The market has evolved valuable alternatives to traditional dealer liquidity.

Electronic trading was tested in the March 2020 sell-off, and it held up well. But, most importantly, it added meaningful liquidity for many investment managers when other sources dried out. Depending on a firm’s investment models, the right blend of electronic trading protocols and dealer relationships could provide material advantage in a tight spot.

Electronic trading was tested in the March 2020 sell-off, and it held up well. But, most importantly, it added meaningful liquidity for many investment managers when other sources dried out. Depending on a firm’s investment models, the right blend of electronic trading protocols and dealer relationships could provide material advantage in a tight spot.

“When chat rooms include sales people communicating information on new issues and trying to keep track of orders, us responding, and also a handful of traders putting in colour – it’s really noisy,” observes Jamie Anderson, head of trading at Insight Investment. “If you have a direct path of communication to a trader and you are coming in on electronic request-for-quote (RFQ) you get around that noise. So I preferred electronic – to the point where dealers were still responding – because it minimises noise.”

Mike Nappi, head of investment-grade credit trading at Eaton Vance says, “I would lean toward electronic trading having outpaced voice, but we trade a lot of high-ticket count/lower volume so I don’t think that lean towards electronic is industry-wide. Firms that have a couple of round-lot tickets to do a day are probably still be going to opt for voice.”

When the market was hit by coronavirus concerns and a price war in the oil market in early March, investors began to sell-off assets. That triggered a steep drop in prices across assets as investors sought cash.

Recap on the sell-off

A summary of the sell-off by the Banca IMI trading desk indicated distinct phases. “In the central part of the month, during the most acute phase of exchange-traded fund (ETF) outflows, largely exposed to financials, industrials and other cyclical sectors, markets experienced a substantial disruption in liquidity. Few deals were executed at very deep discount versus indicative screen prices.”

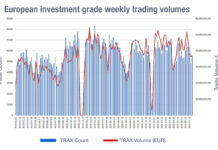

Bloomberg research found that trading costs for investment grade bonds increased from around 5 basis points (bps) in early February to a maximum of 45 bps – depending on sector in mid-March, while volume peaked in late March/early April.

Mark Goodman, head of electronic execution for FX, rates, credit and ETD at UBS, says, “There was a Wednesday morning where we just saw a sea of red, but then people came in to buy at the low. If you are taking a ten-year view that can be an attractive time to trade.”

Why this crisis was different

For buy-side trading teams and portfolio managers, finding opportunity in these conditions was more challenging than during the 2008 liquidity crisis.

“In making comparisons with 2008 people forget that banks did have balance sheet and traded on it during that period,” says Louise Drummond, global head of investment execution at Aberdeen Standard Investments. “This time they didn’t have balance sheet and the capability to price trades based on that.”

Another trader noted, “Relationships probably mean a little less than they did because some dealers that we have great calls into and great relationships with wanted to help, but were told ‘You can’t help’.”

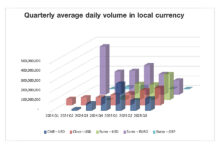

The withdrawal by many traders did not diminish the importance of voice trading. Ken Monahan, senior analyst, Market Structure and Technology at Greenwich Associates says, “TRACE eligible trades in the US went from US$40bn to US$50bn average daily volume (ADV), a 25% increase, with US$1.5bn being e-trading and about US$8.5bn in voice. Proportionately voice was up nearly 25% while electronic was around 14%.”

But the different style of trading that electronic execution offered was significant.

Firstly, platforms offer all-to-all trading as an alternative to dealer-to-client (D2C) trading. They offer portfolio trading which allows traders to sell a whole list of bonds simultaneously, where selling them individually would inevitably lead to liquid assets being sold first and the fund being left with more illiquid instruments in the portfolio.

Secondly, exchange-traded fund (ETF) market makers have evolved by making prices on bonds that are underlying an ETF, as part of the ETF’s creation/redemption process.

A third route is the direct price streaming of prices for government bonds – and increasingly investment grade corporate bonds – by bulge bracket brokers.

Those choices helped when in March the withdrawal of dealer liquidity was pronounced across fixed income assets. Sell-side firms shut off auto-quoters for bonds, reducing the support for small ticket sizes increasing the pressure on their dealer desks already swamped by higher volumes.

On-screen prices were up to 10% off the prices at which bonds were actually trading at across credit and rates, according to multiple trading desks.

“Regarding rates flow business, voice trades especially on large-in-scale (LIS) orders were preferred to algorithmic trading in because bid-ask spreads shown on screen were very wide, pushing clients to make enquiries for better execution,” note Banca IMI’s trading team. “In credit the key has been offering to customers a steady flow of axes. E-trading had a bigger role than normal.”

An alternative to dealers

At this point where some firms were paralysed, others were finding the opportunity to generate returns for investors.

“We were more active in all-to-all,” says Nappi. “Where we saw a name we liked and had cash, we could step in when the street stepped away. We had to be nimble – we might need to react in eight minutes – so all the credit goes to the portfolio construction teams who were reacting to things I was seeing.”

This not only created investment opportunities, it also drove information flows for the firm which other asset managers may have missed out on.

“We were best on a lot of bonds, in some cases where bonds didn’t trade,” he continues. “That gives us a tremendous amount of information. If we’re bidding 80 cents on the dollar and we’re the best, we get a lot of information back. Without the ability to participate in all-to-all trading you don’t get that colour.”

MarketAxess reported US$916.6 billion in total volume traded with its all-to-all Open Trading protocol reaching an average daily trading volume of US$4.4 billion and total trading volume of US$96.3 billion, making up 35% of credit trading.

UBS Bond Port, which 27% of traders use for all-to-all trading according to The DESK’s 2020 Trading Intentions Survey, found buy-side firms were increasingly price makers.

“As price deciders we saw a 152% uptick in buy-side order provision and they became 50% of liquidity provided on the UBS Bond Port platform,” says Goodman. “You can argue that is through necessity – that there was not liquidity in the market partly through traders being risk off due to volatility but also due to the number working from home creating potential operational challenges.”

Portfolio trading also proved invaluable across both the MarketAxess and Tradeweb platforms, noted several traders, particularly at moments of stress where it allowed traders to price liquid and illiquid assets simultaneously to support client withdrawals, rather than selling liquid assets first and punishing remaining investors by leaving them with a more illiquid portfolio.

Market operator Tradeweb reported that the number of daily line items executed via in-competition (comp) portfolio trading increase by over 100% in March against January and February.

Dan Philip, fixed income institutional services for Europe at Jane Street says, “We found portfolio trading to be an effective tool in helping our clients manage risk during periods of high volatility, with many investors using it for the first time over the past few months. Portfolio trades allowed us to package together a group of bonds on behalf of clients for all-or-nothing trades.”

Dan Philip, fixed income institutional services for Europe at Jane Street says, “We found portfolio trading to be an effective tool in helping our clients manage risk during periods of high volatility, with many investors using it for the first time over the past few months. Portfolio trades allowed us to package together a group of bonds on behalf of clients for all-or-nothing trades.”

Philip noted that portfolio trading during the first quarter was up 50% over the prior quarter. ETF market makers such as Jane Street were uniformly cited by buy-side traders as being useful during the crisis.

“The ETF market makers were great in providing liquidity, while equally bond prices were probably moving faster than they normally would because ETFs were getting hit, exacerbating moves,” says Nappi. “So ETFs are one of those Catch 22s for the market.”

Philip says, “Overall, our bond trading capabilities allowed us to remain active in providing liquidity when these markets were constrained. Jane Street, which launched on MarketAxess’s Europe platform in June of last year, rose to being first by volume, in trading Euro Investment Grade bonds on the platform in April in addition to being a top five by volume dealer for US Dollar Investment Grade trading in March.”

Impact of crisis

The dominance of voice as a trading protocol in March continues to support the dealer-to-client model, but equally the absence of dealer liquidity at points in the market has worried some market participants particularly in markets such as US Treasuries which have no underlying causes for illiquidity and a highly liquid interdealer market.

That has pushed more buy-side traders to look at alternatives such as all-to-all trading, ETF market makers and – where permitted – internal crossing. Reliance on purely sell-side liquidity looks less reliable. Another outcome could be upon daily dealing of funds. As one trader observed, “If the market does not supply us with daily liquidity how can we offer it to clients?”

Consequently, some asset managers expect the industry will review its approach to liquidity provision for investors.

“At Insight Investment we match liabilities and cash flow needs using an approach and asset mix which reduces the uncertainty of delivering on those liabilities,” says Anderson. “Maybe this liquidity crisis will lead to a broader and better understanding of liquidity needs from buy-side investors which may lead to a redesign of asset solutions.”

©The DESK 2020

©Markets Media Europe 2025