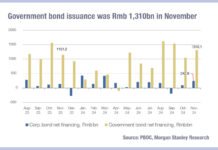

China government bond issuance reducing transparency of total social finance

Understanding state support for the economy in China can be measured across several dynamics, but debt provision to the non-financial private sector, known as...

Is Europe being punished for slower e-trading adoption?

The liquidity shortfall, expected at the end of the year, is traditionally triggered by dealers’ reluctance to make markets when their risk positions are...

The Book: BofA DCM team give issuers confidence for financing in 2025

The DESK spoke with Bank of America’s Julien Roman, head of EMEA DCM FIG Origination, Paula Weisshuber, head of EMEA Corporate DCM, and Adrien...

Gensler confirmed to depart SEC

The Securities and Exchange Commission has announced that its 33rd Chair, Gary Gensler, will step down from the Commission effective at 12:00 pm on...

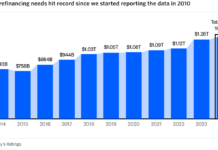

Moody’s: Short-term refinancing to grow in 2025

A report from rating agency Moody’s, has found that the proportion of US non-financial investment-grade corporate bonds needing refinancing within five years has grown...

E-trading platforms show mixed results in October’s market share battle

Electronic trading fixed income platforms saw a slight drop off in volume relative to October, but strong activity against the same period last year.

Bond...

Hamza Hoummady made head of European rates trading at Barclays

Barclays Investment Bank has named Hamza Hoummady as head of European rates trading, promoting him from head of EMEA non-linear rates trading, rates structuring...

Measuring implicit costs and market impact in credit trading

Evaluating the quality of a bond trade is made complex by the multiple dynamics which impact quality, and the frequent absence of data to...

September: US rates ADNV up 35% YoY amid wider uncertainty

In September, overall trading in US rates rose 1% year-over-year, standing at 59% of volumes, while the average daily notional volume stood at US$988...

Under pressure

Secondary markets trading has seen a net trend towards tighter bid-ask spreads for trading across all corporate bond segments in US, Europe and emerging...