FILS USA: How can high yield be traded efficiently in a risk off environment?

Banks are stepping back from taking risk in high yield trading. Trading in a risk-off environment in normal circumstances can be challenging as spreads...

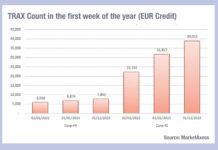

Does this year start with the smallest trades ever?

Trading activity in European bond markets at the start of 2024 has had the highest trade count of the past three years by some...

Citadel Securities’ new hires are reinforcing US credit market expansion

Citadel Securities has seen a spate of hirings on its credit trading teams in January 2024, supporting its expansion into the corporate bond space...

FCA consulting on bond and derivative markets transparency reforms

The UK’s Financial Conduct Authority (FCA) is consulting on proposals to improve the transparency regime for bond and derivative markets.

The consultation, which is open...

A wild ride: Tradeweb’s Hult reviews the bond market in 2023

Historic interest rate moves, a debt ceiling stalemate, major bank collapses and massive geopolitical instability. These mega events sent shocks through the markets in...

November’s bumper month for fixed income e-trading

Electronic trading platforms have reported a bumper November for fixed income trading, with CME reporting interest rate average daily volume (ADV) up by 42%;...

Get better at trading emerging markets credit

A recent article on the challenges for banks in making a profitable business trading emerging markets (EM) credit has highlighted the complexity of the...

Muting Ren joins American Century Investments

Muting Ren has joined American Century Investments on its global Fixed Income Team. He will serve as senior portfolio manager and head of systematic...

SOLVE’s Ticker boosts muni market price transparency

SOLVE, provider of pre-trade quotes data across fixed income markets, has rolled out ‘Ticker’, its municipal market data offering as part of the SOLVE...

Ballooning margin costs hobble US treasury basis trade returns, research finds

Institutional investors betting on yield spread fluctuations between US treasuries are facing ballooning margin costs, new research from derivatives analytics firm OpenGamma reveals.

Rising margin...