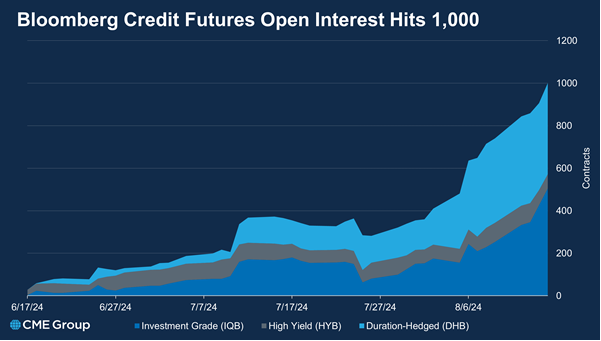

CME Group has seen a rapid rise in Open Interest (OI) for Bloomberg Credit Futures.

In the past two months, the number of these futures contracts has soared to more than 1,000. Regarding Bloomberg Credit Futures, the increase in OI suggests that investors are increasingly using these tools to manage risk or bet on changes in corporate bond markets.

Agha Mirza, CME Group’s managing director and global head of rates and OTC Products, told The DESK, “An increase in open interest, broadly speaking, signifies more end-users taking positions. This helps to increase liquidity and tighten bid-offer spreads. Our standardised and margin efficient credit futures are making excellent progress in providing standing liquidity in a centralised anonymous market which the growing credit market has long needed.”

From mid-June to early August 2024, OI climbed steadily. But in August, OI rose every single day in the first half of the month. By mid-August, the number of contracts reached 1,000. This surge is spread across three types of futures: Investment Grade Futures, lower risk contracts linked to bonds from companies with strong credit ratings, make up the largest share of OI, with around 400 contracts open by mid-August; High Yield Futures, tied to riskier junk bonds, have also seen a notable rise in interest, with about 200 contracts now active; and Duration-Hedged futures, designed to protect against interest rate changes, have grown to around 100 in number.

The data shows the corporate credit spread, the difference in yields between corporate bonds and safer government bonds, widening. This has promoted more investors to hedge or speculate using credit futures, CME posits.

The market has also matured, with more participants and better liquidity, making it easier to trade these futures. On 5 August, the first-ever block trade of 100 contracts was executed.

©Markets Media Europe 2024

©Markets Media Europe 2025