LIBOR: WHEN TO JUMP ON THE SOFR

The transition from the London Interbank Offered Rate (LIBOR) to overnight indexed swap rates is moving, but when should the buy-side make the switch? Dan Barnes investigates.

Timing is everything when new derivatives contracts are launched, and when shifting from a single benchmark to multiple benchmarks, timing is even more crucial.

Since the London Interbank Offered Rate (LIBOR) was found to be open to – and subject to – manipulation, due to its use of sell-side estimation rather than actual transaction records, new benchmarks, all based on real trades, have been established to underpin contracts from floating rate bonds to derivatives.

The Alternative Reference Rates Committee (ARRC) in the US set upon the Secured Overnight Financing Rate (SOFR), based on the overnight rate for actual transactions borrowing cash against US Treasury securities, which are estimated to be in the region of US$700bn.

In Europe, several alternatives to EURIBOR have been proposed in a consultation by the European Central Bank (ECB):

- The euro short-term rate (ESTER), the new wholesale unsecured overnight bank borrowing rate, which the ECB will produce before 2020;

- GC Pooling Deferred, a one-day secured, centrally cleared, general collateral repo rate, which is produced by STOXX, a wholly owned subsidiary of Deutsche Börse Group;

- RepoFunds Rate, a one-day secured, centrally cleared, combined general and specific collateral repo rate, which is produced by NEX Data Services, a wholly owned subsidiary of NEX Group plc, soon to be acquired by CME Group.

In Switzerland, the Swiss Average Rate Overnight (SARON) rate will be used. In the UK, the Sterling Overnight Index Average (SONIA) was selected by the Working Group on Sterling Risk-Free Reference Rates. SONIA measures interest rate on sterling short-term wholesale funds, based on £50bn average daily volume. It is managed by the Bank of England.

By 2021, LIBOR itself will no longer be supported, through which, under its current model, banks provide levels from which the composite rate is formed. Banks and asset managers are thus engaged in a time-limited project with derivatives counterparties, including trading platform operators, to ensure that they are not using an unsupported benchmark to underpin derivatives and bond contracts.

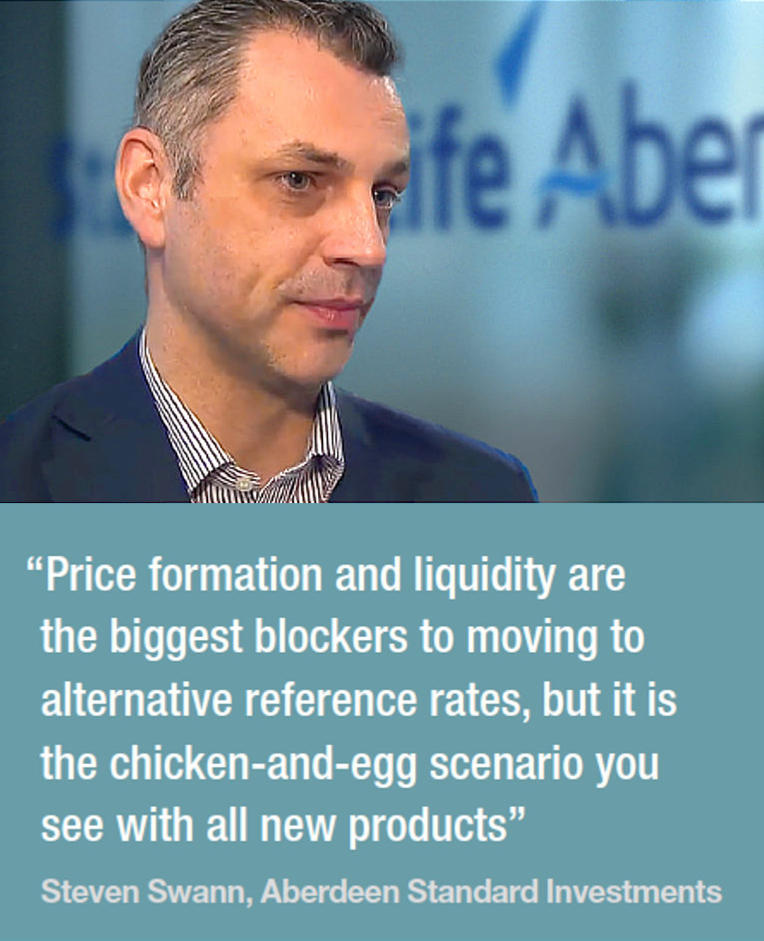

Steven Swann, head of derivatives and client driven solutions, Investment Execution at Aberdeen Standard Investments, says, “The biggest issue is the significant legacy books of business that currently reference LIBOR and some of them are 25 years or longer dated. They are already in the books and referencing LIBOR, and there is some uncertainty as to what will be agreed post 2021. On the derivatives front, ISDA is developing amendments and protocols to its swap definitions by the first half of 2019; indeed we should expect further clarity in the coming weeks post the ISDA Fallback consultation period.”

Contracts and benchmarks

Where both SOFR and SARON are based on the repo rates, SONIA and ESTER use interbank call loans, the former being secured and the latter unsecured.

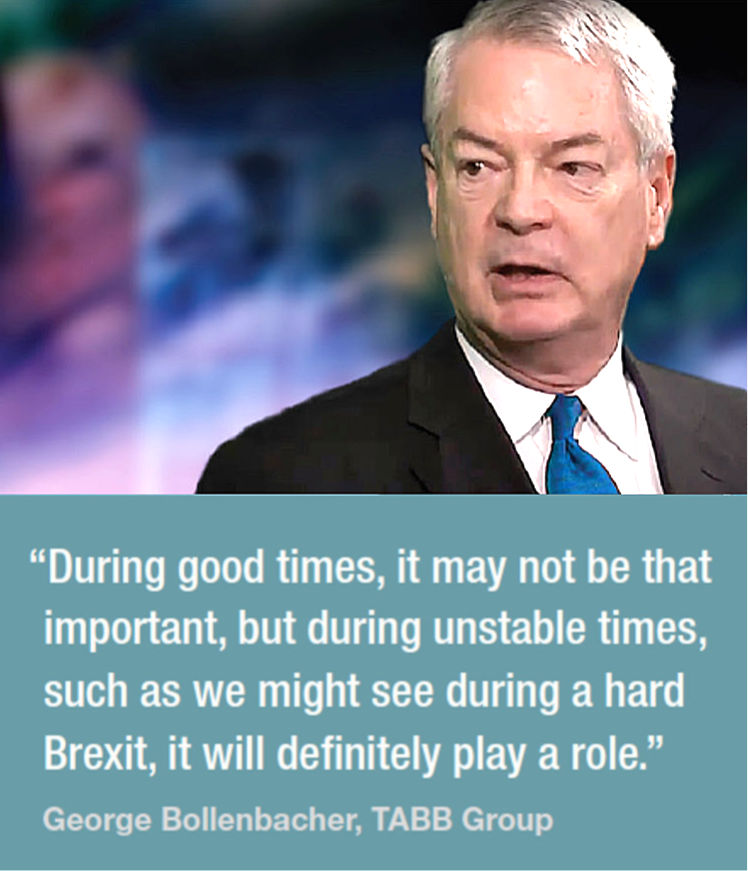

George Bollenbacher, analyst at TABB Group says, “During good times, it may not be that important, but during unstable times, such as we might see during a hard Brexit, it will definitely play a role.”

He also observes that as SOFR and SARON are repo rates they are based on markets with many more participants than just banks.

“The other three are call loan rates, implying that they are restricted to transactions where at least one side is a bank,” he says. “For market participants using these rates, it will be important to determine at the outset if you want to use a money market rate or a bank lending rate.”

For market participants, the practical challenge will be to use contracts that reference the relevant rates, and those must be viable.

“Price formation and liquidity are the biggest blockers to moving to alternative reference rates, but it is the chicken-and-egg scenario you see with all new products,” says Swann. “Fragmentation of liquidity is unfortunately likely initially given the opportunity for new providers to establish themselves as the go-to venue.”

Despite those challenges, the decision on which contract, or market, to use will involve a more layered discussion between the trading teams and the portfolio managers, to assess the value in either investment or hedging terms.

“Assuming industry consensus on the LIBOR replacement terms, the shift shouldn’t be that difficult for the trading desk as it is swapping out one reference rate for another when modelling the curve,” Swann adds. “We’ve already seen some market innovation in response to the proposed discontinuation of LIBOR. CME have launched SOFR futures in the US while in the UK, ICE and CurveGlobal have launched SONIA futures. As with any new products it will take time to build up some critical mass, but I would expect their usage to accelerate over the next two years.”

Markets seeing growth

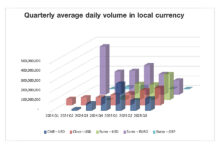

The venues that offer trading in LIBOR replacement contracts are reporting that volume, which to some extent is a proxy for liquidity, is building up very positively.

“In the first five months SOFR futures have traded US$1tn in notional, so it is very meaningful risk transfer,” says Agha Mirza, global head of interest rate products at CME Group. “Most of the activity is on Globex, the CME’s electronic trading platform. The really key feature is that CME Group is the only place that offers price discovery for the entire SOFR yield curve. We have quotes out to 2020/21 and in terms of buy-side participation it is already there now, it is just a matter of time for that to likely develop.”

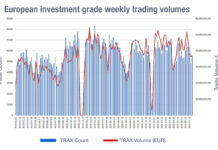

Interest rate derivatives platform CurveGlobal, launched by London Stock Exchange Group in partnership with Cboe, Bank of America Merrill Lynch, Barclays, BNP Paribas, Citi, Goldman Sachs, JP Morgan and Societe Generale reports it has seen 4,364,200 lots traded since 2016, with over 100% growth in open interest in the last six months.

Swann says, “The current state of play is that some firms are electing to trade derivatives contracts off of SONIA and are making the shift based on their individual circumstances, and we’ve already witnessed a significant shift in the LIBOR/OIS basis as a result earlier this year.”

Both platforms have developed specific strategies to support their liquidity growth by fitting into trading and investment strategies, for example, CurveGlobal’s spread trade.

“We already have LIBOR futures and we already have a SONIA future, and we offer an inter-commodity spread trade across the SONIA and the short-dated sterling product so there is no legging risk,” says Andy Ross, CEO at CurveGlobal. “This spread links the LIBOR and SONIA and creates additional depth of liquidity, allowing us to grow and improve pricing.”

That also requires an understanding of the interaction between the use of over-the-counter (OTC) derivatives and listed futures.

“A key part is the conjunction with OTC swaps,” notes Mirza. “When we spoke with market participants on the design for futures, a key theme that people pointed out to us was that eurodollar futures act as highly appropriate and very well-designed building blocks for the adjacent OTC swaps, and that the SOFR future needs to be designed in a manner that they work together with the SOFR basis swap.”

Ross adds, “We are debating launching a minimum price contract (MPC) contract, but we deliberately decided to build up liquidity in the three-month contract before we launched an MPC or a one-month contract. We felt that building liquidity up around that point of the curve would be the optimal way of building overall liquidity.”

Behind the curve

While the trading desk may be able to cope – once market activity has picked up enough – there is still a lot of work for the back office.

Ken Monahan, analyst at Greenwich Associates warns that the biggest mechanical issue is for extant derivatives contracts in the event that LIBOR ceases to exist or becomes an unreliable benchmark.

“Then you have to shift from a LIBOR reference to a SOFR reference,” he says. “That is difficult because the term structure and the credit of those benchmarks are both very different, and so if you are valuing an asset that has a large notional using LIBOR and you switch to a SOFR derivative it will not necessarily be clear that you have properly done that, and you may have a change in valuation or reserve against that position because its value under LIBOR is different to the interpolated SOFR’s credit and term.”

Ross, also agrees that there are challenges to moving, and that liquidity is not the greatest, with the biggest challenge for banks being a move to a SOFR-discounted or SONIA-discounted environment.

“You need a curve that can support your risk engine and pricing engines,” he says. “That takes a bit of time and work. I think there is already sufficient liquidity, in the products that we are trading.”

©Markets Media Europe 2025