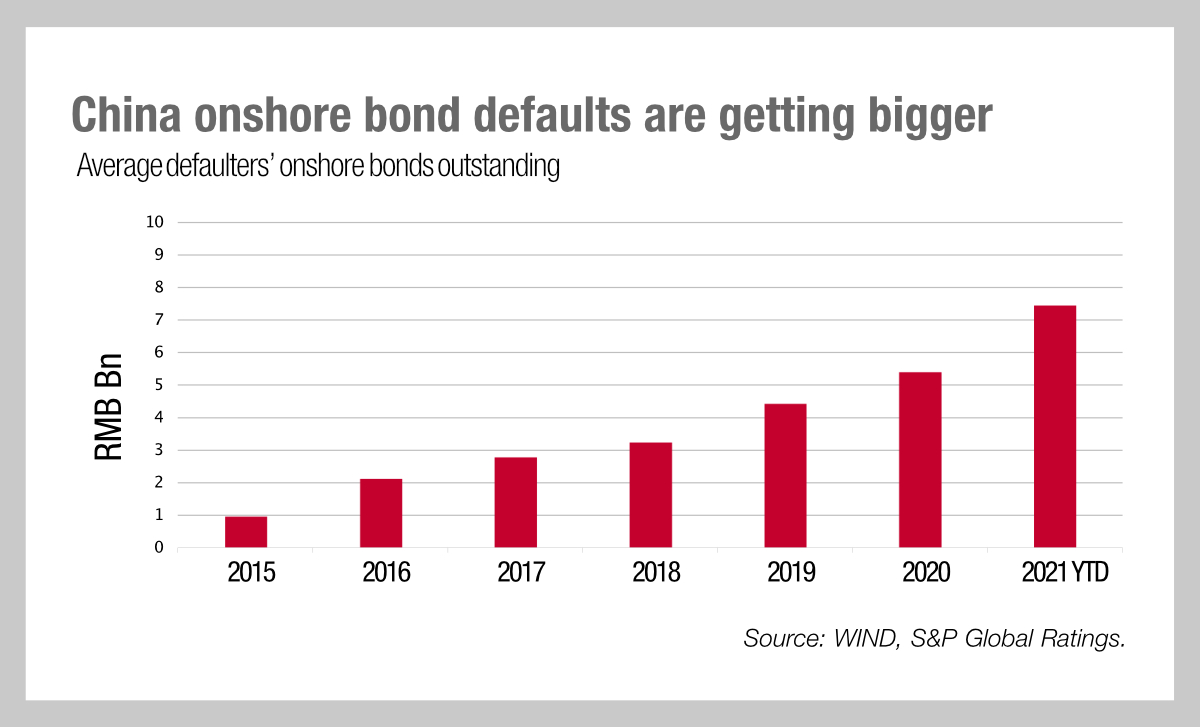

Concern around issuer defaults in China is clearly based upon good evidence; our chart this week from S&P Global Ratings shows the annual growth in average outstanding onshore bonds for defaulters within China, and it is marked. While the average outstanding for defaulters has fallen to RMB 7.4bn in October from RMB 8.7bn in June that is still well above the 2020 levels.

Defaults spread through Q4 of 2020 and continued, this year with several large defaults early on which hit onshore and offshore bonds. The second quarter saw a default from Huarong followed by Evergrande in Q3 all of which impacted investor sentiment. The cumulative effect of these defaults has been an amplification of volatility; see the article on secondary markets this week to look at the effect on bid-ask spreads.

Not only do these create concern for investors the risk surrounding them is reflected in current policy, as the state seeks to reduce leverage within specific sectors which are perceived to be a risk.

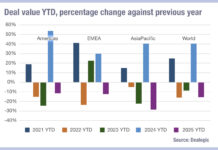

The deleveraging of specific sectors in China’s economy is having several effects. The first is that issuance in Asia Pacific has dropped compared with 2020, which analysis by S&P Global Ratings has shown is directly correlated with the decline in issuance across speculative grade debt in China.

While North Asia is seeing higher levels of issuance than in either 2020 or 2019, China’s primary market activity has declined, driven by the state-owned enterprise (SOEs) and property sectors.

However, the impact of defaults has been largely confined in Asia to speculative grade, mostly to ‘B’ rated issuance, and the effect has mostly been local, with S&P finding that ‘new-issue allocation data suggest US/EMEA-based investors may have less exposure to Chinese property debt.’

Consequently, the ‘Lehman’ event predicted over the summer has not yet come to pass and the policy of deleveraging may still mitigate the risks that the property sector carries to the wider system.

©Markets Media Europe 2025