Portugal to join FTSE World Government Bond Index; India deferred

Portugal has been added to the FTSE World Government Bond Index (WGBI), effective November 2024. FTSE Russell stated that the country now meets all...

Port in a storm: Asian international bond markets resilient amid volatility

Volatile interest rates, a fractious geopolitical landscape, and rumbles in the Chinese property sector. Despite these headwinds, the international bond markets in Asia were...

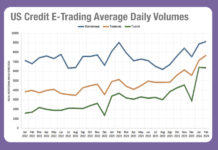

Exclusive: Analysing the battle for US e-Trading in February

The highly competitive corporate bond market saw average daily volumes converge in the US across electronic trading venues in February. The DESK has exclusively...

European HY bond issuance saw 45% increase in 2023

High yield bond issuance reached €66 billion in 2023, up from €45 billion in 2022 which had been a record low.

The findings come...

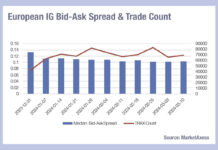

European investment grade seeing smaller, cheaper trades

European investment grade bond traders are seeing a falling bid-ask spread, and a rising trade count since the start of 2024, according to MarketAxess’s...

Coalition Greenwich: US Treasury e-trading volumes hit record in February

US Treasury volumes saw an average daily notional value (ADNV) of US$918 billion in February 2024, Coalition Greenwich’s March Data Spotlight has reported, up...

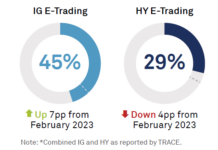

Coalition Greenwich: Electronic bond trading rises in US IG, declines in high yield

The use of electronic trading in corporate bonds will continue to increase, Coalition Greenwich’s March Data Spotlight has stated.

Electronic trading activity grew faster than...

SGX anticipates Japanese growth with STIR futures

Singapore Exchange (SGX Group) plans to introduce short-term interest rate futures related to the Tokyo Overnight Average Rate (TONA) and the Singapore Overnight Rate...

Hargreaves Lansdown offers retail investors access to gilts in primary market

Hargreaves Lansdown is giving its clients access to Debt Management Office (DMO) Gilt auctions.

Tim Jacobs, head of primary markets, Hargreaves Lansdown, says, “This...

Bond market venues tussle over market share amid volumes surge

Fixed income trading venues have reaped the rewards of rising trading volumes, but a highly competitive landscape is having an impact on market share.

Market...