This week we examine the very directional movements of emerging markets (EM) assets under management (AUM), due to investment flows and growing issuance. With primary market activity up on 2023 year-to-date by nearly a third, and improving returns in EM debt, investors are looking at EM once again.

Although investor flows are overall negative, looking at the EM sector in detail there are positive notes for passive funds and certain areas of bonds, which should create relatively positive liquidity conditions, alongside the tails of activity driven by primary markets.

Investor wisdom has seen growing interest for investing in low risk bonds, as central banks in developed markets have increased rates after a decade of low yields.

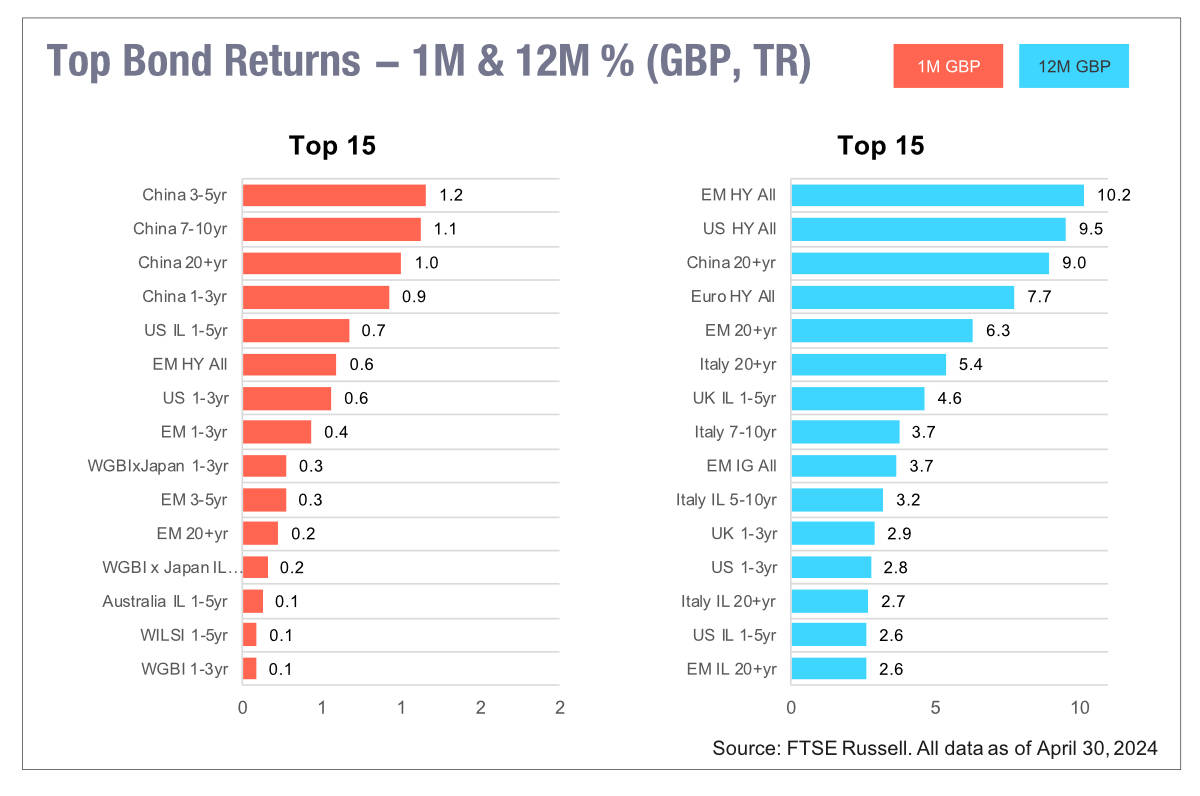

FTSE Russell analysis, which uses pound sterling as the base currency, has found that while conventional bonds saw a fall in April, with Japanese and long-dated bond leading the pack, emerging market and China bonds dodged losses and on a year-to-date basis, “showed gains of 1-6% YTD, in sterling terms, reflecting monetary easing, with currencies also showing modest gains versus sterling.”

Japanese Government Bonds (JGBs) were flagged as weakest in the firm’s analysis, due to the weak yen, with losses of 3-6% across the curve in April and YTD returns seeing JGBs losing 9-14% terms, in sterling terms.

“Duration also took its toll on long gilts, Treasuries, WGBI and Bunds, with losses of 8-10%,” the firm wrote.

Meanwhile, Morgan Stanley analysis has found that overall outflows from EM funds have increased over the past week, seeing US$730 million this week versus outflows of US$653 million in the previous week.

Yet there have been positive inflows, including those seen in hard currency exchange traded funds (ETFs) which saw US$327 million while non-ETFs turned to outflows worth US$342 million, inflows to sovereign funds increased to US$364 million.

In local currency, inflows were seen ETFs turned to inflows of US$148m, from outflows of US$300m in the previous week, versus non-ETFs saw outflows remain more persistent at US$236m, from US$204m in the week before.

Strong buying and selling activity will be supporting overall liquidity in EM markets, and may well be helping dealers to offset risk by trading across the EM sector as market makers.

At the same time EM credit issuance has been booming with a reported US$9.6 billion in last week versus US$4.8 billion the week before, and US$2 billion in new sovereign debt.

“[This brings] YTD sovereign issuance to US$100.3 billion, up US$23.8 billion versus 2023 at this point in the year,” wrote Simon Waever, analyst at Morgan Stanley. “We are currently 56% of the way through our 2024 issuance expectations.”

This is net positive for liquidity although on an individual basis some buy-side desks may be struggling to get strong execution outcomes selling existing debt – potentially lower yielding – into a market awash with positively yielding bonds.

©Markets Media Europe 2023

©Markets Media Europe 2025