Understanding state support for the economy in China can be measured across several dynamics, but debt provision to the non-financial private sector, known as total social financing (TSF), is key.

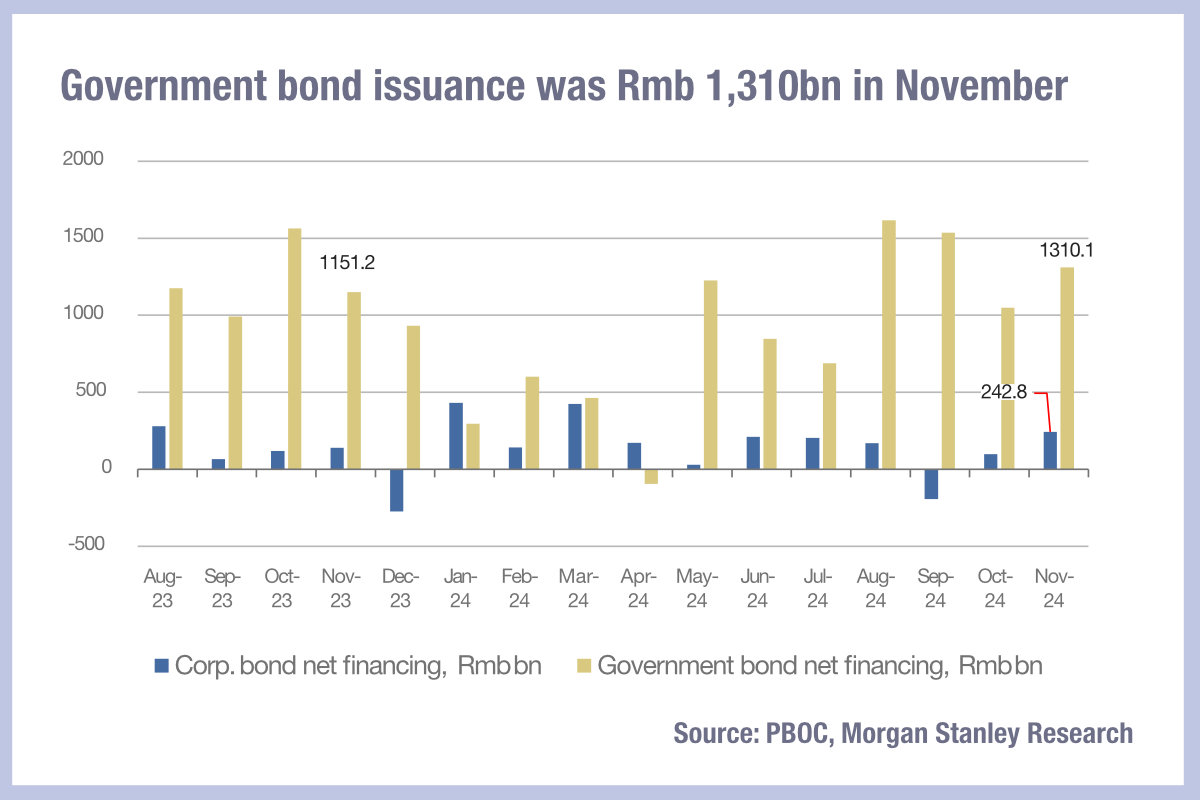

Within this measure are bond sales, and looking across analysis by both Morgan Stanley and S&P, it is clear that new government bond issuance in China is increasingly underpinning TSF.

“The bond market’s expansion has been driven by government bonds, which grew to 19% of TSF from 8%, while that of corporates remained broadly unchanged at around 8%. This suggests that the bond market’s ability to allocate credit efficiently according to risk has remained weak,” noted S&P Global analysts Louis Kuijs, Charles Chang, and Lei Yi earlier this year. “This is because corporate bonds are more influenced by credit risks than bonds issued by the central government and government-owned financial institutions, as the latter are viewed by domestic investors as nearly free of default risk or highly unlikely to default. Hence, as they occupy larger shares of the bond market, less credit is allocated on the basis of efficiency or credit risk differentiation between stronger and weaker firms.”

“Government bonds remain the key support for TSF,” added Richard Xu, Beryl Yang, Chiyao Huang, Chenqian Liu of the Morgan Stanley research and analysis team. “Notably moderated loan growth with reduced window guidance and capacity slowdown in the industrial sector weighed on TSF. We believe TSF growth will slow in 2025 and 2026 despite support from additional government bond issuance. TSF growth was flat QoQ, +7.8% YoY in November driven by government bonds while loan growth further slowed.”

They observed that government bond issuance of Rmb1.31 trillion (US$180 billion) was up Rmb159 billion year on year (YoY), while a newly announced Rmb2 trillion annual special local bond to swap local government financial vehicle (LGFV) debt as a possible driver, with a slowing of loan growth in October and loans down more than 50% YoY in November.

However, the risk-free nature of government debt is a concern, the analysts note. Local government financing vehicles (LGFVs) are specialist investment firms used to fund local governments in lieu of a municipal bond market, by issuing bonds classified as ‘corporate’ debt in order to provide the needed capital. As government debt use in TSF increases, transparency effectively decreases, they warn.

“By reducing the need to issue bonds to finance infrastructure projects, the substitution of government issuers for corporate issuers has undermined credit differentiation and credit risk pricing in the market,” write the S&P Global team. “The diminishing significance of corporate bonds versus government bonds is an important indication of the state sector’s crowding out of the private sector in terms of financing, which reduces participation by more diverse cohorts of firms. This trend remains a core challenge for the country, despite decades of reforms aimed at improving efficiency.”

©Markets Media Europe 2024

©Markets Media Europe 2025