Selling the dip

Credit investors may see the relative calm in the market at present as a point at which to trade into safer positions, according to...

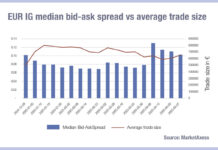

European bid-ask credit spreads not assuaged by tariff roll back

Liquidity costs in European corporate bond trading remain elevated, after the tariff shock in early April saw bid-ask spreads widen significantly across markets, according...

Mexican bond markets: Keep your friends close

Sitting next to the US in the current trade war meant that Mexico avoided the highest bracket of US tariffs, thanks to its existing...

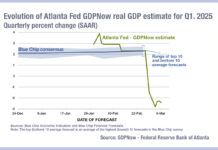

Implications of Atlanta Fed negative GDPNow score for US credit

The Atlanta Federal Reserve’s GDPNow estimate for real GDP growth in the US hit 2.4% on 6 March 2025, up from -2.8 percent on 3 March,...

Picturing uncertainty in a traditionally stable market

Trading numbers in secondary corporate bond markets appear to reflect anecdotal reports of volatility bursts, as political false starts impact the reading of major...

Squeezing the bid-ask spread

Bid-ask spreads in the corporate bond space have continued to collapse in 2025, suggesting that liquidity costs are dramatically improving for buy-side traders.

Looking at...

On The DESK: Leaders in bond trading pinpoint risks and opportunities

We asked the buy-side traders we have profiled on The DESK for the past ten years to discuss the biggest changes they thought had...

The interplay between the cash and derivative credit markets

For investors, the derivatives market is a potentially a rich source for investment returns and risk management. It can also be a valuable source...

Is Europe being punished for slower e-trading adoption?

The liquidity shortfall, expected at the end of the year, is traditionally triggered by dealers’ reluctance to make markets when their risk positions are...

E-trading platforms show mixed results in October’s market share battle

Electronic trading fixed income platforms saw a slight drop off in volume relative to October, but strong activity against the same period last year.

Bond...