Emerging market activity has seen a reduction in volatility in the first half of the year, with both volumes and pricing levels falling slightly, but at a stable rate, according to data from MarketAxess Trax, which tracks trading across multiple markets and counterparties.

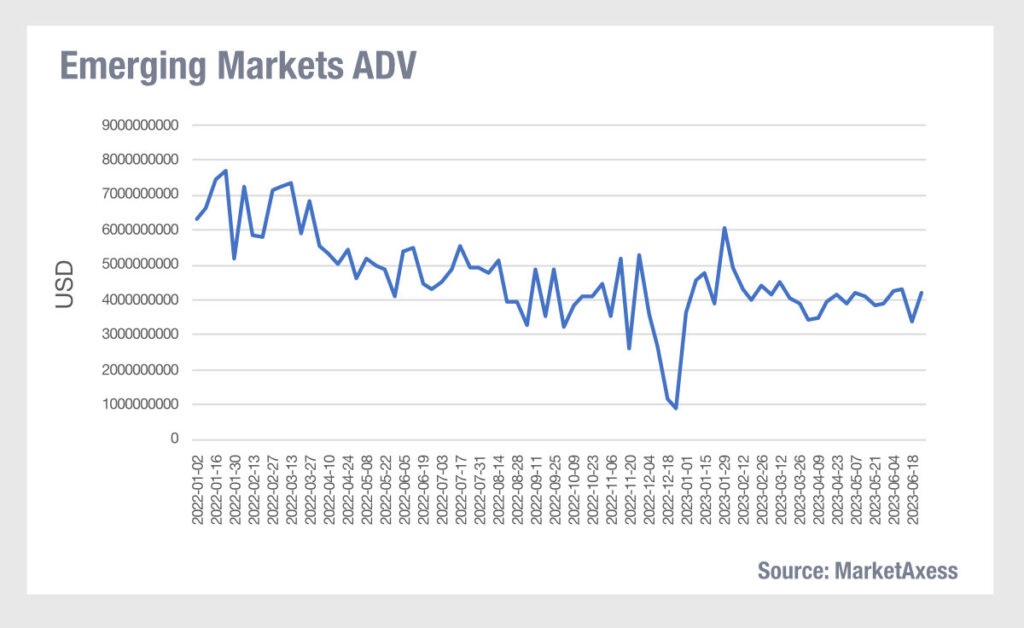

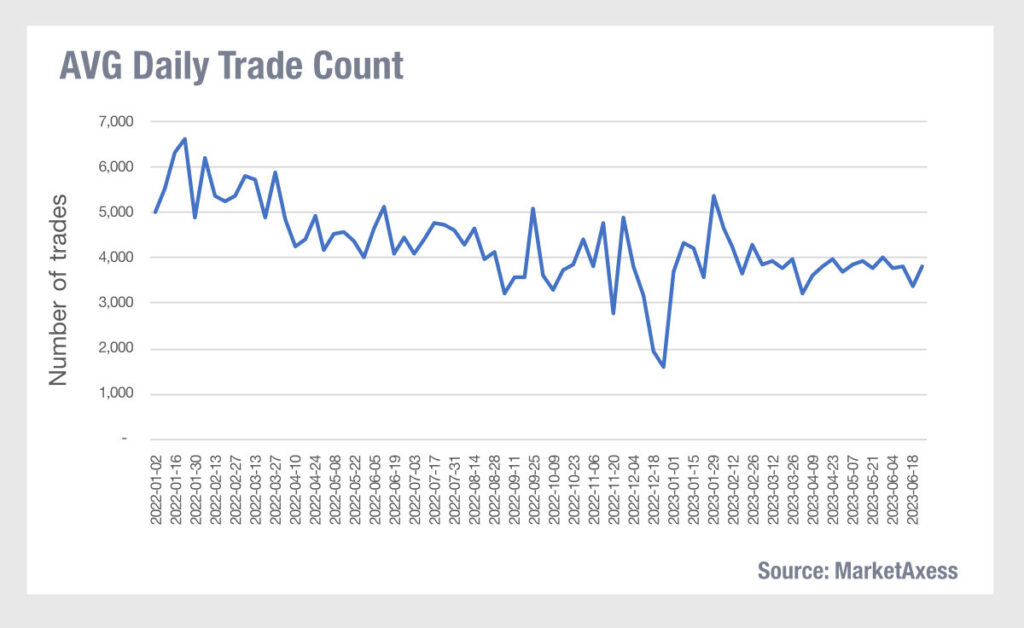

Compared with 2022, volumes have been markedly lower. While that captured the start of Russia’s invasion of Ukraine in March, there had also been far higher volumes in January and February 2022, hitting average daily volumes of over USD7 billion for several weeks, where volumes are currently rangebound at the US$4 billion mark. In EM this year, sources report there has been more focus on frontier/distressed credit names which typically trade in smaller size. Value traded could have fallen as a result of rising rates, which pushes down the value of secondary market bonds, however we do see that trading by average daily ticket numbers has also fallen in parallel.

Compared with 2022, volumes have been markedly lower. While that captured the start of Russia’s invasion of Ukraine in March, there had also been far higher volumes in January and February 2022, hitting average daily volumes of over USD7 billion for several weeks, where volumes are currently rangebound at the US$4 billion mark. In EM this year, sources report there has been more focus on frontier/distressed credit names which typically trade in smaller size. Value traded could have fallen as a result of rising rates, which pushes down the value of secondary market bonds, however we do see that trading by average daily ticket numbers has also fallen in parallel.

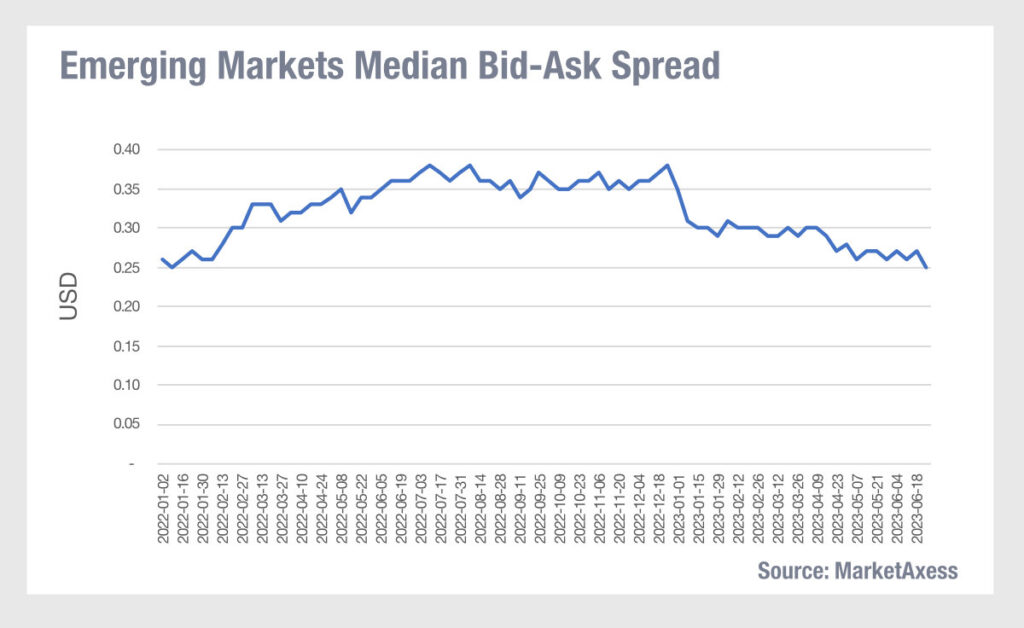

On top of that the uncertain path of interest rates, a challenging environment for market makers and therefore less risk taking by the banks could be reducing flow. Buy side activity is muted where solid performance in the first half of the year is discouraging much trading activity. Bid-ask spreads have fallen since the start of the year. In December when volumes plummeted and spread spiked, we could see this as a proxy for very poor liquidity as trading costs increased and liquidity sourcing became harder.

On top of that the uncertain path of interest rates, a challenging environment for market makers and therefore less risk taking by the banks could be reducing flow. Buy side activity is muted where solid performance in the first half of the year is discouraging much trading activity. Bid-ask spreads have fallen since the start of the year. In December when volumes plummeted and spread spiked, we could see this as a proxy for very poor liquidity as trading costs increased and liquidity sourcing became harder.

The decline in bid-ask spreads is a positive in terms of cost of liquidity, and vol in bid-ask spreads has remained fairly consistent. Twinned with a very slight decline in volume this suggests that overall liquidity is pretty steady. However, if volumes and bid-ask spread are both less volatile, that may allow dealers to support market making more effectively and regain their footing, improving liquidity in EM of the second half of the year.

The decline in bid-ask spreads is a positive in terms of cost of liquidity, and vol in bid-ask spreads has remained fairly consistent. Twinned with a very slight decline in volume this suggests that overall liquidity is pretty steady. However, if volumes and bid-ask spread are both less volatile, that may allow dealers to support market making more effectively and regain their footing, improving liquidity in EM of the second half of the year.

©Markets Media Europe 2023

©Markets Media Europe 2025