Do banks want credit trading to look like FX?

The end game of market making commoditisation is that a smaller number of players provide a vast volume of liquidity to the majority of...

Opinion: Competition, not regulation, will make better bond markets

European credit trading has historically seen levels of electronic trading of around 50% of total corporate credit trading, while the US market has historically...

Analysis: Electronic trading across US and European bond markets

Electronic trading of US credit erupted in May 2024, according to analysis of the US credit market by Coalition Greenwich. It found that investment...

The good news on high yield trading

Two weeks ago we noted that high yield markets have seen trade sizes increase since the start of the year, running counter to the...

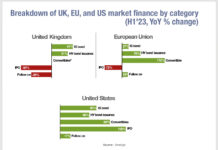

Issuance of debt increasingly financing UK companies

Analysis of corporate financing across European, UK and US markets by the Association of Financial Markets in Europe (AFME) has found that over the...

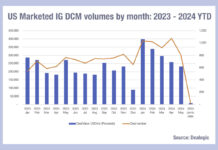

High Yield issuance is taking off

Comparing corporate bond issuance volumes for 2023 and 2024, we can see that the pattern is frequently a high start to the year, with...

CME’s US corporate bond index futures to launch 17 June

CME Group has revealed that its new credit futures are scheduled to begin trading on 17 June 2024, pending regulatory review.

Launching alongside the company's...

Top tips from TradeTech: Connect debt, derivatives and equity trading

Buy-side traders have observed that close ties in the trading team based on the targets on an investment – be that corporate or government...

The credit trading processes you really should have automated by now…

Automation has historically been highly challenging in corporate bond markets for several reasons, but traders say some parts of the workflow ‘ought’ to be...

Jefferies moves into outsourced fixed income trading with Siegel hire

Industry veteran Jory Siegel has joined Jefferies as head of fixed income outsourced trading, from Marex.

Siegel was previously managing director and head of fixed...