A recent study prepared on behalf of the Global Financial Markets Association (GFMA) by Boston Consulting Group, Cravath, Swaine, and Moore LLP, and Clifford Chance has assessed the “opportunities and risks of distributed ledger technologies (DLT) and DLT-based securities and DLT-based payment instruments used in conjunction with such securities.

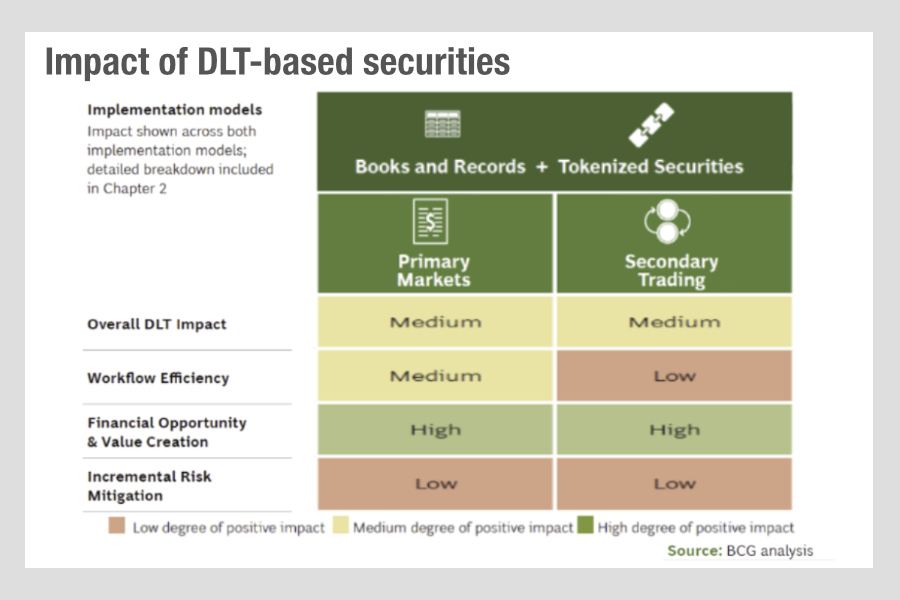

The case for DLT in traditional capital markets has typically been focused on operational efficiencies in post-trade activities, as it is this part which a distributed ledger contributes to, potentially allowing existing internal ledgers to be replaced by a single ledger which never requires reconciliation and offers T+0 settlement. The paper makes the argument that DLT offers “technical capabilities that could support broader developments across the end-to-end securities lifecycle … [including] clear opportunities for growth and value creation, as well as incremental risk mitigation. Having made an impact assessment and qualitatively scored these possibilities based on the degree of “positive” effect.

In primary markets the work noted that sell-side work could evolve “to require less operational involvement,” beyond their role in underwriting new issues with intermediaries in the primary issuance value chain predominantly focused on operational execution “at a higher risk of disintermediation”. What is interesting about the report, is that it echoes the Siemens bond issuance via a distributed ledger in February 2023, which bypassed using banks as intermediaries.

The underwriting of bond issuance and distribution via syndication desks is a key bank activity and revenue earners for banks, however, the risk of disintermediation has been fought against despite significant operational inefficiencies in the current model. This report gives further credence to the idea that, as with the Siemens deal, banks may not be needed for distribution in the same way they are today.

©Markets Media Europe 2023

©Markets Media Europe 2025