant technical standards during the course of 2024. This preparatory phase may include a public consultation and stakeholder workshops, the regulator said.

© Markets Media Europe 2023

©Markets Media Europe 2025