Editorial: Asset managers wilt as banks impose hose-pipe ban

In the UK, during dry conditions, the government bans the public from using hosepipes in order to conserve water. In 2022, the sell side...

MarketAxess Mid-X launches in US

MarketAxess has made Mid-X, its anonymous session-based matching protocol, live for US market participants after its initial launch in Q4 2020 with European participants.

The...

Bryan Harkins joins Trumid

Electronic credit trading platform Trumid has appointed Bryan Harkins in the newly created role of chief revenue officer.

Harkins is an experienced executive with expertise...

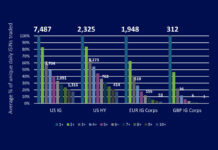

European bond traders struggle with block trades and counterparties

Analysis of the European and US corporate bond markets by Coalition Greenwich has found that block trades and counterparties are a far greater concern...

MarketAxess rides all-to-all and volume growth to record revenues in Q1

Bond market operator MarketAxess has reported Q1 2021 revenues of US$195.5 million, up 16% on the previous year and a company record. While Q1...

How traders weathered the Treasury sell-off

The US Treasury’s auction of seven-year notes last Thursday saw the lowest investor appetite ever, according to some sources, leaving primary dealers holding the...

State Street introduces buy-side to buy-side repo programme

State Street has launched a new peer-to-peer repo programme for the buy side. Building out from its sponsored repo and securities lending model, including...

SGX, Trumid and Hillhouse Capital to launch new Asian bond trading platform

Trumid, Singapore Exchange (SGX) and Hillhouse Capital have formed a joint venture, XinTru, to better support liquidity and execution in the Asian bond market...

MarketAxess launches centralised marketplace with integrated rates trading

Electronic bond market operator, MarketAxess, has launched a centralised fixed income trading marketplace integrating rates trading capabilities within the MarketAxess trading system.

MarketAxess acquired government...

Bloomberg: No charge for buy-side fixed income trading

Bloomberg has quashed rumours that buy-side traders are to be charged for fixed income trading in 2021. Buy-side traders had reported to The DESK...