Squeezing the bid-ask spread

Bid-ask spreads in the corporate bond space have continued to collapse in 2025, suggesting that liquidity costs are dramatically improving for buy-side traders.

Looking at...

On The DESK: Leaders in bond trading pinpoint risks and opportunities

We asked the buy-side traders we have profiled on The DESK for the past ten years to discuss the biggest changes they thought had...

The interplay between the cash and derivative credit markets

For investors, the derivatives market is a potentially a rich source for investment returns and risk management. It can also be a valuable source...

Is Europe being punished for slower e-trading adoption?

The liquidity shortfall, expected at the end of the year, is traditionally triggered by dealers’ reluctance to make markets when their risk positions are...

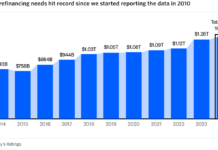

Moody’s: Short-term refinancing to grow in 2025

A report from rating agency Moody’s, has found that the proportion of US non-financial investment-grade corporate bonds needing refinancing within five years has grown...

E-trading platforms show mixed results in October’s market share battle

Electronic trading fixed income platforms saw a slight drop off in volume relative to October, but strong activity against the same period last year.

Bond...

Measuring implicit costs and market impact in credit trading

Evaluating the quality of a bond trade is made complex by the multiple dynamics which impact quality, and the frequent absence of data to...

Under pressure

Secondary markets trading has seen a net trend towards tighter bid-ask spreads for trading across all corporate bond segments in US, Europe and emerging...

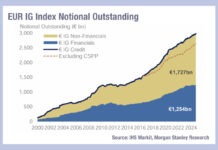

Ongoing effect of CSPP on European credit markets

Europe has seen considerable growth in credit issuance this year relative to 2023, with last week finding a 116% year-on-year increase in non-financial high...

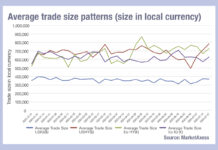

Not average: Trade sizes in 2024

Looking at the average trade sizes for high yield and investment grade bonds, across Europe and the US in 2024, we can see considerable...