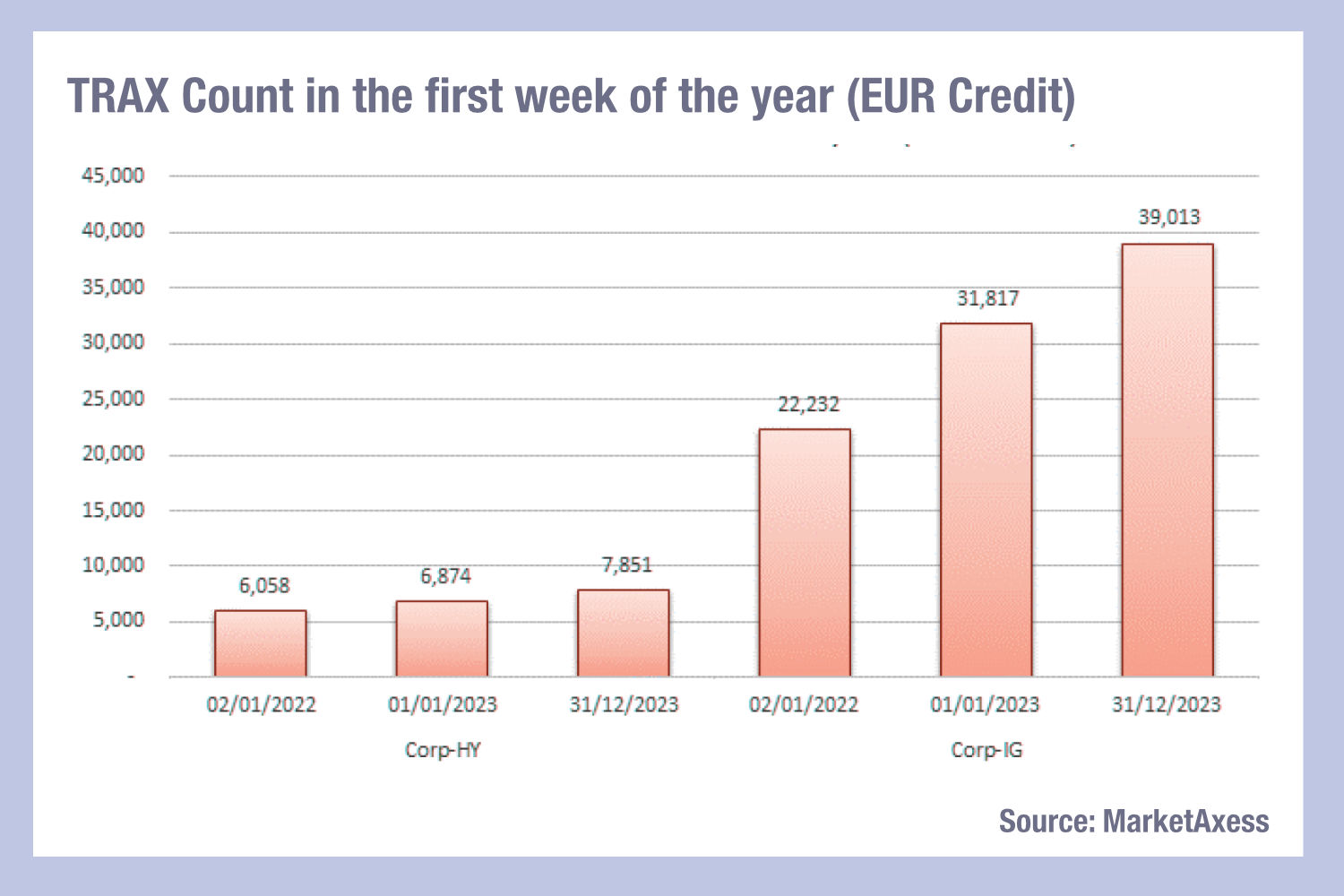

Trading activity in European bond markets at the start of 2024 has had the highest trade count of the past three years by some margin, according to data from MarketAxess’ Trax, which measures trading activity across multiple market places and platforms.

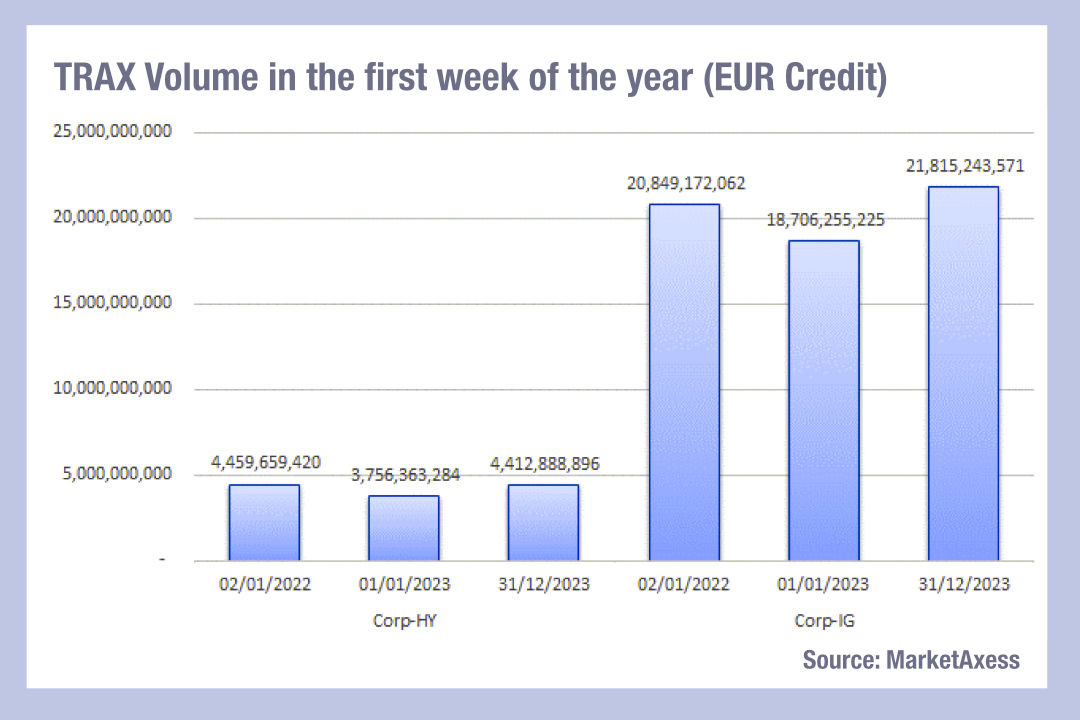

In European investment grade trading, the trade count for the first week of the year was just shy of 40,000 tickets, nearly double that of 2022, despite it starting on a trading holiday for European markets. High yield trade count was also higher, not at the same rate, but nearly 30% greater than the count in 2022. Trading volumes were also up on the last two years in investment grade trading, at €22 billion notional traded, while high yield trading was up on 2023 but lower than 2022.

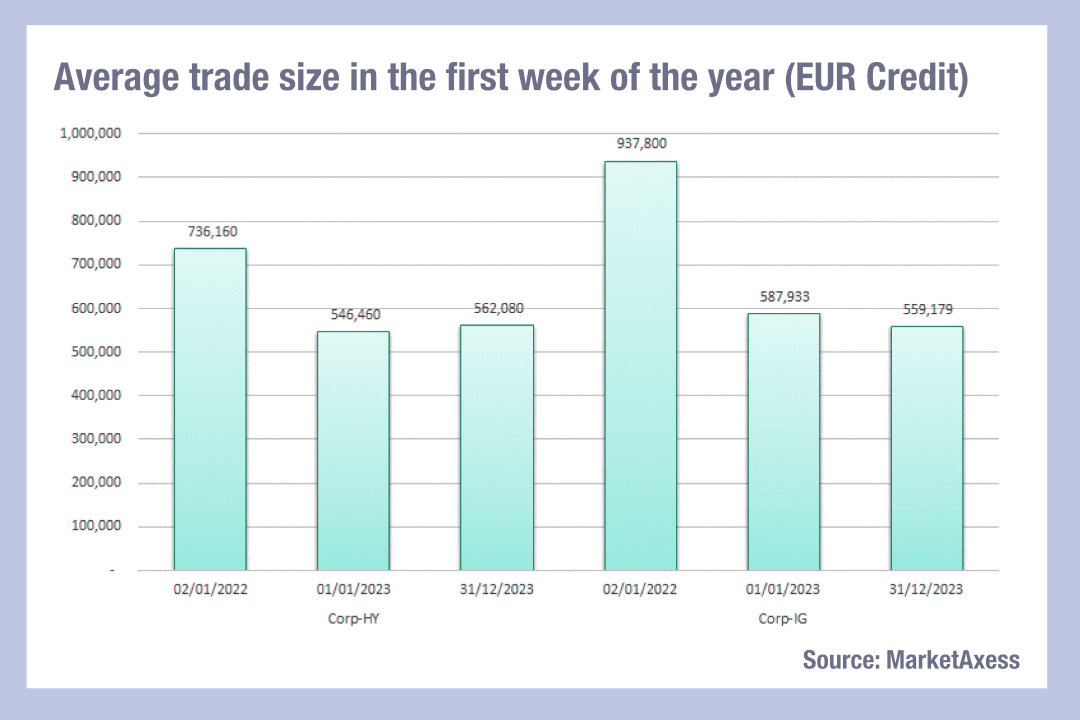

These volumes are matched by high activity levels in the primary market. Perhaps most interestingly, if we divide the notional traded in the first week of each year by the number of tickets traded, we see that the average size of an investment grade trade has fallen to its lowest level in three years. At €559,179 it represents a 40% drop off since 2022, when the average trade was €937,800.

In high yield, the average trade size for the first week of the year has risen slightly on 2023, but is also down 25% on 2022. The falling average trade size, and rise in trade count is indicative of the rapid electronification of market that has taken place over the past year, through multilateral and unilateral trading, but may also indicate a challenge to trading blocks of bonds with dealers. We know that electronic trading is used more frequently for both smaller tickets and shorter tenors, and we have seen shorter-dated bonds being issued in order to help issuers avoid being tied into higher rates for longer.

With Barclays’ estimate that over half of European IG trading is now electronic, this corresponding fall in trade sizes supports the narrative and suggests that buy-side traders would be making strides to understand just how much activity can be conducted either via trading platforms or direct with dealer streams.

©Markets Media Europe 2023

©Markets Media Europe 2025