Average daily volumes (ADV) for Tradeweb’s cash rates trading were US$455 billion for the month of July, the company reported, with overall government bond volumes reaching US$10 trillion. MarketAxess reported US$22 billion and US$492 billion for cash rates trading ADV and trading respectively.

Although cash rates ADV dropped month-on-month (MoM) for Tradeweb, with European government bonds falling by 15% from June and US government bonds by a less drastic 2.17%, significant gains were seen year-on-year (YoY). US government bonds were up 47% from July 2023, while European government bonds rose by a less drastic 17%.

At MarketAxess, US government bonds ADV was up by 29% YoY and down 0.88% MoM – mirroring the trend on a smaller scale.

There was a more balanced fight in corporate bond trading, which saw overall July volumes of US$147 billion at Tradeweb and US$159 billion at MarketAxess. The figures represent a YoY increase of 19% for MarketAxess, driven by activity in investment-grade credit, and a 41% hike at Tradeweb.

High yield credit trading contributed US$18 billion to Tradeweb’s July volumes, up 48% YoY, while investment grade carried the bulk with US$128 billion, up 40% YoY.

A similar balance was seen at MarketAxess, with high yield and investment grade volumes reported as US$24.8 billion and US$133.9 billion respectively. However, while this represents a close to 30% increase (29.1%) in investment grade volumes YoY, high yield volumes were down 9.5%.

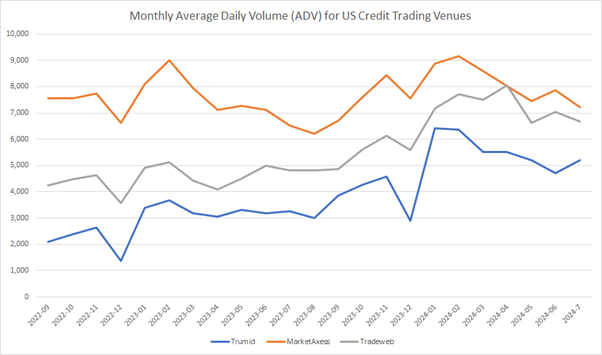

Tradeweb fell below MarketAxess on net corporate bond trading ADV despite significant growth, recording US$6.6 billion to MarketAxess’s US$7.2 billion in July – a 4.9% YoY drop for the latter, and a 32.1% rise for the former. Trumid reported US$5.2 billion and saw the greatest YoY improvement of the three firms, up 59%.

Investment grade ADV was up 36.9% to US$5.8 billion at Tradeweb, and up 48.9% for high yield – reaching US$829 million. By contrast, MarketAxess recorded a 17.9% rise to US$6 billion in investment grade credit YoY, and a decline of 17.7% to US$1 billion in high yield.

Commenting on the month’s results, Chris Concannon, MarketAxess CEO, said, “We are not pleased with the progression of US credit market share in July, but we are encouraged by the prospect for potential increases in market volatility in the coming months.”

MarketAxess’s new tie up with ICE Bonds has provoked a strong positive reaction from market participants.

©Markets Media Europe 2024

©Markets Media Europe 2025