Opportunities in e-trading credit derivatives

Credit futures and swaps complement each other by providing investors with different but interconnected tools to manage credit risk, hedge exposures, and to gain...

IG issuance across US and Europe up 20% on five-year average

US investment grade debt issuance has hit $1.7 trillion year to date (YTD) in 2025, a 12% increase year on year (YoY). That brings...

US credit activity dropped off a cliff in late November

Analysis of US corporate bond market activity has found that trading volumes and counts plummeted going into the final month of the year. A...

How a credit sell-off might unfold…

Someone, somewhere, is cooking the books

In 2007, I explained the risks of cumulative capital market investments to a friend as a series of interconnected...

Credit trades’ double-figure yearly growth proves liquidity dividend

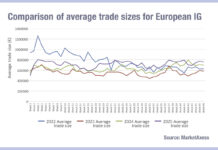

The gradual growth in trade sizes for European corporate bond trades is made clear in the latest MarketAxess TraX data comparison for data from...

Investor Appetite: Credit buyers show stiff upper lip

Credit investors have proven resilient to political uncertainty while happy to take up the promised future view of AI application. As a result corporate...

I just dropped in to see what condition my credit was in…

Credit conditions are in the headlines following several private credit defaults, and the debt-fuelled, forward investment in data centres which are expected to underpin...

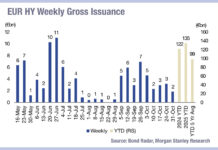

Issuance tracking down in lower rated debt

Issuance of lower rated bonds and leveraged loans across Europe and the US fell in October, according to analysis by investment bank Morgan Stanley,...

Secular vs cyclical: How e-trading, issuance and credit spreads align with liquidity

Primary markets are a crucial source of liquidity in secondary markets, as new issues trigger a round of buying and selling activity for newly...

Bid-ask spreads expanding in European credit

European credit traders have seen bid-ask spreads expand over the past two weeks, however this follows a notable tightening since summer, according to data...