Access to primary bond markets has been a headline topic for buy-side traders over the last four years. As issuance volumes have grown, rising to nearly US$2 trillion in 2020 according to the Securities and Exchange Commission, quadruple what it was in 2010 – yields have fallen, from an average of 3.22% for a ten-year treasury in 2021 to 0.89% in 2020. That has meant while investors need greater value from their investments, the work involved in finding and acquiring those investments has increased considerably.

A very public concern has been the manual work needed to engage with multiple banks on every deal in order to determine if a portfolio manager has interest in buying in to a new issue, then negotiating on the deal and then getting an allocation.

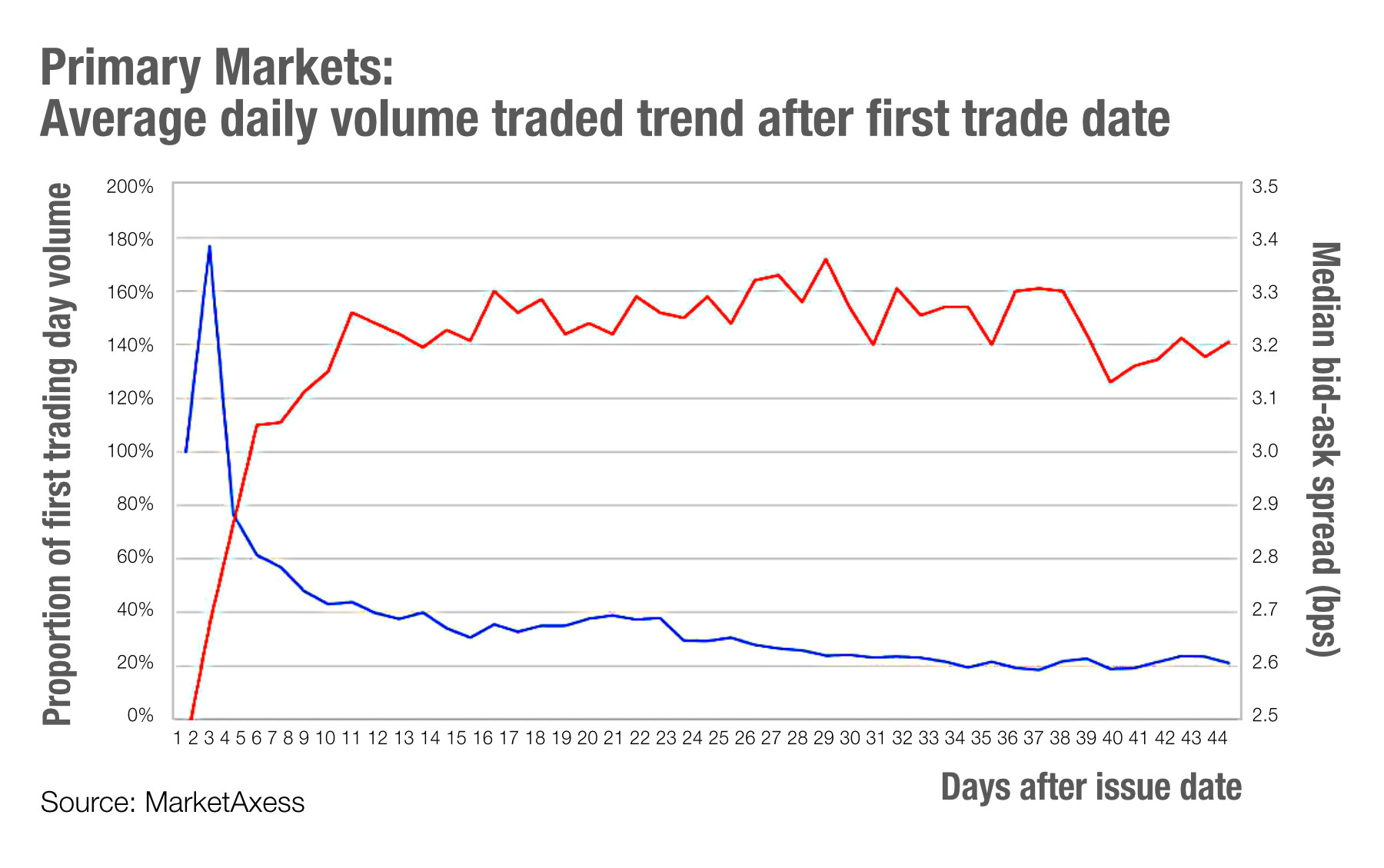

Getting in early on a deal carries a significant advantage and newly released data from MarketAxess shows quite how much of an advantage that is. Even when a deal is missed in the primary market there is considerable secondary activity which can be engaged with shortly afterwards to lower the cost of investing.

Spreads on a new issue increase steeply, from 2.5 to nearly 3.3 in the first seven days, making early trading advantageous. And while volume of trading activity typically increases to around 180% of the issuance volume in the first day, it then drops significantly, reaching below 40% by the eighth day. At 20 days after it first hits TRACE, the daily volume traded drops to 30% of that on the first trade day.

Although volume does not directly equate to liquidity – trading can be one directional favouring either buyers or sellers – this data suggests that the cost of trading, in terms of spread and bond liquidity, is sharply in favour of buy-side trading desks that can access the secondary market directly after a bond is issued. Having access to data that can be used to profile that advantage for bonds at a more granular level could convey a significant upside.

©Markets Media Europe 2025