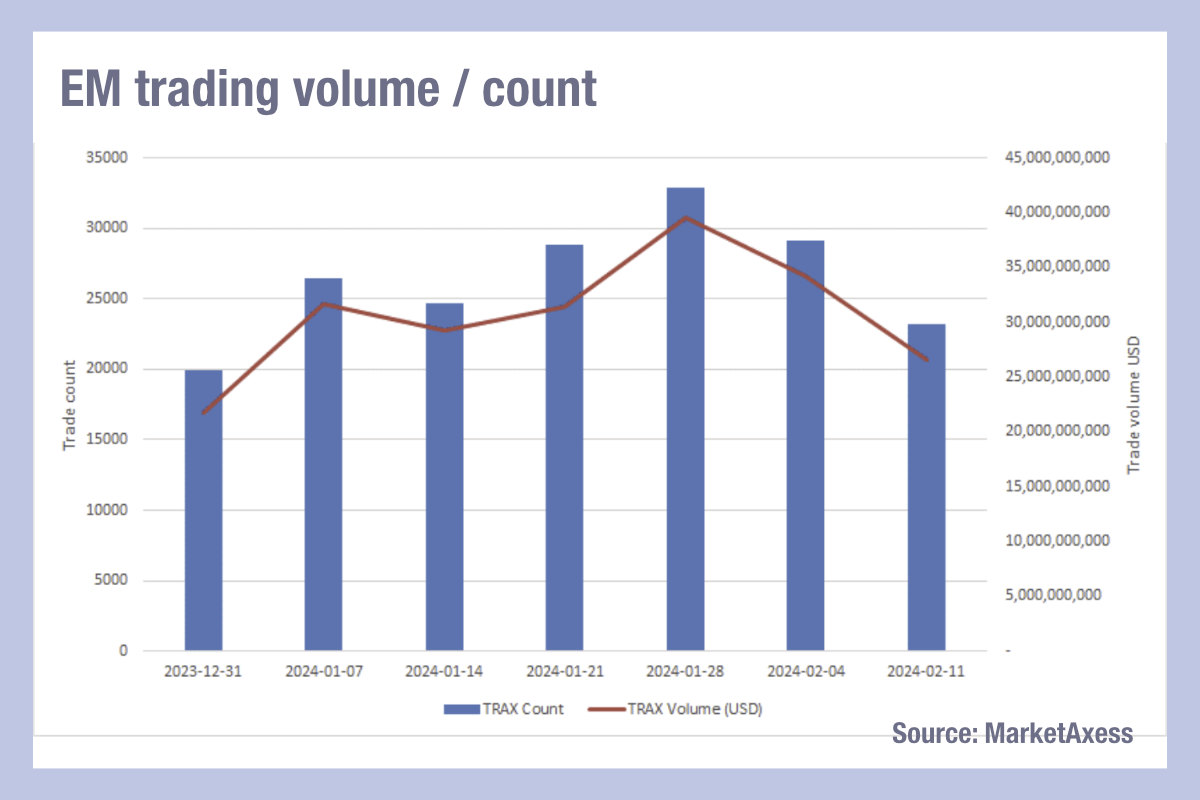

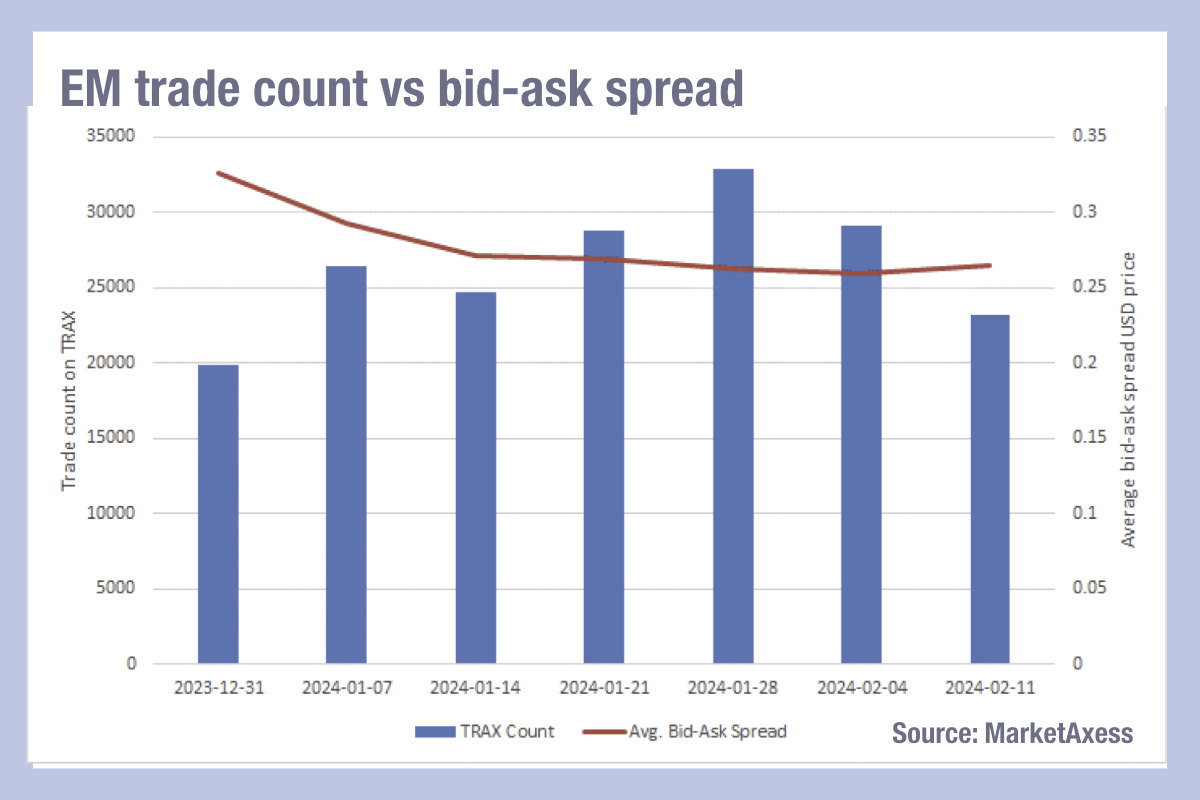

Emerging market bond traders will see trading costs rising as volumes begin to decline. According to MarketAxess data from its CP+ pricing tool and the Trax service, which assesses trading activity across multiple markets and sources, trade count and notional volume are staring to decline since the end of January.

In EM bond markets, trade count and volume are both highly correlated this year, which is indicative of consistent sizes of trading and, that implies, a relatively limited impact from both bilateral and intermediated trading approaches, i.e. there are fewer ways to break large orders up into small size or to trade blocks more economically, both of which would lead to a divergence between the volume traded and the number of tickets used to trade that amount.

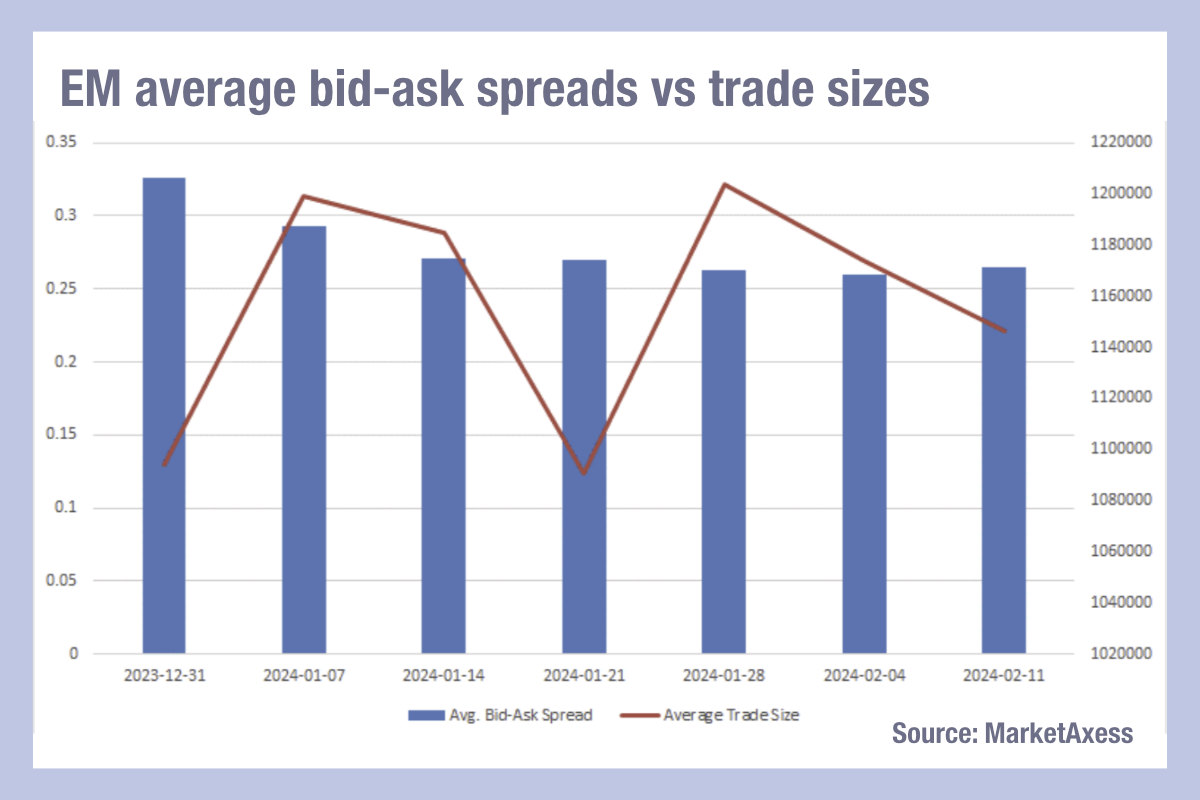

When we look at the bid-ask spread for EM bond trading, we see that this consistently correlates with the level of trading activity (both volume and count being closely tied) in an inverse pattern, i.e. the cost of liquidity falls as activity level increases. This pattern should be contrasted with that of both the US and Europe, where we have seen falling bid-ask spreads even where volumes are also ticking down, indicating that the cost of liquidity is falling overall.

In EM markets there is clearly much room for electronification and greater efficiency in hard currency trading. We also find that there is a lower correlation between average trade size and the cost of liquidity, with occasional significant dips in average trade size showing no corresponding link to bid-ask spread.

With emerging bond markets looking full o promise for investors this year, and a close eye being kept on bond issuance, traders should try to take full advantage of more efficient ways of trading – electronically where possible – in order to bring the cost of liquidity under control, even at points of lower market activity.

©Markets Media Europe 2024

©Markets Media Europe 2025