Andrew Cameron, Automation Solutions at MarketAxess, discusses the benefits of automation in trading.

Automation technologies have revolutionised so many aspects of our lives that it’s hard to remember a time before them, despite being relatively new. In the last couple of years, we’ve seen everything from automated assembly lines to AI-based chatbots that can answer inquiries in real-time.

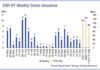

The same is true in fixed income. Automation has revolutionised the credit landscape and MarketAxess is at the forefront of this innovation offering unrivalled efficiency and precision in trade execution. As a leader in this space, MarketAxess has seen tremendous growth in the adoption of automation with trade volume exceeding $1 trillion since its inception in 2018.

This recent surge in automation technologies emphasises its transformative power not only in the real world, but also within modern credit trading. More and more firms are looking to leverage these technologies to enhance execution performance, access unique liquidity sources, and streamline investment workflows. We are continuously refining and streamlining the automated trading process so that we can provide our clients with a competitive edge as they navigate the evolving fixed income market.

What are the key advantages of using automated trading systems?

Just like in everyday life, automation technologies are constantly evolving to ease our lives. The automation suite at MarketAxess is just as dynamic as these real-world examples as it expands based on client demands, trading intents, and changing ideas. These solutions initially revolved around the core concepts of providing a compliant, rules-based trading assistant that enables clients to “do more with less,” the basic principle behind automation. This phrase is nothing new in the world of trading automation, but its basic meaning has changed vastly beyond the basic approaches that were launched into the market 5-10 years ago.

Our thriving user community, which has more than 310 clients, leverages the efficiency offered by automated trading, but with other core aims like enhanced execution performance and access to unique liquidity sources. Many clients don’t want to give up the benefits they get from their time and effort once they have made automated systems part of their everyday investment and trading workflows. Now that automated trading solutions have evolved so far, we can offer a more flexible and adaptable approach tailored to the specific needs of individual clients.

What are the main barriers to adoption of automation?

Any new technology has faced barriers in terms of adoption, and the development of our automation tools are no different. Over the years, I have observed five primary barriers to adoption:

- Unclear automation strategy, no designated decision-making bodies, or support structure at the client level.

- Inflexible rule governance, guardrails, risk controls and the recently-launched auto-hedging.

- Inability to action and deploy real-time data for pricing and risk mitigation purposes.

- Low confidence measurability of results, real-time and post trade.

- Limited protections/efficiencies for the middle/back office.

With the launch of Adaptive Auto-X at MarketAxess, we have addressed barriers 2-5. Clients who embrace automation and have the right systems in place are more likely to see the biggest benefits from using advanced automated trading tools.

Can automation efficiently handle orders across various sizes?

We built our automation tools absent of a “one size fits all” approach. Depending on the objective of the client and constraints of the market, automation can handle orders of all sizes. Capturing smaller orders is extremely competitive – not only have smarter workflows led to greater capacity in the market, but there are more passive trading opportunities here.

Clients can now place large orders over a longer period (from hours to weeks) while controlling who can see the order and using smart counterparty selection to reduce the risk of information leakage.

With last year’s launch of Adaptive Auto-X and our upcoming expansion to Europe, clients can essentially engage the market with a single mouse click, whether for a single order or thousands of orders at once. This streamlined approach allows clients to leverage the power of automation to execute orders of any size efficiently and effectively, while maintaining control over their trades.

Where do you see automation going from here?

Automation is evolving rapidly, and clients are already benefiting from the next wave of innovations. They’re constantly looking for ways to enhance execution efficiency while minimising risks related to budget, trade errors, and settlement complexities. As the demand for more advanced solutions grows, there’s a clear focus on technologies that go beyond traditional methods – utilising real-time analytics and simplifying the management of diverse trading and data APIs.

This new generation of automated solutions empowers clients to confidently improve execution without worrying about operational and logistical setbacks. We remain closely attuned to these advancements, ensuring our automation suite aligns with the evolving needs of the market.

©Markets Media Europe 2025