US Treasuries: Coalition Greenwich update on falling interdealer volume and BIS warning

US markets have had an eventful summer according to analysis by Coalition Greenwich, which saw an average daily notional volume (ADNV) for US Treasuries...

Tradeweb announces JSCC clearing for MTF and SEF Yen swaps

Multi-asset market operator, Tradeweb has reported that institutional clients executing Japanese Yen swaps on its multilateral trading facilities (MTFs) and swap execution facilities (SEFs)...

What’s all the fuss about… the US Treasury market?

Who is kicking up a fuss about US government bonds?

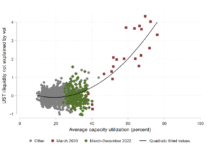

A new paper published by Darrell Duffie for the Jackson Hole Symposium entitled ‘Resilience redux...

Analysis: Market response to US Treasury’s increased borrowing needs

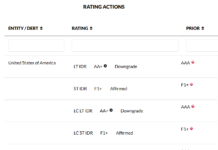

The US Treasury’s need to increase debt issuance, beyond market expectations, has had several effects. Firstly there was a ratings downgrade of the USA...

Implication of US bank downgrades on credit markets

Markets are truly feeling the economic pressures at present, with Moody’s downgrade to US financials on Monday following Fitch’s controversial downgrade of the US,...

LatAm sees e-trading momentum with support for all-to-all

In Latin America, 46% of trading in corporate hard currency bonds is conducted electronically, according to research by analyst firm Coalition Greenwich, compared to...

The US: Too big to Fitch?

Ratings agency Fitch has downgraded the United States’ long-term credit ratings to AA+ from AAA and removed the rating ‘Watch Negative’ stating “ reflects...

Implied cost of liquidity falling, with US high yield an exception

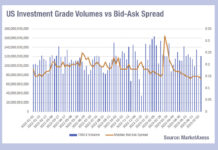

Volumes in the corporate bond markets have been picking back up, relative to bid-ask spreads, indicating an improving liquidity picture across the US and...

Trumid adds RFQ to credit trading protocols

Electronic bond market operator Trumid, has launched new Request for Quote (RFQ) trading on its platform. Trumid clients can now initiate, view, and respond...

Review: Mixed bond trading revenues in choppy first quarter

Banks have seen mixed results from bond trading in the first quarter of 2023, across credit and rates, while electronic trading platforms have seen...