The CMSA, invitation-only event, is setting an agenda based on market professionals’ concerns, and has captured a groundswell of interest.

The DESK: What has been the response to the CMSA Conference?

Chris White: Since the announcement of the upcoming Credit Market Structure Alliance (CMSA) Conference on June 15th, there has been an overwhelmingly positive response from market professionals and solution providers. The concept of the event is simple: Eliminate the barriers to entry that prevent thought leaders and decision makers from the buy-side, sell-side, and regulatory communities from discussing key trends in credit markets.

TD: Why is that support so strong?

CW: ViableMkts, the organiser of the CMSA, believes that the current “barriers to entry” come in the form of attendee and vendor costs, as well as a ‘pay to play’ agenda structure. Solution providers seem to be in agreement. The CMSA now has over 10 participating sponsors including, Trumid, Symphony, BondCliQ, Refinitiv, Lucera, IPC, OpenFin and MTS Bonds. The event is invite-only, with no ticket charge, but attendees must register as a guest of one of the sponsors. They can ask for an invitation here.

TD: What is the agenda that the market has put together?

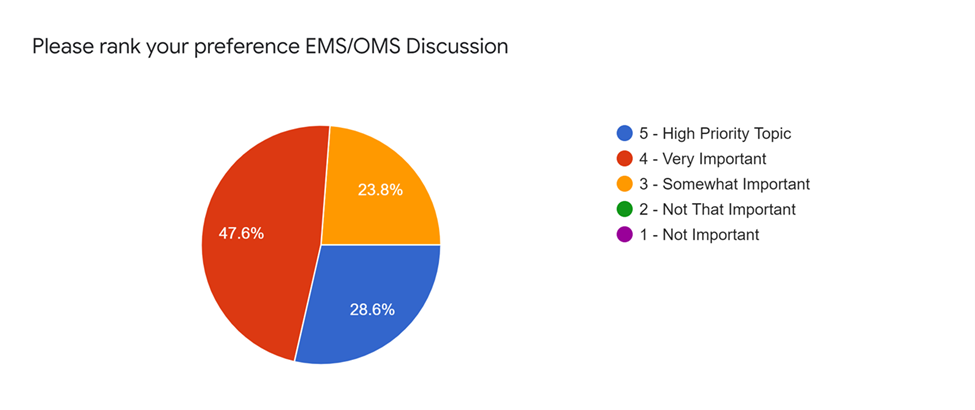

CW: The agenda for the CMSA has been determined by voting from market professionals. The first topic to be tackled is functionality for the future of execution and order management systems (EMS/OMS). As credit markets have evolved, order management and execution management systems have become an essential part of the trading ecosystem. This discussion will identify what future functionality is needed from OMS/EMS providers to meet the needs of the buy-side, while also supporting communication with dealers and the integration of vendor solutions.

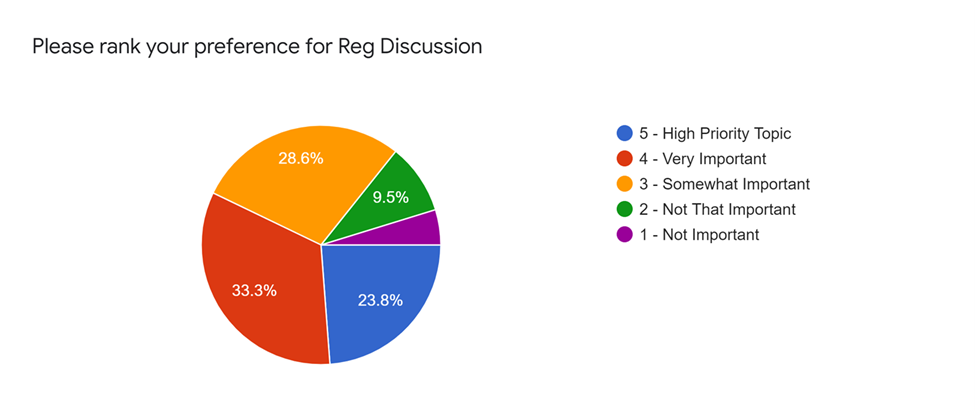

The second topic is around regulation, which can be an accelerant for positive change in a market system, or cause stagnation and confusion. This discussion will outline some of the key rule proposals that could impact credit market structure in the near future, present a vision of their potential impact, and outline an approach to improve communication between regulators and practitioners.

TD: How is electronification and automation being addressed?

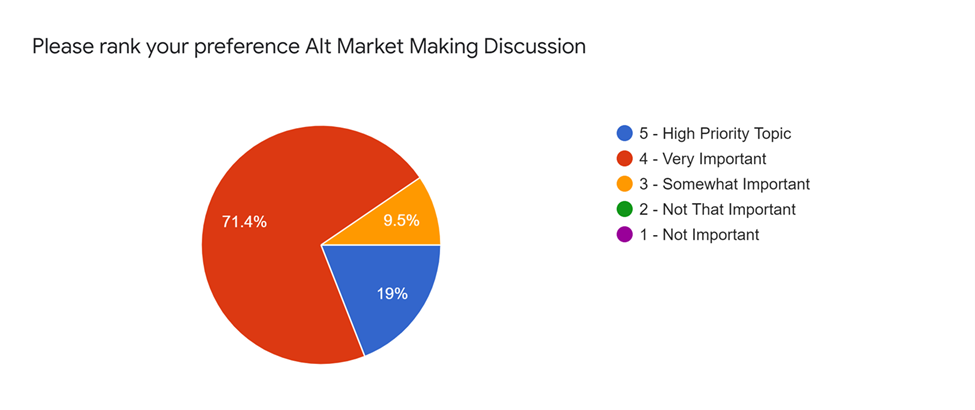

CW: Alternative market makers have quickly established themselves in corporate bonds and are now a material part of the market ecosystem. We will have a discussion that will examine the role that alternative market makers currently play in providing liquidity and present a vision of their future impact on corporate bond market evolution.

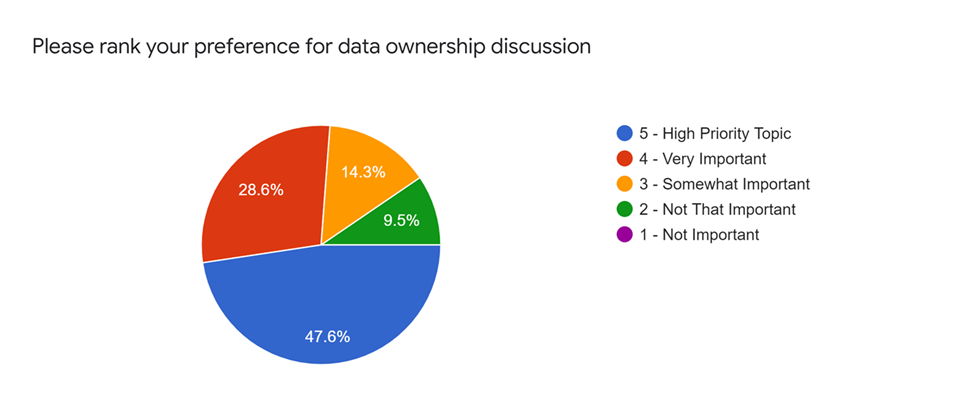

Likewise, while the amount of data in the credit markets has been increasing, the rules of the road for access, usage, and redistribution have never been set. We will be discussing how pervasive the use of unauthorised data has become and the negative consequences of this practice. In addition, this session will attempt to articulate potential rules of the road for establishing a framework for data licensing. Details on participating speakers, as well as the breakout sessions led by OpenFin, BondCliQ, and Trumid will be provided over the next two weeks.

TD: What are your expectations for outcome of the 15 June event?

CW: I am optimistic that 15 June will articulate how important it is for us to gather as an industry and allow all voices from the market to be heard. By collaborating, fixed income fintech vendors can make this a regular occurrence for market participants without the unnecessarily high commercial barriers.

©Markets Media Europe 2025