Reports of reduction in headcount on buy-side trading desks at BlackRock, Nuveen and Wellington with cuts also reported at investment banks, are demonstrating the commercial pressures that trading desks face on both sides of the street. Most firms that are not cutting roles have a hiring freeze in the trading space, according to several traders spoken to by The DESK.

At BlackRock, Nikhil Sethi, the firm’s EMEA head of credit trading since 2015, has left the company. The firm declined to comment on job cuts and his departure. Martin Small, chief financial officer at Blackrock had told investors on the firm’s Q1 earning’s call, “In line with our guidance in January, at present, we’d expect our headcount to be broadly flat in 2023.”

Wellington Management has seen the departure of several trading team members, after a reduction in the number of roles. A spokesperson for the firm said, “We recently concluded a strategic business review to ensure we remain positioned to deliver outstanding investment results and service to our clients over the long term. On the basis of this review, we will continue to invest in our business to meet client needs. We will also seek operational efficiencies, which has led to

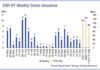

the elimination of just over 5% of roles at the firm. These changes will help us maintain the strength and stability our clients rely on, innovate and evolve our capabilities, and attract, retain and develop the best talent in the industry.” While several fixed income traders have left Nuveen, a TIAA company, following a reduction in headcount. The firm did not respond to several requests for comment. A report published today by analyst firm, Boston Consulting Group, said, “Wealth and asset management firms are facing a formidable triad of challenges: rising costs, shrinking margins, and intensifying customer demands. It’s a somewhat unenviable position for an industry long perceived as enviable by other sectors, especially in terms of consistent profitability over long periods of time.” Cuts on trading desks may reduce the overall costs allocated to a team but in a bond market facing reduced issuance and dealer liquidity provision, they also add considerable pressure on the traders who are left to manage order flow, as well as personal pressure on the traders now looking for new roles.

©Markets Media Europe 2023

©Markets Media Europe 2025