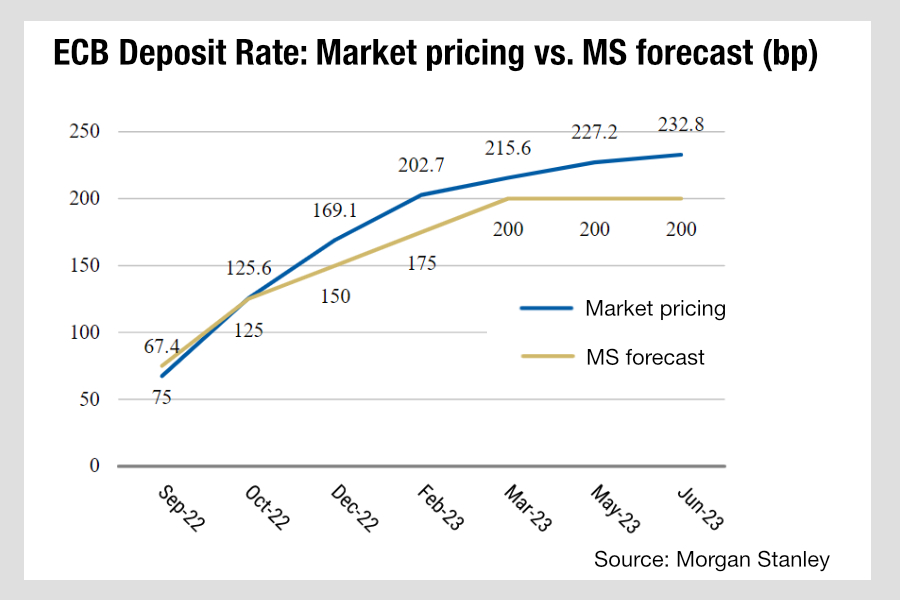

Expectations on the European Central Bank’s appetite to increase its interest rate will have a direct and negative impact on European bond trading which has already been hard hit in 2022 so far. Despite the ECB being far less aggressive than other banks in raising rates, European bond trading has proven less liquid than the US by comparison.

There are several likely reasons for this. The US has always been a simpler market to trade than European credit, even with Europe’s single regulatory approach. Europe does not yet have a single market – bonds are issued in multiple currencies. Benchmarking of corporate bonds is against a range of different government bonds. The lack of single markets for govies all make secondary trading far less liquid than in the US. Exchange-traded funds (ETFs) are also able to support trading in Europe less easily as a result of that complexity, and they have become a key market of bond market liquidity.

This does not bode well for European credit liquidity. As rates rise – and the expectation is for a series of steep rises – investors will try to move out of lower yielding bonds and into higher yielding assets of the same credit worthiness. With high yield issuance at a record low, there will be enormous pressure to access the European IG market through primary issuance as well as via secondary trading.

The long and the short of it is, European buy-side traders need to prepare for an even tougher second half of the year. That will mean strengthening dealer relationships, identifying most valuable data sources for pre-trade analytics and building effective trading workflows that can take advantage of trading protocols as and when they are the best route to executing a trade.

©Markets Media Europe 2022

©Markets Media Europe 2025