The European Central Bank’s (ECB) latest briefing paper, ‘Managing liquidity in a changing environment,’ underscores the critical need for banks to adapt as central banks globally withdraw liquidity, potentially increasing funding market volatility.

Report author Imène Rahmouni-Rousseau, director general of market operations, stressed the importance of banks proactively adapting their liquidity buffers and diversifying funding sources: “Financial institutions must proactively adapt their liquidity buffers and diversify their funding sources to mitigate potential market stresses.”

The ECB highlighted the transition from an environment of surplus liquidity to one in which funding markets increasingly play a critical role, urging banks to integrate central bank refinancing operations into daily liquidity management strategies.

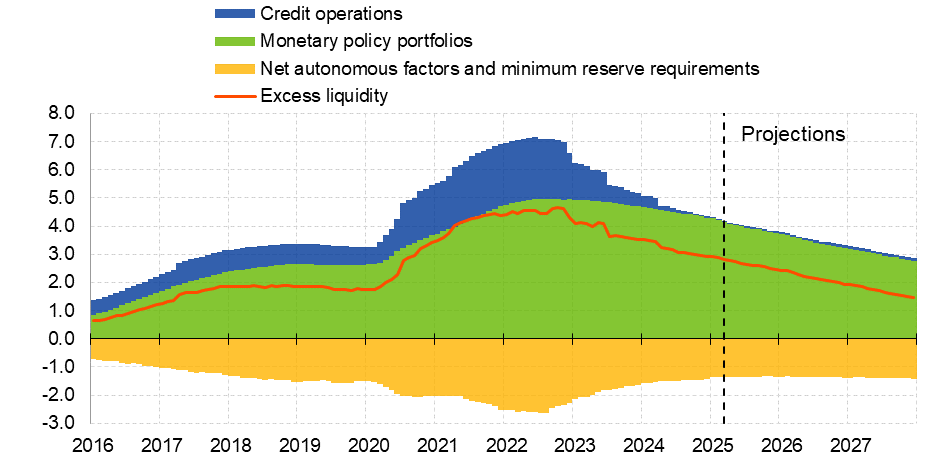

The paper details how declining excess liquidity levels, driven by repayments of pandemic-era targeted longer-term refinancing operations (TLTROs) and ongoing quantitative tightening, require banks to rely more heavily on repo markets and short-term funding channels. This reinforces the need for enhanced liquidity management practices.

Sources: ECB and ECB calculations.

This sentiment is echoed globally. Roberto Perli, head of monetary policy implementation at the New York Federal Reserve, warned on March 5, 2025: “The longer balance sheet runoff continues while the debt ceiling situation persists, the higher the risk that reserves could rapidly decline, potentially causing considerable volatility in money markets.”

Similarly, John C. Williams, President of the Federal Reserve Bank of New York, emphasised flexibility in the Fed’s quantitative tightening approach to avoid excessive liquidity withdrawal that could strain markets, noting the importance of ensuring the Fed.

He said : “We need to ensure the Fed doesn’t go too far with the drawdown and take out too much liquidity.”

Read more: https://www.fi-desk.com/rules-and-ratings-us-rate-cuts-now-challenged-by-tariff-policy/https://www.fi-desk.com/rules-and-ratings-us-rate-cuts-now-challenged-by-tariff-policy/

In its December 2024 review, the Bank for International Settlements (BIS) also noted that: “Ongoing quantitative tightening by major central banks alongside heavy government debt issuance has introduced occasional spikes in overnight repo rates.”

The BIS indicated the need for strong dealer intermediation and central bank support during this transitional phase.

©Markets Media Europe 2025