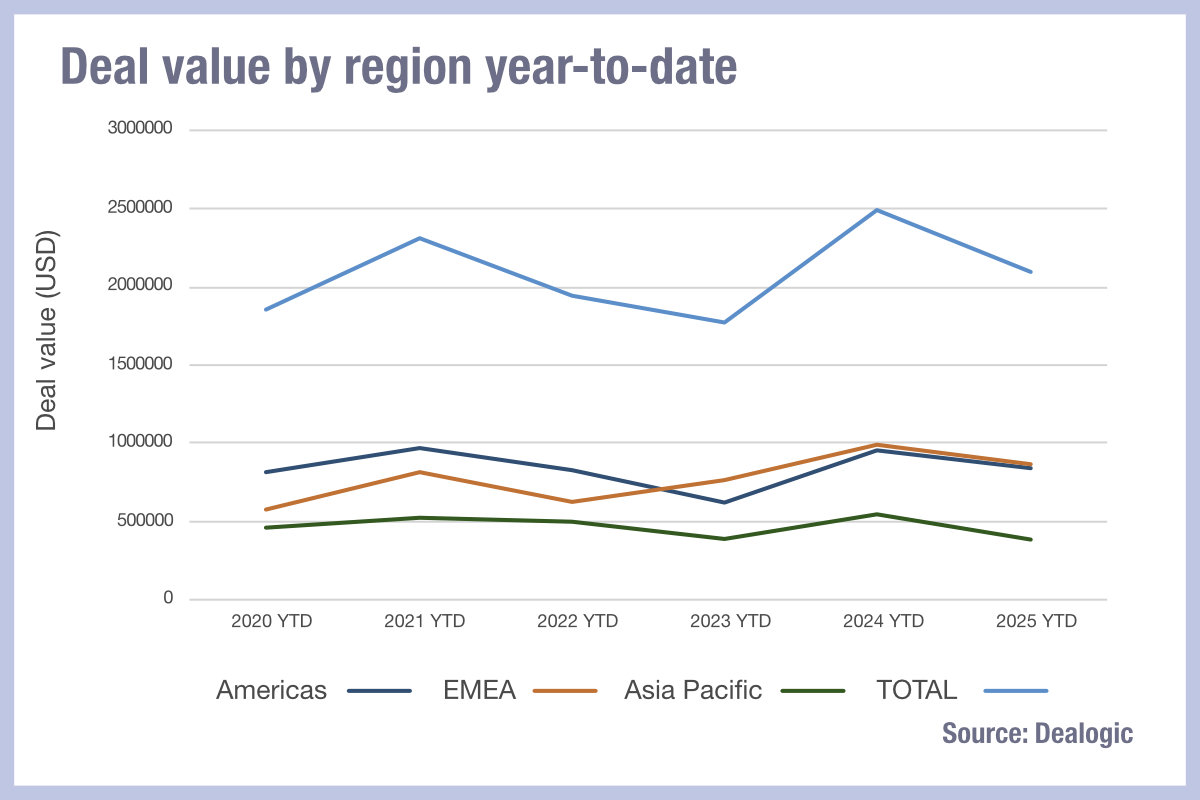

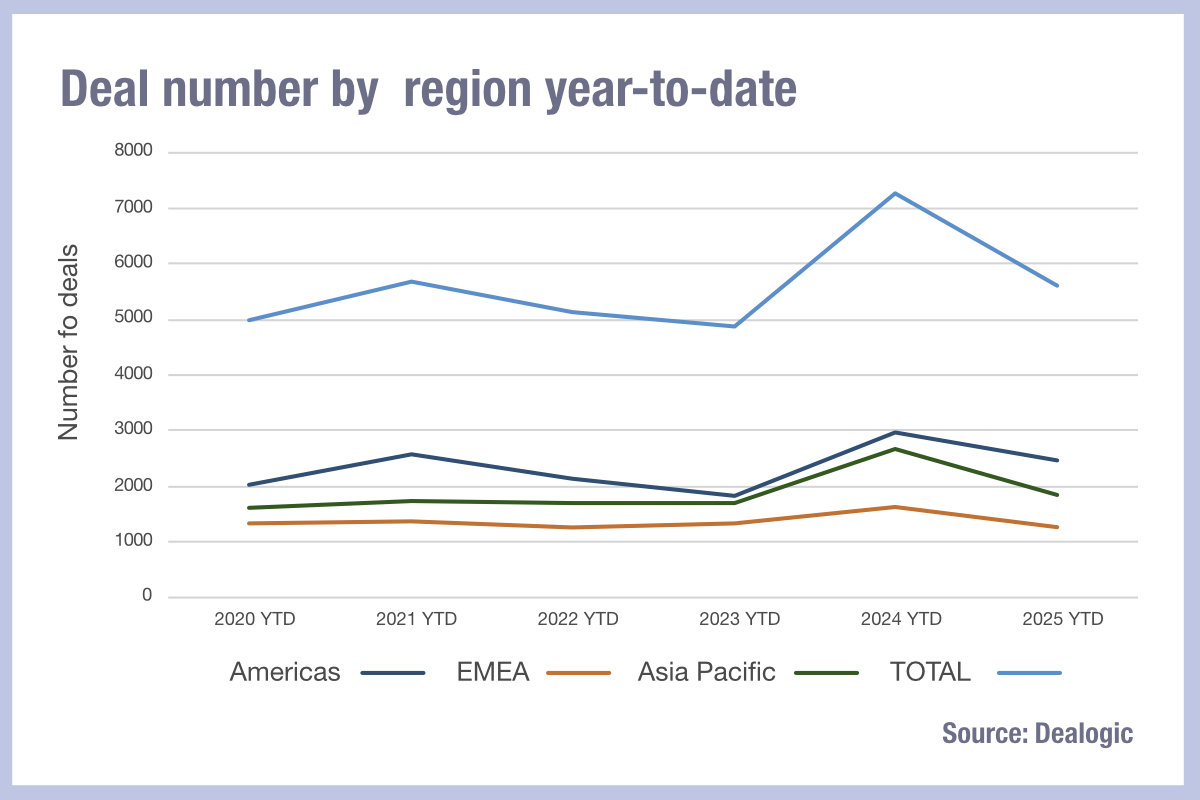

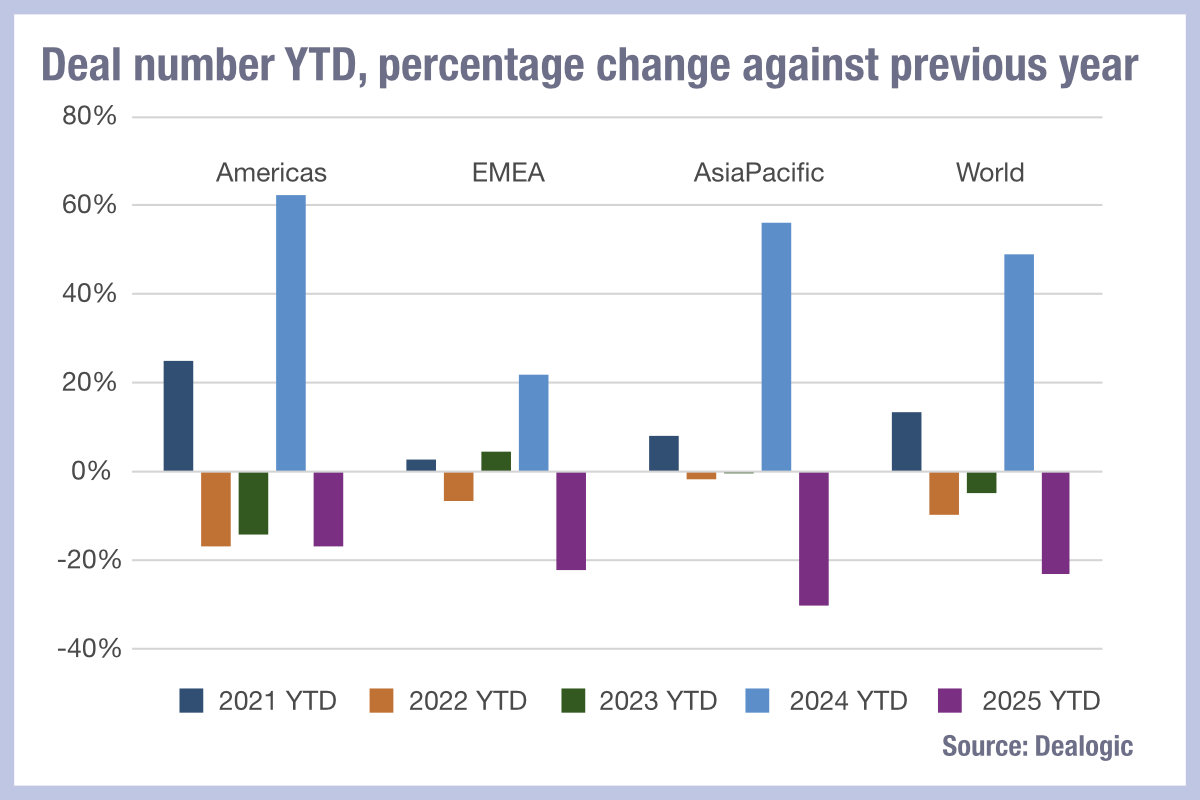

Debt markets have seen a year-on-year (YoY) decline in deal activity in 2025, according to data from Dealogic, reflecting the pensive mood amongst corporations and governments.

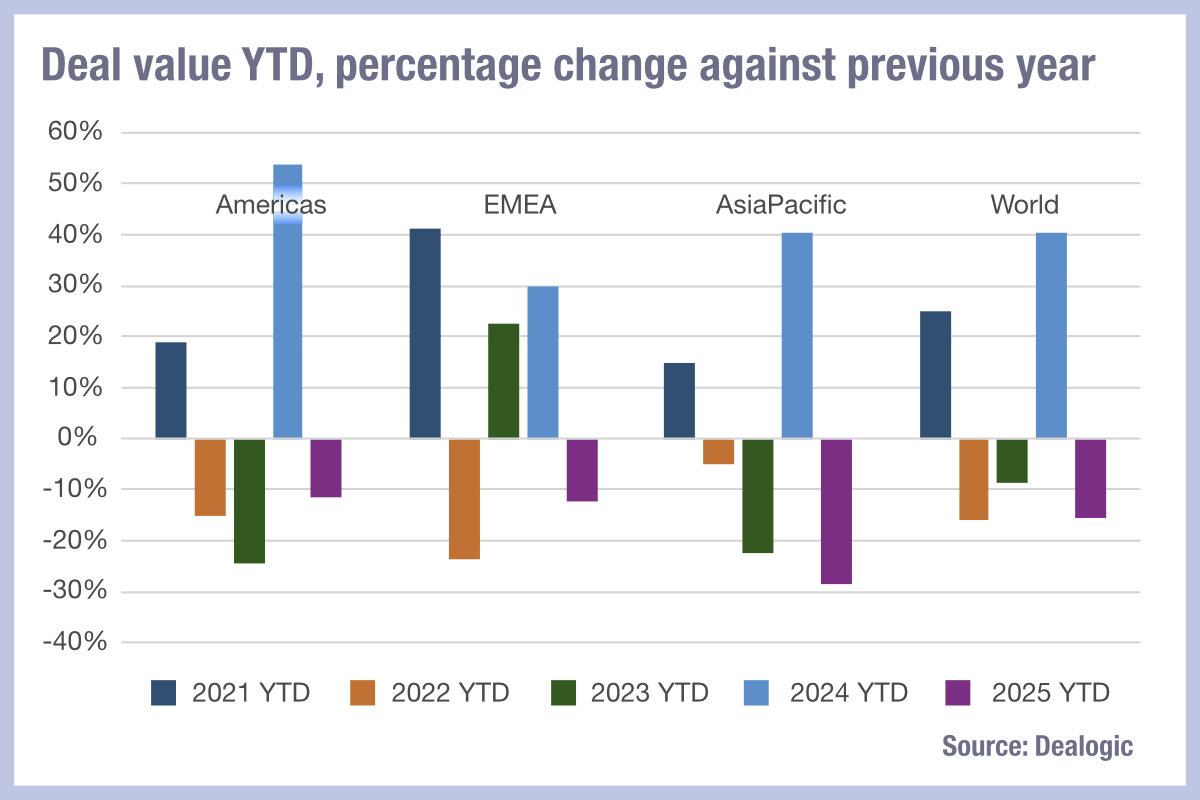

Globally, deal value year-to-date (YTD) fell by 16% against the same period in 2024, while the number of deals fell by 23% YoY.

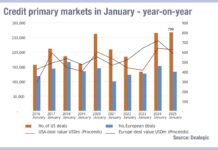

This is the largest YoY decline in deal value since 2022, which also saw a -16% hit in the value of deals, led by a -24% decline in Europe, Middle East and Africa (EMEA). This rebounded in 2023, creating a positive 23% upswing in deals, and balancing a proportionate fall across the US and Asia Pacific (APAC).

The big fall in 2025 has been in APAC, which has seen a -29% fall in deal value and a -30% fall in deal numbers.

Although the US has widely reported concerns around its economy and the threat of recession, it would seem apparent that the old adage ‘When America sneezes the world catches a cold’ is still relevant, with Europe and APAC seeing a greater proportional fall in activity across both measures.

That said a larger value of deals have been conducted in EMEA to date, which is likely to reflect the level of funding needed to support specific industries, such as defence, rather than broader economic growth.

©Markets Media Europe 2025