Asset managers fight for high-touch coverage

Relationship management between buy- and sell-side firms is more necessary than ever, as the push to electronic trading risks alienating clients, Dan Barnes writes.

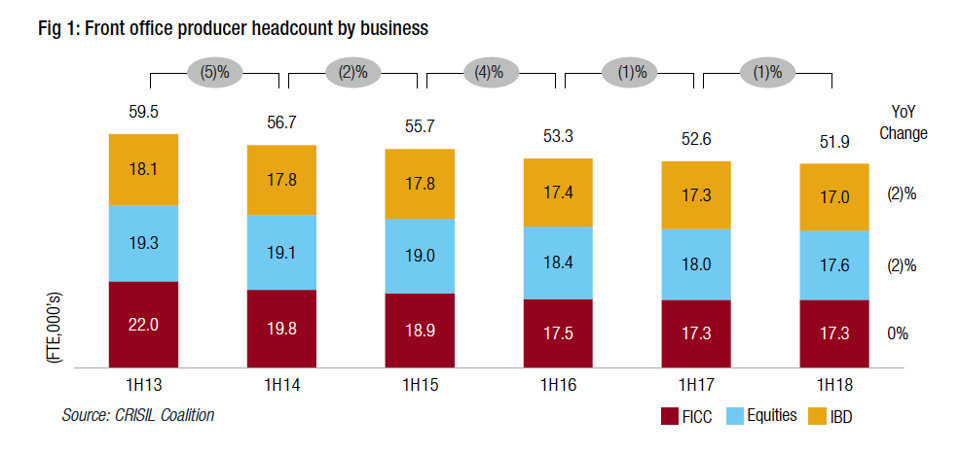

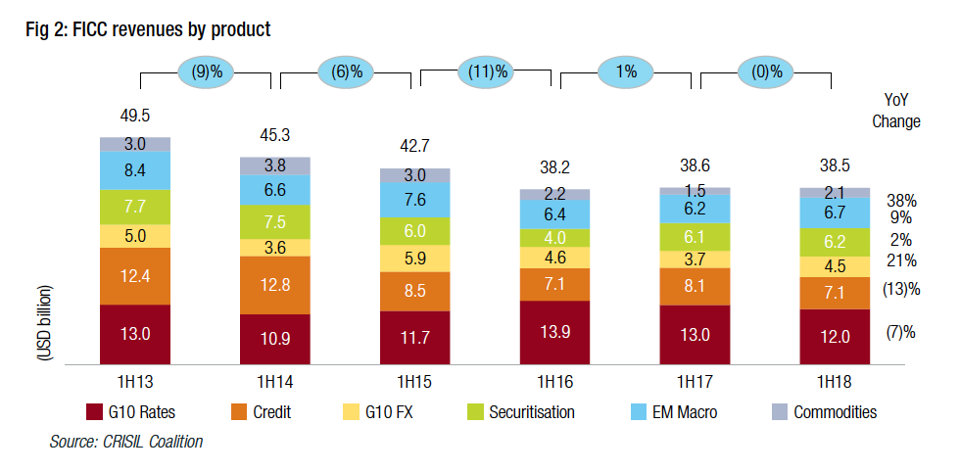

Asset managers will have seen their brokers’ front office headcount decline 21.3% over the last five years (see Fig 1), in line with a 22% decline in fixed income revenues (see Fig 2) according to analyst house Coalition.

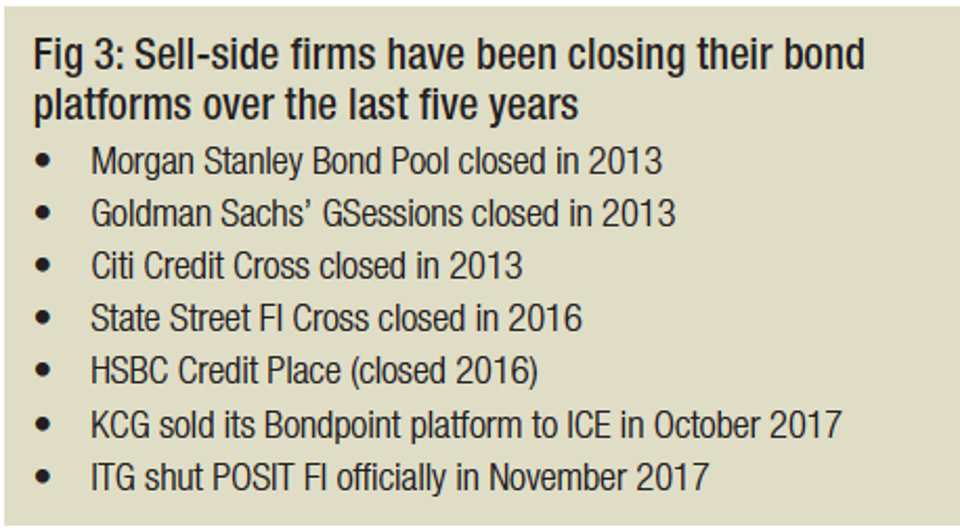

This has led to more of the trading process being electronified. The equities business had already seen a high level of electronification from the mid-2000s; the bond business had not. As sell-side firms sought to increase the proportion of electronic trading that could service buy-side clients, they built platforms that would enable them to provide direct liquidity. However, by 2013 many of these were already closing down (see Fig 3), a trend that continued over the next five years.

As it became more difficult to provide clients with the tailored coverage that they demanded, the revenue hurdle to justify high-touch service has become ever higher. As volumes fell over this period, fewer clients were economically viable for voice trading.

One buy-side trader, speaking on condition of anonymity, says, “In the P&L driven environment that we are in I feel that counterparties are revisiting that old-fashioned tiering style, where if your trades are of a certain size then you fall into a certain bracket.”

The risk is that inappropriate support will see relationships between buy- and sell-side fragment, making relationship management increasingly important.

Paul Cable, head of International Fixed Income Trading at T Rowe Price, says, “Depending on the size of AUM you’re managing/trading there is typically enough coverage out there, so if a sell-side institution is not providing the right coverage for one asset manager, and it’s not addressed through discussion; it is possible for that institution to fall off that asset manager’s radar.”

Stuck in the middle

The sticky part comes for those firms who may not get the coverage that suits the type of order flow they have to manage.

“If you are a small firm and you’ve got small order sizes, you might want voice, you might want the colour, but because it is such a low-touch trade, a lot of the counterparties won’t make that much from the trade and therefore they would rather push that type of client onto a platform,” notes one trader. If they are assessed by the value of overall order flow, rather than on an order-by-order basis, and brokers decide they do not generate the return necessary to support voice trading that can leave traders struggling.

“The issue is when you have tickets which are larger than normal, particularly in less liquid products,” says Nick Cox, a veteran buy-side trader. “If you are one of the world’s top fixed income houses that is fine, you can get a high-touch service. The bigger challenge is for medium-sized firms. A lot of their flow can be supported by electronic execution, but when they do get large tickets, the migration that banks have made from providing a high-touch service across their whole institutional client base may create some challenges.”

There will be instances in which voice or electronic execution are more appropriate, often depending upon liquidity.

“If you are showing a counterparty £100 million, on-the-run, ten years, you can easily do that on voice,” notes a senior bond trader at a large US firm. “Most traders will tend to slice that up and put it on a platform because they feel they are getting better execution. If I show one guy £100 million, because I am showing him a high-touch voice trade, I am expecting better than the platform.”

However he notes for small- to medium-sized firms, the decision will have been taken out of their hands. “If the counterparty is not generating that much revenue from that ticket, or over a period of time from those small tickets, they will generally push you or encourage you towards a platform,” he says.

Pushing back

Electronic trading does not always equal smaller trade sizes. Block trading on specialist venues such as Liquidnet is well established, and it reports the drive towards electronic trading has allowed it to capture a larger share of the market.

“The banks are doing a great job, they are working with fewer people but service their clients well,” says Constantinos Antoniades, head of fixed income at Liquidnet. “Yet there is clearly a need for a diverse market place; buy-side firms shouldn’t have to rely upon a decision that banks have made in order to access liquidity.”

He notes that predictions of increasing volatility over the next 12 months are driving discussions about coverage and platform engagement.

“When volatility is higher, the gap in liquidity supply is bigger; that is the gap that trading platforms are filling,” he says.

Not only will markets become more choppy, there is likely to be a reduction in sell-side coverage from European banks as a result of their withdrawal from the market.

“If you were to take a realistic/pessimistic outlook, you could see a drop of 10-20% in asset class coverage from European banks which could have a negative impact on liquidity,” says Cox. “A positive outlook could expect coverage remaining broadly as it is today. However it is hard to think of a situation in which liquidity improves markedly over the next two to three years.”

For the trading team, who risk finding their counterparts are not supporting them adequately, it is incumbent upon them to find either platforms or counterparts who will take the other side of their trades.

For most asset managers, the starting point will be to focus on the coverage that their current brokers provide, and negotiate that level up to more appropriate levels.

“This is still a relationship business,” says Cable. “A head of desk will be able to see coverage trends, and would meet and discuss with senior relationship managers should there be a need for change. They will always hear each other out.”

Cox adds, “You have to focus on the asset classes that are important for your business, whether that be sterling credit or EM, or whatever; then be sure to build an excellent rapport with those key counterparties.”

The MiFID effect

A challenge to the common-sense approach of negotiating coverage and execution is the regulatory imperative. Under the revised Markets in Financial Instruments Directive (MiFID II), which came into force on 3rd January 2018, many traders feel their decision-making ability is being constrained.

“It has become very black and white; pre-trade – who is best on price? The regulators have made that very clear,” says the senior bond trader at a large US firm.

The view that a trader has to get three prices from brokers in competition (‘in comp’), in order to ensure best execution means they are more likely to risk information leakage, a non-competitive trade could be more optimal.

“The regulatory push of legislation, such as MIFID II, is towards more exchange-like execution and away from non-comp trading,” says Cox.

A focus on price within execution quality can also put a straightjacket on choices a trader makes.

“There are negotiations about coverage, they may not be formal, but often dealers are happy to respond to what we say,” says the anonymous trader. “But at the end of the day, under this MiFID II world, we have to deliver best execution. Even if we don’t like the counterparty on a platform, if they are showing best price it is very difficult not to trade with them.”

©Markets Media Europe 2025