Crunch on liquidity costs

As bid-ask spreads begin to widen on both sides of the Atlantic, buy-side credit traders need to reassess how to best manage the crunch...

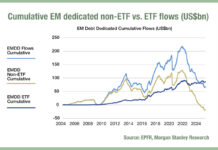

Inflows to EM debt beta funds could change trading patterns

Emerging market (EM) exchange traded funds (ETFs) have seen cumulative inflows of US$1.9 billion year to date, according to analysis by Morgan Stanley, while...

Fixed Income Automation Surge: 60% of Credit Traders Now Use Robots

The electronification of fixed income markets is accelerating, driven by increased adoption of automated trading systems, with 60 per cent of credit market participants...

The interplay between the cash and derivative credit markets

For investors, the derivatives market is a potentially a rich source for investment returns and risk management. It can also be a valuable source...

IRS electronification: 20 years in the making

With the 20th anniversary of Tradeweb’s interest rate swaps (IRS) marketplace around the corner, the firm’s head of US institutional Rates, Bhas Nalabothula, looks...

Meet the consolidated tape contenders

Europe’s development of a consolidated tape for trading data now has clear front runners and benefits.

Three firms have confirmed they will compete to be...

FILS USA: The three fierce battles for credit e-trading market share

Electronic trading in US fixed income is hotly contested between Bloomberg, MarketAxess, Tradeweb and Trumid all competing for market share of trading cash bonds...

The credit trading processes you really should have automated by now…

Automation has historically been highly challenging in corporate bond markets for several reasons, but traders say some parts of the workflow ‘ought’ to be...

Coalition Greenwich: US Treasury e-trading volumes hit record in February

US Treasury volumes saw an average daily notional value (ADNV) of US$918 billion in February 2024, Coalition Greenwich’s March Data Spotlight has reported, up...

Why Europe’s electronic credit trading is accelerating

The level of electronic trading in European corporate bond markets has overtaken the US, according to analysis from firms including Propellant and Coalition Greenwich....